October 2025 dairy market review

Wednesday, 12 November 2025

Milk production

Domestic

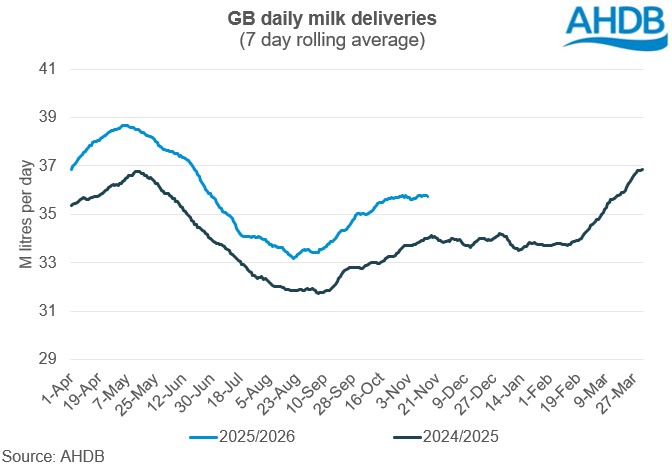

GB milk deliveries in October totalled an estimated 1,100 million litres, up 6.8% compared to the same period in 2024. Daily deliveries averaged at 35.48 million litres.

Production for this year’s milk season so far (April to October) sits at 7,661 million litres, up 5.5% compared to the same period in 2024. We are now also annualising against a period of growth in October 2024.

Milk supplies have been running well ahead of the five-year average since autumn 2024. For the milk year to date, GB milk supplies are 5.3% or 331 million litres up on last year. The whole of the UK is ahead by 6% or 455 million litres.

This is partly due to even stronger production from Northern Ireland. April–July deliveries increased by 9.2% year-on-year, equating to an extra 86.8 million litres, in comparison to an additional 225.6 million litres produced in GB during the same period (+5.3%).

According to the Ulster Farmers’ Union, NI accounted for approximately 18% of total UK milk deliveries in April, playing a significant role in the UK dairy market.

AHDB’s September reforecast predicted GB milk production for the 2025/26 season was forecast to record a new high of 12.89bn litres, 3.6% more than the previous milk year, before beginning to contract.

With such a production boom in September and October, this is now looking pessimistic and will be revisited in December.

The milk to feed price ratio (MFPR) continues to be well in the expansion zone incentivising farmers to push production.

However, milk price announcements for November mark a sharp change in direction with many processors dropping milk prices, in some instances to levels as high as 8 or 6ppl.

The Met Office reported largely clement conditions in October, with slightly milder and drier conditions than usual. This has stimulated grass growth, with some reporting almost springlike grass conditions.

Dry conditions have allowed later turnout than usual, which has helped ease some of the forage difficulties.

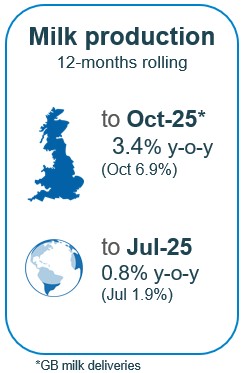

Global

The latest global production data estimate shows global milk flows now accelerating. Global milk deliveries averaged 775.5 million litres per day in July, an increase of 14.7 million litres per day (+1.9%) across the selected regions, compared to the same period last year.

All regions recorded year-on-year volume increases except for Australia.

More recent data for the EU and the USA, which together represent about four fifths of global milk production within the top six exporting regions, show strong growth for both regions in recent months.

The EU has returned to growth of 6% in September, bouncing back from production and fertility issues causes by bluetongue virus.

The USA are seeing strong production growth driven by herd expansion to supply new cheese processing capacity and growing export markets, up by 3.2% in August according to Eucolait.

Fundamentally, milk supplies are running too far ahead of what global demand can absorb. Demand is notably flat currently with export demand steady.

Dairy product inventories are growing globally, which means that even after production comes under control, commodity prices will take some time to recover.

