Black Sea tensions will influence new crop rapeseed prices: Grain market daily

Thursday, 3 March 2022

Market commentary

- UK wheat futures (May-22) closed yesterday at £269.00/t, gaining £4.00/t on Tuesday’s close. New crop (Nov-22) closed at £223.50/t, down £5.50/t from Tuesday’s contract high.

- Paris rapeseed futures (May-22) closed yesterday at €803.75/t, down €22.00/t from the day before. However, new crop (Aug-22) futures closed at €711.50/t, up €3.00/t on Tuesday’s close.

- Heavy rains in Argentina alleviate fears of prolonged droughts. Oilseed markets were slightly pressured yesterday with both Paris rapeseed and Chicago soyabeans closing lower.

- The bullish spur in wheat remains as news of the Russian invasion on Ukraine continues to dominate market sentiment.

- The latest GB animal feed production and UK human and industrial cereal usage up until January 2022 is now published. Please note some of the usage and production figures have been revised, due to updated data being received. These revisions will be reflected in our next AHDB balance sheet, which is schedule for release 24 March 2022.

Black Sea tensions will influence new crop rapeseed prices

Although latest analysis may seem repetitive, current affairs in Ukraine are very topical and could have the potential lasting impacts to drive your rapeseed price next year.

As mentioned in Monday’s market report, Ukraine and Russia collectively account for 10% of global major oilseed production (rapeseed, soyabeans, sunflower).

In this analysis I want to focus on how the disruption, notably in the Ukraine, will impact oilseed prices going forward. I am going to discuss:

- Why the Black Sea region is so important for setting oilseed market sentiment.

- How this could impact Ukraine’s upcoming sowing season, which could impact sunflower seed production.

Why is the Black Sea region important?

The main oilseed grown in the Black Sea region is sunflowers. Being large processors, Ukraine and Russia on average (2017-2021) collectively account for c.60% of global sun oil production and account for over 76% of global exports.

As Helen discussed last week, Ukraine were yet to export 4Mt of sun oil by 14 February 2022 for this marketing year to fulfil the USDA’s forecast.

For Russia, data shows sun oil exports at over 550Kt from September to December 2021. This is behind previous years. Russian full year (Sep-Aug) sun oil exports forecast is 3.8Mt (USDA). Based on 5-year-averages, over 30% of Russian sun oil is exported between March-May. Therefore, there is still a sizable amount to be exported (© 2022 IHS Markit - Federal Customs Service of Russia).

Ukrainian sunflower seed production focus

Old crop trade is not the only concern. Attention needs to be made to the 2022/23 crop too. As Ukraine accounts for c.30% of global sunflower seed production (5-year-average), they have great influence over market sentiment. With the Ukraine currently experiencing large disruption this could impact sunflower plantings in the region.

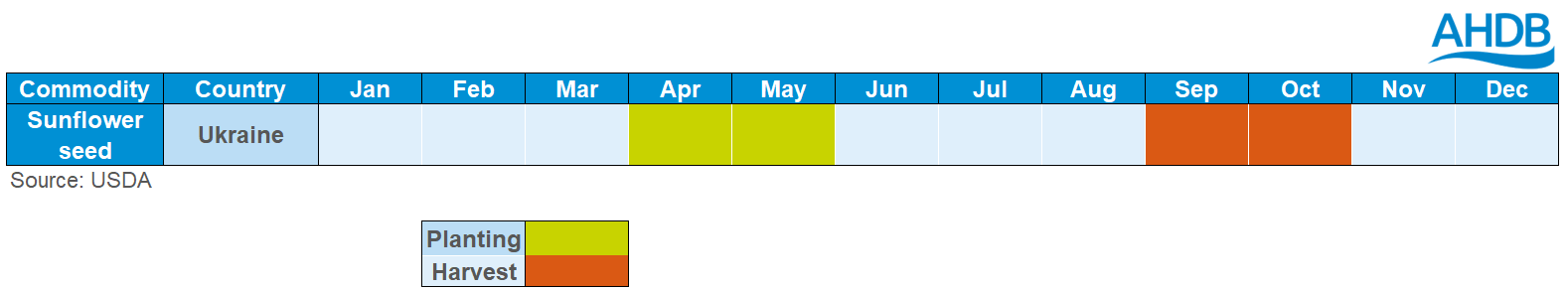

Due to an earlier than usual spring, optimal sowing time is 8 to 9 weeks from now (UkrAgroConsult).

Current 2022/23 forecast for sunseed area is 6.7Kha, slightly down from 6.8Kha last year (UkrAgroConsult).

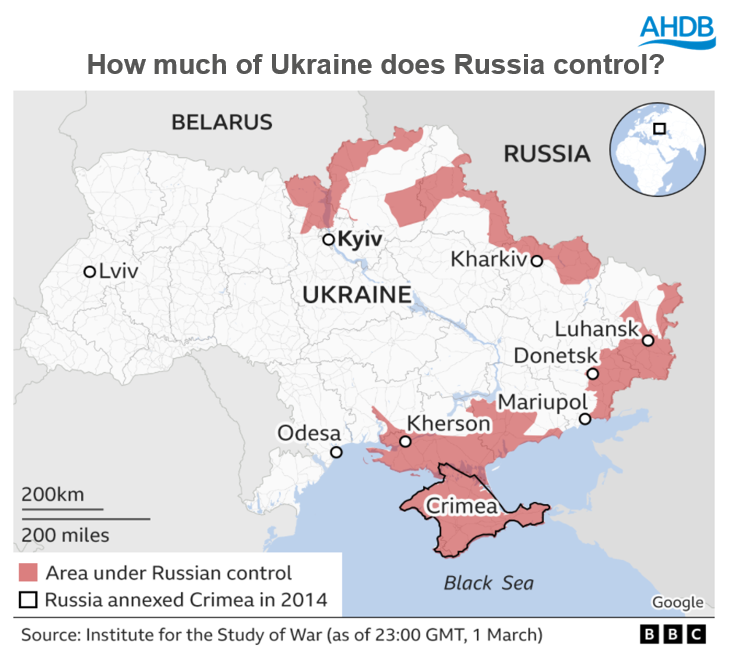

As shown in the map above, much of Ukraine’s production is grown in the central and Eastern parts of the country. The top three productive regions (Kharkivska, Dnipropetrovska and Kirovohradska) account for almost 30% of total production.

With Russia moving from the East, parts of some productive sunflower regions are being occupied by Russian forces.

This map from the BBC shows areas that Russia currently controls. The invasion of these regions right now, could impact sunflower plantings for 2022 harvest. Aside from that, availability (and cost) of fuel, fertiliser and labour may also have an effect.

Conclusion

There is a lot of what ifs and unknowns currently. However, if Ukraine’s sowing window is compromised it will likely have an impact on global vegetable oil prices.

In turn, an impact on global vegetable oils will inevitably affect rapeseed too. If Ukrainian sunflower plantings are compromised, we could see a bullish market sentiment continue across oilseed markets as a whole, into the 2022/23 marketing year.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.