Arable Market Report - 30 August 2022

Tuesday, 30 August 2022

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

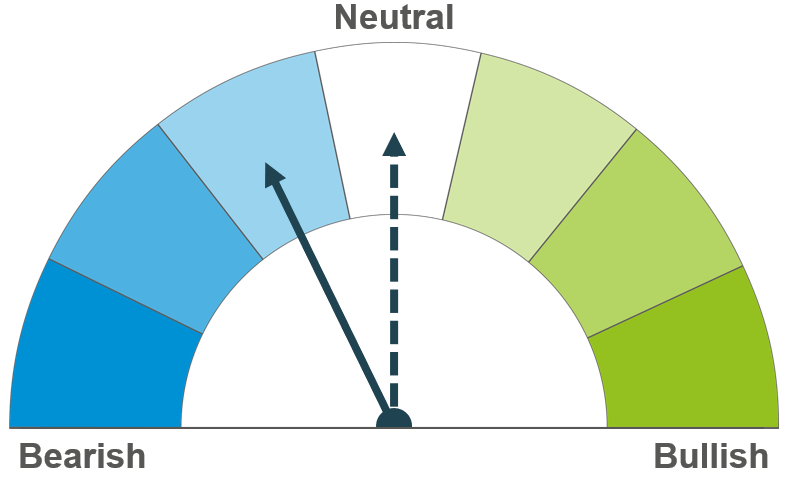

Wheat

Maize

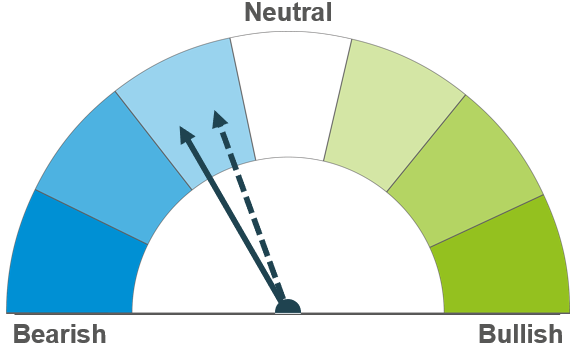

Barley

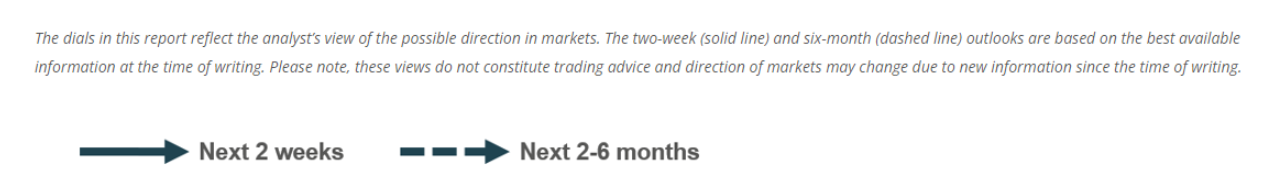

In the short term, volatility remains. Ukrainian exports are expected to increase, though wheat markets are finding support from rising maize prices. In the long term, continued demand and limited supplies continue to provide a floor of support.

Hot and dry weather in both the EU and US is tightening the supply outlook for maize. Weather and its effect on yields will remain a watchpoint over the next few weeks.

Both the domestic and global barley market remains tight, with markets following the wider grains complex.

Global grain markets

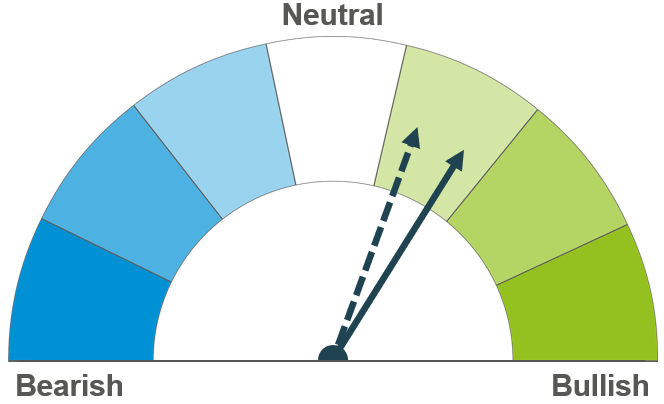

Global grain futures

Global grain markets were supported last week and yesterday, as reports indicated that US maize conditions were worsening. The hot and dry weather experienced across the US Midwest over the past few weeks is said to have resulted in a much lower yield estimate for the country’s maize crop. In the USDA’s weekly crop survey report released yesterday, the US maize crop fell another one percentage point (pp) from the previous week, now at 54% in good or excellent condition as at 28 August.