Stocks of dairy products

Both butter and cheese supplies picked up in Q2 due to higher production and cheap imports. Butter production increased by 18% (9,000 t) year-on-year in Q2 following higher prices in UK wholesale markets, and also record high milk volumes in the domestic market growing availability of dairy fats for processing.

Imports also picked up by 5% (1,000 t) during the period following the availability of cheaper US and Oceania butter in the market. Exports declined marginally by 1% as UK butter remained less competitively priced on the global market.

Higher production and imports paired with lower exports resulted in a growth in butter stocks of 18% (10,000 tonnes).

Cheese stocks were reported to be in surplus due to a 6% boost in production (7,500 t) compared to last year. Most imports came from the EU, followed by New Zealand.

Though overall imports were on the higher side, there were fewer imports from New Zealand during the quarter year-on-year. Lower imports from New Zealand were compensated for by increasing imports from the EU (France, Ireland and Spain).

UK cheese prices have been less attractive on the global market. Despite this, export demand picked up from some Asian and MENA (Middle East and North Africa) nations, growing by 5% (3,000 t).

The combination of these factors resulted in available supplies of cheese growing by 3% (6,500 t).

Wholesale markets: October

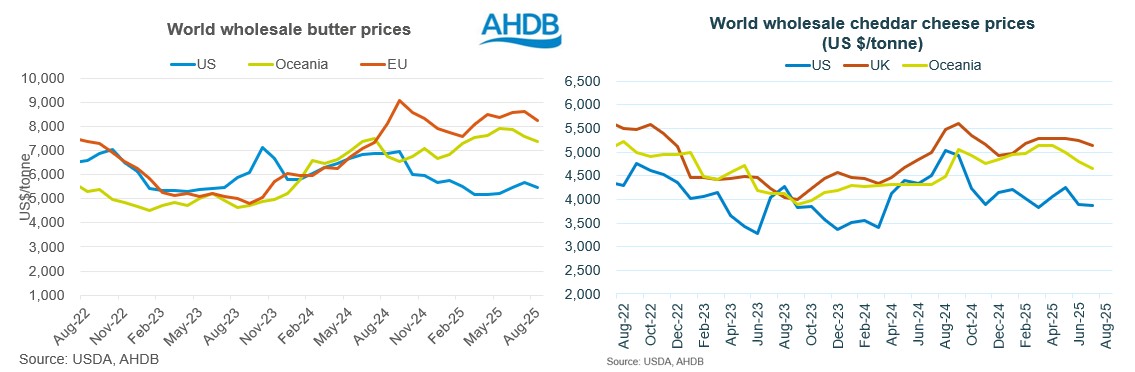

Commodity prices have been badly affected by the oversupply in milk seen domestically and globally. As the peak holiday period took hold, market activity was said to be ‘deadly quiet’ in August.

Wholesale prices fell across the board, with the exception of SMP, with butter and cheese now sitting marginally below values seen last year.

October continued, and deepened, the downturn in market prices seen in September, with butter, cream and cheddar prices slumping.

Sellers were said to be finding the market conditions extremely difficult with thin demand and an excess of (often expensively made) product to dispense with.

Butter prices lost £860/t in October, building on the £500 lost last month. The market has been afflicted by oversupply, with European milk production roaring back to life in Germany and France and butter supplies following suit.

As the year-end approaches, many are motivated to shed stock being unwilling to utilise expensive storage over the winter.

The only glints of light were an uptick in retail demand noted in Germany due to lower prices and some competitiveness returning to the global market, where the price difference to Oceania has been eliminated.

Bulk cream prices followed suit with average pricing sitting £600/t lower in October compared to September.

Top end pricing at the start of the period was around £2.25/kg but the very latest prices are more like £1.80/kg with some reports of even less. The average for the month was £1.99/kg.

Mild cheddar prices caught butter’s cold, with another substantial drop of £310/t month on month to bring down to £3110/t. Sellers need to sell to clear stock build ups, but are stuck between a rock and a hard place.

Cheese has been produced with expensive milk, and the bottom has fallen out of the market with plenty of cheese around ahead of year-end and weak demand. Sellers are also reluctant to sell too cheaply to avoid alienating existing commercial arrangements.

