Underlying support for natural gas: Grain market daily

Tuesday, 6 September 2022

Market commentary

- UK feed wheat futures (Nov-22) closed yesterday at £267.50/t, gaining £1.00/t on Friday’s close. The May contract also gained £1.00/t over the same period to close at £273.50/t.

- There were greater gains for new-crop futures as Nov-23 UK feed wheat closed at £261.25/t gaining £4.25/t on Friday’s close. New crop futures are gradually moving up to trading with this marketing year’s prices.

- With the Chicago market closed yesterday due to public holiday. UK feed wheat followed Paris milling wheat futures higher, which gained support from a weakening Euro. Further to that increasing exports from Ukraine and falling prices for Ukraine and Russian grain has curbed international wheat markets.

- Nearby Brent crude oil closed yesterday at $95.74/barrel, gaining $2.72/barrel on Friday’s close. Some support came as OPEC+ agree on a small output production cut of 100,000 barrels per day from October.

Underlying support for natural gas

Wholesale prices of natural gas have been very volatile in recent weeks. Energy markets continued to be supported over mounting concerns for natural gas supplies.

The continued closure of Nord Stream 1 pipeline put a bullish spur into UK natural gas markets yesterday, as the pipeline had been scheduled to reopen on Saturday. Gazprom have extended the closure of this main pipeline that feeds Europe, on “technical problems”. However, speculation remains that this may be an economic attack on the EU for supporting Ukraine (BBC). This is something to monitor going forward as events evolve.

Although the UK isn’t directly dependent on Russian gas, our domestic wholesale price continues to react to EU prices, which are to some extent dependant on Russian gas.

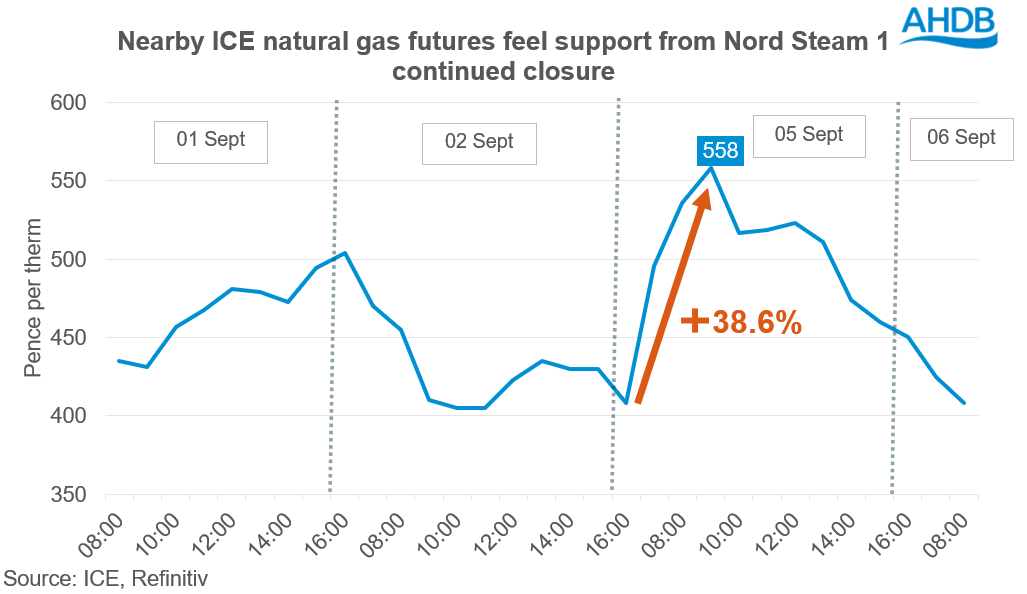

Yesterday’s morning trading of nearby ICE Natural gas futures touched 558.00p/therm, jumping 38.6% on Friday’s (05 Sep) close of 402.42p/therm. However, trading closed yesterday at 462.60/therm. This is a 245% increase on the same point last year.

Although this wasn’t a contract high, markets remain volatile from energy being used as a political tool.

What could the impacts of this be?

There are a lot of unknowns around what will happen between Ukraine and Russia. But what we do know, is that it’s causing large amounts of volatility in natural gas markets.

Further to this, there are threats of gas shortages this winter. This is causing concerns over recession risks in economies in industries that are heavily dependent on fuels. Both the sterling and the euro have weakened by 6.0% and 2.3% respectively since the start of August, as investors seek safety in the US dollar, reducing their exposure in economies that may need to cut back industrial activity. Trading closed yesterday at £1 = $1.1513 and €1 = $0.9926.

If sterling and the euro remain depressed against the US dollar, this could mean that wheat markets could be supported in comparison to other origin grain. A weaker currency stimulates exports by making them cheaper for overseas customers to buy, this will all be relative to the global market at the time, which is expected to remain supported going forward.

Ultimately the impacts of all of this are higher inputs into producing the 2023 crop, which could squeeze margins. As the main feedstock of AN fertiliser, rising gas prices has seen soaring fertiliser over the past six months. CF Industries ‘temporarily halted’ ammonia production at their Billingham site, which will further add to fertiliser price increases.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.