The unfavourable weather conditions in Europe have seen the EU Commission cut its EU maize crop estimates from 65.8Mt last month to 59.3Mt, in a release on Thursday. As at 22 August, 47% of the French maize crop was in good or excellent condition, compared to 91% a year earlier. This morning, Agritel estimated that French maize production would be the country’s smallest maize crop this century, at 10.8Mt. Agritel also pegged their estimation of EU maize production at 53.8Mt, much lower than reported by the Commission on Thursday.

In more bearish news, Ukraine’s Agriculture Minister said yesterday that their exports could be expected to rise to 6.0-6.5Mt in October. This is double the volume seen in July, as seaports in the country gradually reopen. He added that harvest could include 19Mt of wheat, and that half of that could be exported. Though quality is said to be lower than last year due to unwelcomed rains.

It was also revealed that Ukrainian winter wheat sowing for harvest 2023 is expected to fall by at least 20% on the year (from harvest 22), to around 3.8Mha. The minister reported that in addition to area under Russian control, a significant area of non-controlled territory would not be sown this autumn but did not state a figure.

Canada, the third largest exporter of wheat, pegged their wheat production at 34.6Mt yesterday. This is a 55% rise on the previous year, making it potentially the second-biggest Canadian wheat harvest in nine years if realised. This will be a watchpoint over the next few weeks as wheat harvest begins in the country.

UK focus

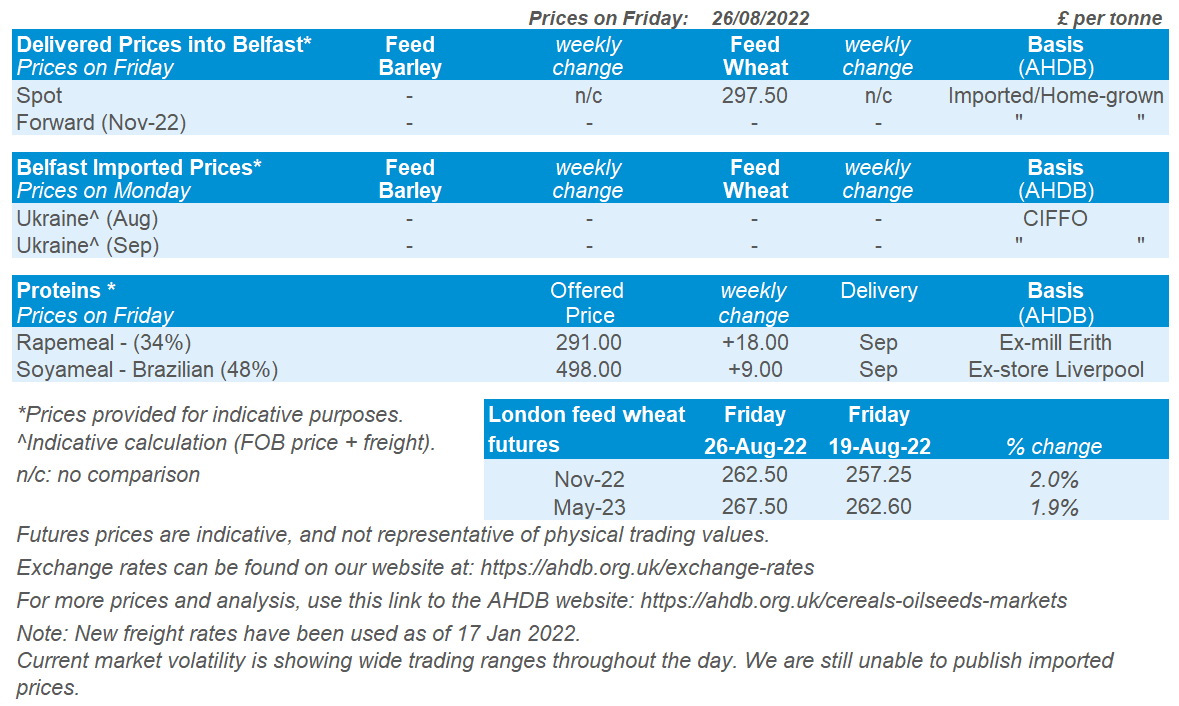

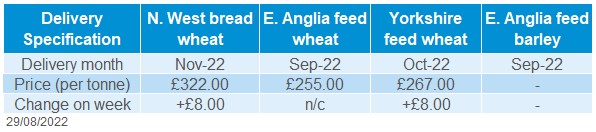

Delivered cereals

Following trends in global grain markets, UK feed wheat futures (Nov-22) gained £5.25/t last week, closing at £262.50/t on Friday. The Nov-23 contract closed at £251.90/t, a rise of £10.90/t over the same period.

East Anglia delivered feed wheat prices (for October delivery) were quoted at £256.50/t on Thursday, up £7.50/t on the week. This price increase mirrors UK feed wheat futures movements (Thurs-Thurs).

Bread wheat delivered into London/Essex for October was quoted at £299.50/t, up £9.00/t Thursday to Thursday.

