Pig feed prices continue to fall, yet feed production is slow

Thursday, 14 November 2024

Since the heights of 2022 grain prices, feed costs have steadily reduced showing a positive effect on pig production net margins. So, where next?

Compound and raw material prices both drop back

Defra’s GB compound pig feed prices have fallen 25% since 2022 highs. In the latest Q2 2024 data (April to June), Defra recorded a compound pig feed price of £295/t, exactly £100/t lower than the same quarter in 2022. Yet prices remain 15% above the same quarter in 2019, demonstrating the overall effect of agricultural inflation which has seen farm input prices increase 44% between December 2019 and May 2024.

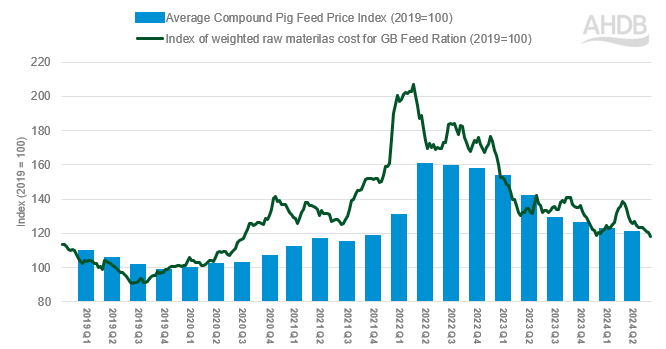

We can compare compound price movement to the cost of raw materials in the ration, to understand price direction going forward. Figure 1 compares Defra’s GB compound pig feed price against a weighting of the main GB ration feed ingredients (wheat, barley, maize, oilseed rape cake/meal and soya cake/meal) using AHDB GB animal feed data. Both time series are indexed to 2019 as a base and compare change over time.

Overall, the compound price and cost of raw materials show silimar trends. Though interestingly, the average of the GB weighted ration was back 33% (£113/t) in Q2 from the same period in 2022, to £225/t. This is a steeper decline in raw material cost than we saw in GB compound pig feed price over the same period, showing compound prices staying slightly firmer for longer.

The decline in the weighted feed price has been driven mostly by the reduction in wheat cost; wheat made up 48% of total raw materials used to produce animal feed in August 2024. In the latest quarter, July to September, we saw a further fall of 2% from the previous quarter, which we could see translate into Q3 compound prices when they are released.

Figure 1. Defra compound pig feed price index vs weighted raw materials cost for GB feed ration 2019-2024

Source: AHDB, Defra

Positive net margins continue but no rebound in feed demand

The decrease in pig feed prices and impact on feed cost has been a large contributor in improving the net margin for GB pig production.

For the latest quarter (Q3 2024), estimated net margins sit at £19/head, an increase of £4 on the previous quarter. For more analysis of quarterly cost of production estimates, visit the pork cost of production and performance page.

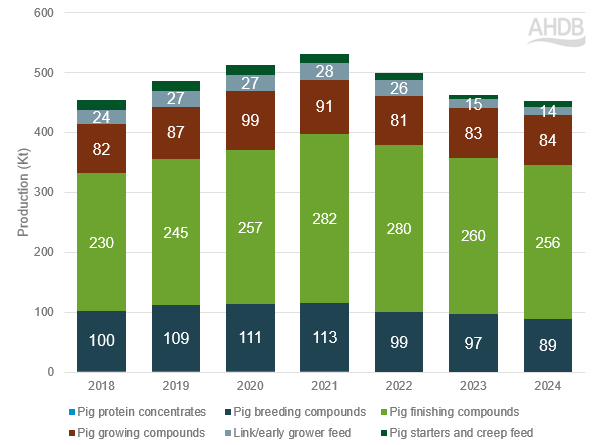

Despite pig feed prices easing, and GB pig production margins improving, we haven’t yet seen strong signals in GB compound pig feed production increasing. July to September GB pig feed production is down 3% year-on-year showing a continued decline over the past three years, demonstrating a continued lack of industry feed demand.

Figure 2. July–September year-on-year GB pig feed production 2019-2024.

Source: AHDB

To summarise

- Pig feed prices continue to fall. This is driven by a decline in wheat prices which are down 25% since Q2 2022 although remain 15% above the same period in 2019 as calculated in the GB ration.

- This falling feed cost has been a main contributor to positive net margins over the past 18 months which sit at £19/head for Q3 2024.

- Yet early GB pig feed production figures continue to fall, 3% year-on-year.

Where next for feed costs?

Looking forward for feed cost, it will be important to follow UK cereal prices closely. UK feed wheat prices have been experiencing downward pressure in recent weeks, influenced by competitive global market forces and currency fluctuations.

A stronger pound, coupled with subdued EU wheat exports and heightened competition from Black Sea supplies, has reduced UK wheat futures prices. Ex-farm prices have followed suit.

Demand for maize, particularly from the US and Brazil where domestic needs of ethanol and feed are high, is supporting maize prices globally and may temper further declines in wheat prices.

Given these factors, it is worth closely monitoring both wheat and maize markets in the coming months, particularly watching for changes in currency and export activity, to better anticipate feed cost trends as you prepare for 2025.