New crop Ukrainian commodities a market sentiment setter: Grain Market Daily

Wednesday, 16 March 2022

Market commentary

- UK wheat futures (May-22) closed yesterday at £302.00/t, gaining £1.50/t on Monday’s close. New crop futures (Nov-22) closed at £255.00/t gaining £1.00/t over the same period.

- Nov-23 UK wheat futures have had 7 days of successive growth, gaining £15.50/t Tuesday to Tuesday, closing yesterday at £218.00/t. However, only minimal volumes have been traded on this contract.

- Fuelling support yesterday was the Russian export curbs and the dryness in the US plains. Further information and analysis is in Megan’s Grain Market Daily, published yesterday.

New crop Ukrainian commodities a market sentiment setter

With the recent bullish spur in markets coming from export implications in the Black Sea, focus is now turning to availability for the 2022/23 marketing year.

Yesterday, the APK-Inform consultancy warned that Ukrainian spring cropping could fall by 4.7 million hectares due to the Russian invasion; conflict means there isn’t the physical opportunity to start sowing in some regions.

At the weekend, President Zelensky called for as many crops to be sown this spring as possible. Over the same period, the Ukrainian Agriculture producers’ union suggested farmers will favour buckwheat, oats and millet over sunseed, rapeseed and maize.

As our recent analysis shows, this invasion will have greater implications on spring crops such as sunflower seed, than winter cropping, such as wheat, for 2022 harvest.

Rapeseed focus

Ukraine produces 2.5Mt of rapeseed on average (2016-2020, USDA). A large proportion of that is exported to the EU. Ukraine have exported 1.6Mt of rapeseed to the EU this marketing year (2021/22), accounting for 44% of EU rapeseed imports (EU commission).

With Ukrainian exports front loaded, UkrAgroConsult pegged current season exports at 89% complete (to 14 Feb), against full season estimates of 2.7Mt (USDA).

Further to that, a large proportion of Ukrainian rapeseed is winter sown, therefore the sowing window for 2022/23 production was prior to the invasion.

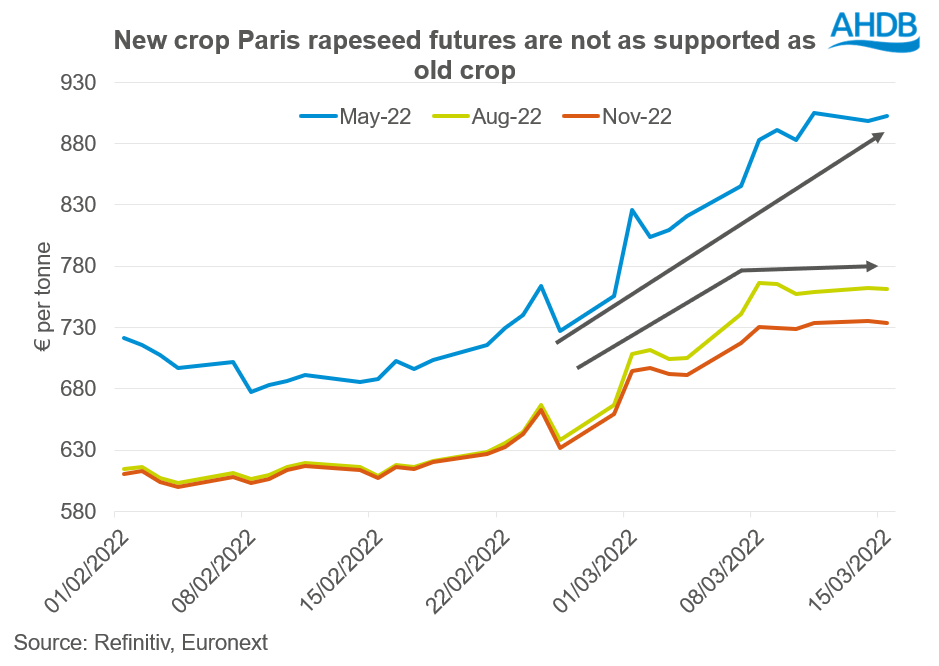

Since the start of the invasion, May-22 rapeseed futures have gained €139.00/t, but new crop Aug-22 and Nov-22, have gained €94.75/t & €71.00/t respectively.

Gains are greater in old crop, reflecting the current tightness in the market. However, new crop prices have plateaued in the last few days, following spikes at the start of the Russian invasion.

Conclusion

There is still a lot of unknowns around spring sowing and fieldwork, whether Ukrainian harvest will be disrupted and further potential crop losses from the Russian invasion.

The next key piece of information for global rapeseed availability is the Canadian principal field crop areas, scheduled to be released 26 April 2022. This will be a sentiment setter for new crop rapeseed, both globally and domestically.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.