Estimated cereal stocks held by Merchants, Ports, and Co-ops were updated on Thursday. According to the latest data, 587.2Kt of home-grown wheat and 279.3Kt of home-grown barley was held at the end of June, up 17% and 16% on the year respectively. Imported wheat and maize stocks also saw a yearly rise of 19% and 11% respectively. View the data in full. Defra also released the latest on-farm stocks up to the end of June.

Last week, CF industries announced that they were to ‘temporarily halt’ production of ammonia at their Billingham site. The closure will have a significant impact on the industry, with questions being asked over physical availability of fertiliser for spring 2023 application. As well as the obvious impact on fertiliser prices, the shortage of CO2 domestically will impact the slaughter of poultry and pigs, and in turn affect demand for cereals for animal feed. For more information, read Thursday’s Analyst insight piece here.

The fifth GB harvest progress report was released on Friday. In data up to 23 August, 95% of the total GB harvest was complete, exceeding the five-year average of 69% complete by this point in the season. The GB winter wheat harvest is estimated to be 98% complete, with the majority of crop left to be cut in Scotland. GB spring barley harvest was 81% complete, with 90% of the GB oat area also harvested.

Oilseeds

Rapeseed

Soyabeans

In the short-term, news of a bumper Canadian crop and exports leaving Ukraine are pressuring prices. Longer-term, the wider oilseed complex supply and demand balance is still tight.

US soyabean conditions are looking good which is pressuring both short-term and long-term markets. Though weather will remain a key price driver. Chinese demand now remains something to watch for prices longer-term.

Global oilseed markets

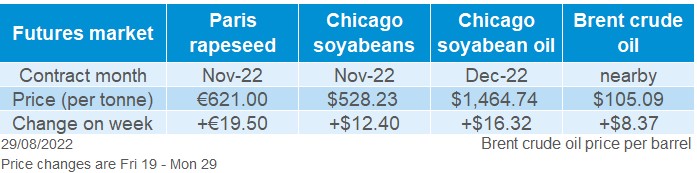

Global oilseed futures

Last week, we saw US soyabean futures (Nov-22) gain $21.03/t (4%) Friday to Friday, to close at $536.86/t. The contract then lost some of these gains on Monday.

US soyabean markets continue to react to incoming reports of soyabean conditions from the US Pro Farmer tour. Concerns highlighted by the tour on hot and dry conditions in the Midwest supported prices last week. China too is seeing a heatwave, could this increase their import requirement? Though, Brazil is expected to plant a large crop this year which is capping gains.

In data released yesterday, the USDA soyabean condition score remains at 57% good to excellent for the week ending 28 August. Though 11% of the crop is now in excellent condition rather than 10% compared to the previous week. Yesterday, Chicago soyabean (Nov-22) futures fell $8.63/t (2%) on positive news for the US crop. The US tour projects the soyabean harvest to be slightly larger than the USDA estimate, which is already a record harvest (Refinitiv).

Indonesia have continued to extend their crude palm oil export levy until the end of October and expected increases in global palm oil supply have continued to weigh on wider oilseed markets this week (Refinitiv). Malaysian palm production is set to increase as they enter peak production months, though exports may be capped by export competitive Indonesia.

Across the week and England, Wales and Northern Ireland's bank holiday weekend, brent crude oil strengthened closing at $105.09/barrel in the nearby contract, the highest price seen since the end of July.

Rapeseed focus

UK delivered oilseed prices

Paris rapeseed futures (Nov-22) closed at €621.00/t yesterday, up €19.50/t Fri – Mon. Though yesterday saw prices fall €8.25/t from Friday’s close. Yesterday’s movement tracked the Winnipeg canola (rapeseed) futures downwards following the release of updated Canadian government crop forecasts, as well as pressure on palm oil.

A bumper Canadian rapeseed harvest of 19.5Mt is expected this season by Statistics Canada, the largest in 3 years (Refinitiv). This eases some global supply worries and added some pressure to markets yesterday.

Yesterday, Ukrainian consultancy UkrAgroConsult placed Ukraine’s rapeseed harvest at 99% complete, in data up to 25 August. Yields are pegged higher than last year, at 2.84t/ha.

GB’s rapeseed harvest was completed in week 6 (w/e 16 August) as mentioned in Friday’s harvest report. Though reportedly with recent rain showers in some areas, some farmers have taken the opportunity to drill WOSR when the combine was parked up.

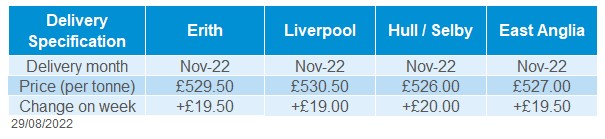

Delivered oilseed rape prices for November delivery were quoted at £529.50/t for Erith on Friday, up £19.50/t on the previous Friday.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.