Despite this, many producers were chasing sales in what was described as a very thin market. The global cheese market is increasingly competitive, adding to the pressure.

SMP prices saw the least movement but did ease £90/t month on month falling throughout the month. As with the other commodities there is too much milk and only so much space to process it.

It is notable that European (and UK) butter and cheese have been relatively uncompetitive on the global market as products from elsewhere, but particularly the USA, have been trading at a strong discount globally.

While this product has not been coming to the UK directly, it does displace EU product on the global market which is adding to the local oversupply situation.

.jpg)

Farmgate milk prices

The latest published farmgate price was for September, with a UK average milk price of 46.5, up 1.4% on the previous month.

The latest announced farmgate prices were largely very negative in November.

Retail aligned liquid contracts were more positive than non. Muller Co-op Dairy Group upped by 0.84ppl. Tesco announced a price cut of 0.11ppl. M&S held.

On non-aligned liquid contracts, most buyers on the AHDB League table announced price cuts. Freshways announced the biggest drop of 6ppl followed by Payne’s Dairies at 4ppl. Muller Direct and Pembrokeshire Creamery fell by 1.25ppl and 1.20ppl respectively. Grahams was the only one to make no change.

The biggest decline in prices was in cheese contracts, with Parkhams Farms announcing a record-breaking cut of 8ppl. This was followed by Wyke Farms by 5.20ppl; Lactalis by 5.19ppl; Leprino Foods 4ppl; Barbers Cheese 2.57ppl.

First Milk Manufacturing made a price cut of 2ppl and this is the second monthly reduction in a row. Belton Cheese, South Caernarfon Creameries and Wensleydale Creamery also reduced their prices by 1.50ppl, 3.50ppl and 2.55ppl, respectively.

Manufacturing contracts - Meadow reduced their price by 6ppl. UK Arla Manufacturing cut by 2.63ppl while Pattemores Dairy Ingredients cut by 3.79ppl.

.jpg)

Retail demand

During the 52 weeks ending 4 October 2025, volumes of cows’ dairy declined by 1.2% year-on-year (NIQ Homescan POD, Total GB). Spend on cows’ dairy increased by 6.0% year-on-year, driven by a +7.3% increase in average prices.

Cows’ milk volumes continued to decrease (-2.7%) year-on-year (NIQ, 52 w/e 4 October 2025), due to a 3.9% increase in average prices paid. Declines were seen for semi-skimmed and skimmed milk, while whole milk grew by 2.3% increase year-on-year (26.5 million litres), due to an increase in shoppers. Plant-based milks saw a decline.

Cows’ cheese saw a 1.6% increase, with spend up 5.3% year-on-year. Cheddar, which represents a majority (45.2%) of all cow cheese volumes, saw a slight increase in volumes (+0.1%). Snacking (+2.5%), speciality and continental (+3.2%), and other cows’ cheese (+7.4%) also saw volume growth, with cottage cheese driving growth within other cows’ cheese. This growth offset declines in British regionals, processed, and Stilton and British blue.

Cows’ butter saw a 2.3% decrease in volumes purchased. However, spend saw a 9.5% increase year on year, driven by a 12.1% increase in average prices paid (NIQ, 52 w/e 4 October 2025).

Block butter continues to be the only subcategory to see volume growth (+5.5%), driven by increases in the number of shoppers and the frequency of purchase. However, this growth was not enough to offset the decline in cow butter spread volumes (-5.6%).

Cows’ yogurt, yogurt drinks and fromage frais volumes continued to grow (+6.3%). The only declines were seen in fromage frais (-8.1%) and standard flavoured yogurts (-5.5%). Cows’ standard plain yogurt saw the fastest growth of 25.7% year-on-year, while cows’ fat-free yogurt drove most volume growth with 17 million kilos purchased year-on-year (+10.8%).

Cows’ cream volumes saw a 2.4% increase year-on-year despite inflation. This was led by strong growth in double (+4.3%), sour cream (+3.9%), and aerosol (+2.1%), which offset the declines in other categories.

See the full data and these insights visualised on our GB household dairy purchases retail dashboard.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.