New crop wheat prices moving up to old crop? Grain market daily

Thursday, 8 September 2022

Market commentary

- UK feed wheat futures (Nov-22) closed yesterday at £271.00/t, gaining £6.50/t on Tuesday’s close. The new crop contract (Nov-23) closed at £260.00/t gaining £3.00/t over the same period.

- The UK market followed the Paris and Chicago market higher yesterday, as Putin suggests he wants to limit destinations for Ukrainian exports causing concern about supply distributions.

- Chicago soyabean (Nov-22) closed yesterday at $508.30/t, the lowest price in over 3 weeks. Lower demand from China and forecasts of a record US crop are weighing on prices. Chinese soyabean imports in August were down 24.5% from the same point last year, recent customs data showed.

- Paris rapeseed futures (Nov-22) closed yesterday at €609.25/t, gaining €3.75/t on Tuesday’s close. Yesterday Canadian stocks (as at 31 July) of principal field crops were released. Canadian canola stocks were estimated at 875Kt, down 50.7% from the same point last year. Lower supplies reflected the lower production in 2021 when Canada was hit by drought.

New crop wheat prices moving up to old crop?

The bullish sentiment for global grains looks to remain for this marketing year (2022/23), despite on-going exports from Ukraine out of the Black Sea. Volatility and high prices remain from:

- The politics of the Russian Ukrainian war causing volatility as the situation develops daily impacting prices – for example there has been optimism as exports leave Ukraine via the Black Sea. However, Putin’s annoucement yesterday suggests the developing world had been “cheated” by the UN-brokered Ukrainian grain export deal and he suggests to revise its terms to limit the countries that can receive grain shipments.

- There is a continued tighter global supply and demand for 2022/23 with Ukrainian production of barley, wheat and maize down.

In addition to price volatility, input costs are also climbing. Inputs into harvest-23 remain high, and with recent developments with the closure of Nord Stream 1, it doesn’t appear that energy and specifically fertiliser prices will be easing significantly any time soon.

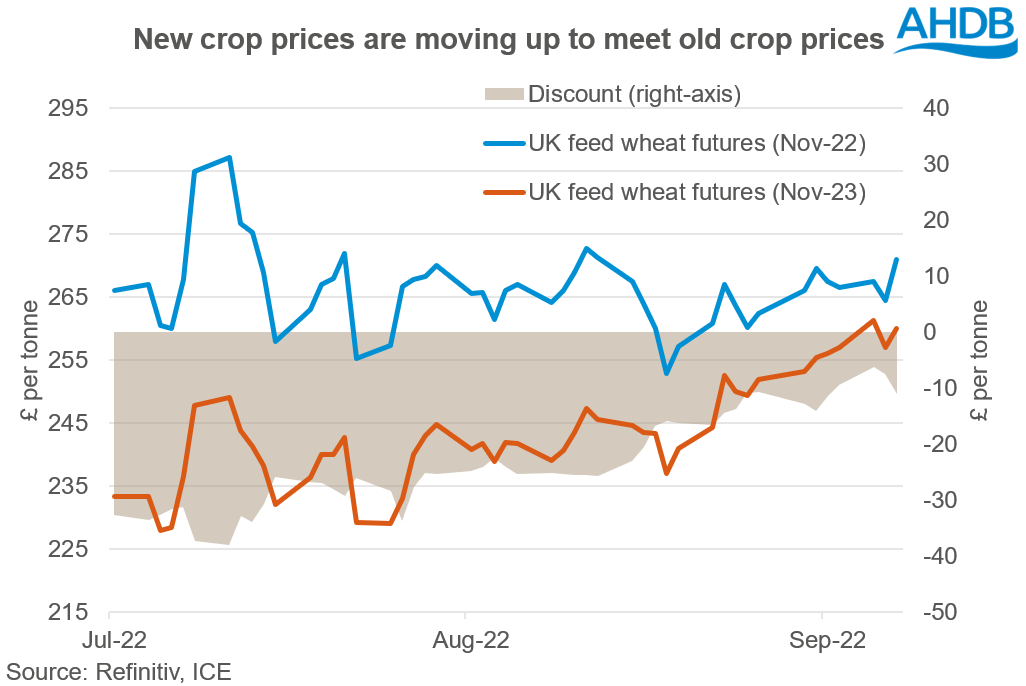

Interestingly, over the past months new-crop UK feed wheat prices have started rising up to this current marketing year’s prices, indicating that possibly this high input year for 2023 is currently being met with a high price, based on historical averages.

Old crop meets new crop prices

In just over two months new crop (Nov-23) UK feed wheat futures discount to old crop (Nov-22) has closed by over £21.00/t.

Based on yesterday’s close, that discount is £11.00/t with Nov-22 closing at £271.00/t and Nov-23 closing at £260.00/t. But this week (05 Sep), the discount narrowed to a low as £6.25/t.

Further to that, new-new crop (Nov-24) price sentiment has had recent developments in the past month too. Although there aren’t traded volumes on the contract there has been a closer alignment between the bid and ask on the contract, with the bid moving up to the ask.

On 10 Aug, the bid price (Nov-24) was £215.00/t and the ask price £250.00/t. However, as of today (08 Sep) the bid is now moved up to £245.00/t with the ask at £258.00/t.

Taking advantage of these prices

It is crucial to form a marketing strategy that takes advantage of high prices. High input costs and political discourse are currently keeping this grain market supported, but rising costs make decision making difficult. Knowing your breakeven point will be crucial, especially for harvest-23.

Despite current bullish sentiment, these prices may not last forever. When we get round to harvest 2023 the global political landscape may look a lot different (for better or worse). But if you can sell for harvest-23 ahead, above your cost of production, why wouldn’t you take advantage now if this fits with your risk appetite?

Pricing the cost of production for harvest-24 is a lot trickier, as input costs are more difficult to estimate. But if global political issues in the Black Sea are resolved current prices would be very good. However, to market your crop now would again depend on your appetite for risk.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.