Market Report - 28 February 2022

Monday, 28 February 2022

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

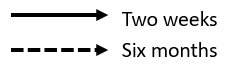

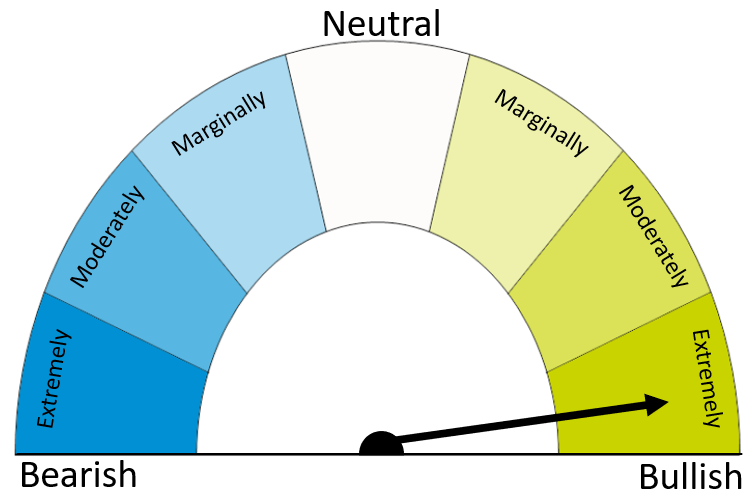

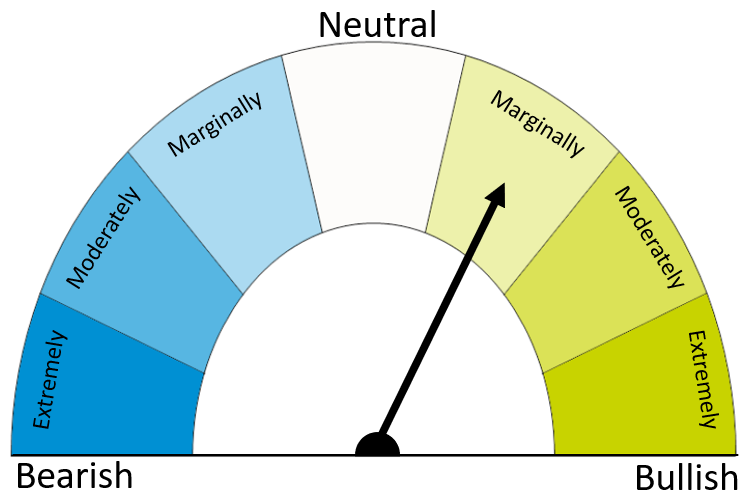

The dials in this report reflect the analyst’s view of the possible direction in markets. The two-week (solid line) and six-month (dashed line) outlooks are based on the best available information at the time of writing. Please note, these views do not constitute trading advice and direction of markets may change due to new information since the time of writing

Wheat

Maize

Barley

Exports from two top global wheat suppliers (Russia and Ukraine) are disrupted, pushing demand to other origins. With already minimal stocks in wheat exporting countries and risks to 2022/23 production, the longer-term outlook is highly uncertain. Much depends on how long the conflict lasts.

Ukraine is an important supplier of maize to the world and exports are paused. The sharp rise in wheat prices will also push more animal feed demand to maize. Meanwhile, if spring planting in Ukraine is disrupted, it could also reduce 2022/23 supplies.

The rises in wheat prices will pull barley prices up too. With tight global availability, barley can’t pick up more demand from wheat in 2021/22. But, the impact maybe slightly less as Ukraine has already shipped most of its barley this season.

