How much grain is leaving Ukraine? Grain market daily

Wednesday, 31 August 2022

Market commentary

- UK feed wheat futures (Nov-22) gained £3.50/t yesterday, closing at £266.00/t. The Nov-23 contract closed at £253.20/t, rising £1.30/t from Friday’s close.

- UK prices caught up with global markets yesterday after the bank holiday, with relatively higher-volume trade on the Nov-22 contract. Markets have seen recent support from the news that EU and US maize crop conditions are said to have deteriorated due to the hot and dry weather earlier on in the season (Refinitiv).

- Though after several days of support, there was a broad decline in global markets yesterday as recessionary concerns continue. Chicago maize futures slid slightly lower yesterday, With the December-22 contract falling $2.27/t, to close at $266.63/t.

- Paris rapeseed (Nov-22) futures also fell yesterday, down €18.75/t to €602.25/t. This followed pressure on Chicago soyabeans, brent crude and Malaysian palm oil.

How much grain is leaving Ukraine?

Following the invasion of Ukraine at the end of February, which saw Ukrainian ports blockaded and sanctions imposed on Russia, exports from the Black Sea region have been limited.

However, an export deal was signed on 22 July between Russia, Ukraine, Turkey, and the UN to allow ports to re-open. As reported yesterday by the Ukrainian Infrastructure Ministry, since then, a total of 61 cargo ships carrying around 1.5Mt of food had left Ukraine as of yesterday.

So how much food can we expect to see leaving the region over the coming months, and how does it compare to previous years?

Exports

While the deal has enabled Ukraine to reopen key seaports, the country has not yet returned to pre-war export levels.

Maize makes up 63% of the 1.5Mt of food exported since the deal began, followed by wheat (17%) and barley (6%). This shows maize to be a priority crop so far.

According to Ukrainian Consultancy UkrAgroConsult, as of 24 August, 1.02Mt of grain had been moved in August via land crossing or sea. In July, we saw these total grains number reach 1.72Mt, of which 1.18Mt was maize. In 2021, this total grain export number was 3.09Mt in July and 5.78Mt in August for comparison. For oilseeds, July saw Ukraine export 116.3Kt of rapeseed and 367.0Kt of sunseed (UKrAgroConsult). Official’s expectations of total grain, oilseed and oil exports are pegged at 3.0Mt exported in July and 4.0Mt exported in August currently (Refinitiv).

In October, the Ukrainian Ministry say agricultural exports could rise to 6.0 – 6.5Mt. However, concerns remain around insurance and quality of grain shipped. Yesterday, there were reports of grain silos hit by Russian shelling at port Mykolaiv causing a fire.

Where are current full season forecasts?

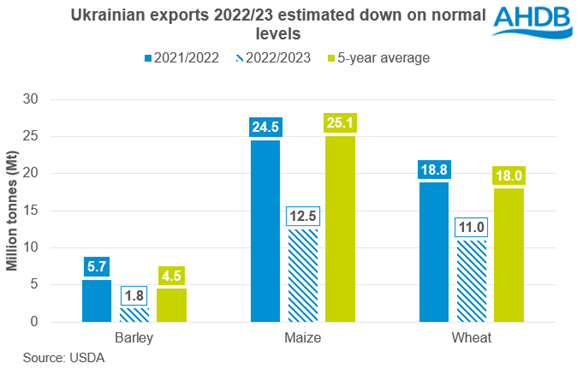

Looking at this month’s USDA world supply and demand estimates, it is expected that forecasted Ukrainian maize exports for the 2022/23 season will be down 12.6Mt on the five-year average, with wheat and barley down 7Mt and 2.7Mt respectively.

Production is forecasted down for both harvest 2022 and 2023, impacting what can be exported longer term. Ukraine’s 2022 grain harvest is estimated to drop to 50Mt, from 86Mt in 2021. According to Refinitiv, Ukraine sowed more than 6Mha of winter wheat for this harvest but only around 4.6Mha would be harvested due to the invasion. As discussed in yesterday’s market report, winter wheat and winter barley plantings for harvest 2023 are also both expected to fall by around 20%, though it’s thought rapeseed area would remain unchanged.

What does this mean for global markets?

How much grain and oilseed are exported from Ukraine will be a key watchpoint in the next few months. If we start to see numbers climb as expected by Ukrainian Officials, could we see the USDA revise their figure upwards?

The low levels of exports leaving the Black Sea region continue to provide a floor of support in global grain and oilseed markets. There are increasing volumes of specifically grain leaving Ukraine, though production is looking much below average, and ports are not exporting at pre-war levels at this point. Therefore, monitoring how much grain leaves ports will be important, but full season export levels look to remain capped currently, keeping the global supply outlook tight.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.