Global grain markets

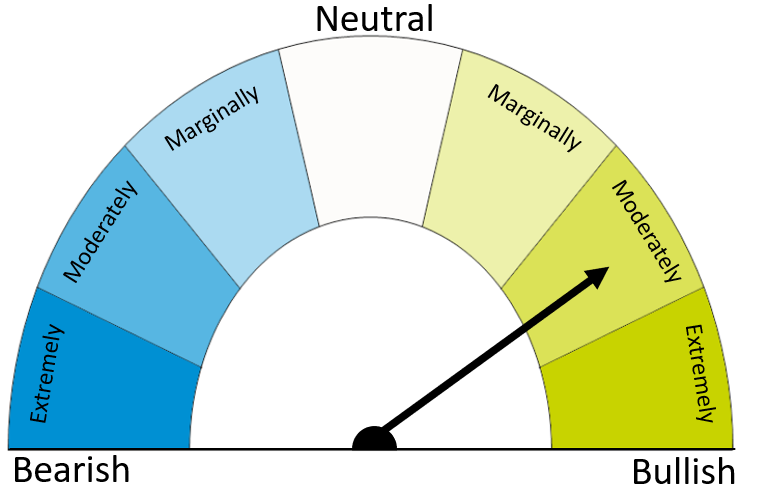

Global grain futures

Wheat prices soared due to the Russian invasion of Ukraine last week. Nearby UK and Parisian futures closed at new records on Thursday, while Chicago futures reached a nine and a half year high. Prices eased back on Friday due to profit-taking and uncertainty about what the weekend could bring, but still posted large weekly gains. Markets are trading higher again this morning (11am).

The conflict prevents exports from Ukraine in the short term as ports are currently closed to commercial shipping. Russian exports are also more difficult due to international sanctions limiting credit availability, and disruption to shipping routes. This pushes more demand to other exporters, including the US and EU.

Egypt’s state buyer, GASC, cancelled a tender on Thursday due to a lack of offers. GASC usually buys heavily from the Black Sea. While Egypt reports it has strategic stocks, it launched another tender over the weekend. We will watch what origins are offered.

Old crop maize prices also rose last week as Ukraine is a significant maize exporter. However, the rise in new crop maize prices was more muted. The USDA predicts the US maize area for harvest 2022 at 37.2Mha. This is down 1.5% from 2021 but a smaller decline than the industry expected (Refinitiv). Rain in Argentina is also helping to stabilise maize crops there, according to the Buenos Aries Grain Exchange.

Longer-term outlook highly uncertain

It’s currently not possible to judge the longer-term outlook.

Spring planting is due to start in Ukraine. But, the conflict will impact Ukrainian farmers’ ability to complete field work in a timely manner, and secure inputs e.g. fuel and fertiliser. Globally, the rise in input costs will also challenge costs of production and could create challenges for yield potential.

Meanwhile, US winter wheat crops are continuing to feel the affects of dry weather. Condition scores are lower than in late January in many of the key producing states. French winter wheat and barley conditions also dipped slightly from last week but remain very good (FranceAgriMer). The EU MARS report showed elsewhere in Europe more rainfall is needed.

UK focus

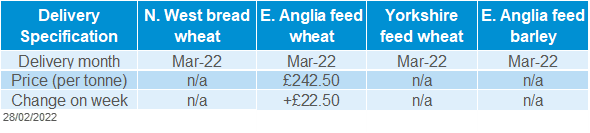

Delivered cereals

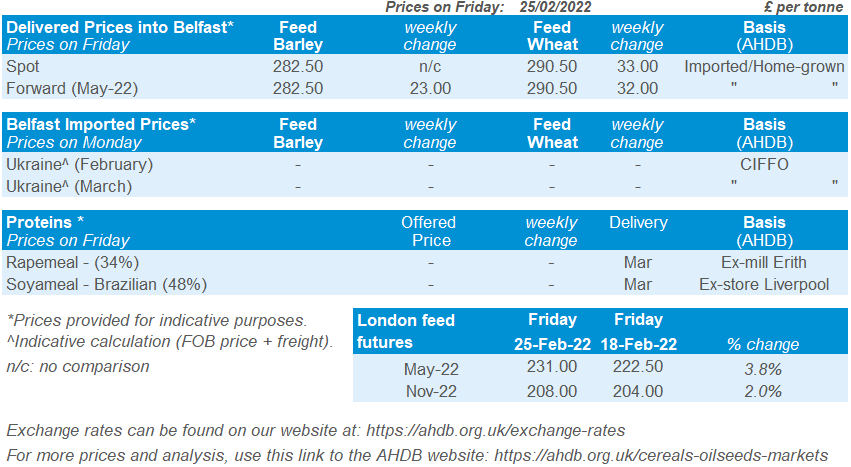

UK feed wheat futures soared on Thursday, following news of the invasion. Prices eased back on Friday, but still posted large weekly gains.

The volatility in world markets meant traded volumes were very limited last week and there was a wide range in quoted values. This meant we could only publish very limited delivered prices last week.

Although premiums for delivered bread wheat over May-22 futures eased in past weeks, the availability of UK bread wheat with a 13% protein content also slowed. This could mean the volume of high protein imports requirements required stays higher than the price alone might suggest. Given the sharp global price rises and international trade situation, this requirement will be very challenging for our industry.

The rise in global crude oil and natural gas is also likely to mean higher costs and challenges for UK growers who have not yet bought or taken full delivery of key inputs. AHDB has advice on dealing with higher nitrogen fertiliser costs here.

Oilseeds

Rapeseed

Soyabeans

Global rapeseed supplies remain tight. Although much of Ukrainian rapeseed exports are front loaded in the season, the bullish sentiment from the sanctions is supporting the market. Longer term, the price direction will depend on an array of factors, such as Canadian plantings and Black Sea tensions.

Soyabeans have the potential to move up with the bullish sentiment from the Black Sea. However, other news is limiting upward price movement for now. The Brazilian harvest is way ahead of last year (33% as of 19 Feb vs 15.5% last year). Plus, initial forecasts from the USDA’s annual Agriculture Outlook Forum point to the US soyabean area rising 0.9% year on year for harvest 2022.

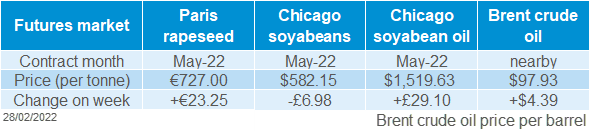

Global oilseed markets

Global oilseed futures

The last week was very volatile for crude oil, edible oils and oilseeds as Russia moved into the Ukraine with a full-scale invasion. Commodity prices spiked last Thursday when the Russian military moved into Ukraine but subdued slightly last Friday as commodity markets reassess the impacts of this invasion.

Over the weekend, there was news of intensified sanctions on Russia. The blocking of certain Russian banks access to the SWIFT international payment system reignites commodity markets. This could further limit the globes’ access to Russian agricultural commodities.

These sanctions, combined with disruption in Ukraine from the invasion, could potentially limit availability of oilseeds from the Black Sea region. Russia and Ukraine account for 10% of major oilseed (sunflower, soy, rape) production. This means what happens in the region in the coming weeks could really set the tone for oilseed markets in the 2022/23 marketing year.

With Russia and Ukraine forecast to export 78% of global sunflower oil this marketing year, the conflict will influence Chicago soy oil and Malaysian palm oil prices. Currently, edible oils and oilseeds are trading higher this morning because of the sanctions mentioned above.

Although these sanctions will impact Russia’s economy, it will also impact the West with a spike in prices. Furthermore, rising input costs and the huge disruption in Ukraine at the moment could have implications for Ukrainian spring field work, potentially impacting area and yields for this year’s harvest.

The latest Stratégie Grains oilseed report released last Friday cited Ukraine is expected to stop the processing and exports of Ukrainian oilseed crops for at least one month. This will curb flows of sunflower seed and oil to the EU.

Rapeseed focus

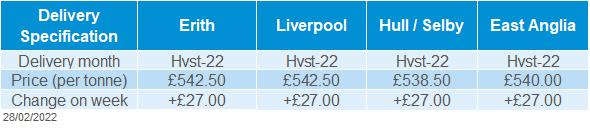

UK delivered oilseed prices

Paris rapeseed futures (Aug-22) closed Friday at €638.00/t, gaining €16.75/t across the week. There was large volatility as the August contract closed at a contract high last Thursday at €666.75/t. The contract has traded as high as €687.25/t this morning (11:00 GMT).

Delivered rapeseed (into Erith, Aug-22) was quoted at £542.50/t last Friday, gaining £27.00/t across the week. The survey was conducted between 11:00 GMT and midday on Friday. The delivered prices were indication of market conditions at this time, but the prices may have moved considerably since then. Sterling weakening against the euro (-0.78%) across the week would have helped support domestic prices across the week. Trading closed Friday at £1 = €1.1905.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.