Bull run continues into 2022/23: Grain market daily

Wednesday, 2 March 2022

Market commentary

- London feed wheat futures (May-22) gained £12.95/t yesterday, to close at £265.00/t. That’s £41.00/t more than the start of the calendar year and the highest price in history. The Nov-22 contract also gained (£8.50/t) yesterday, to close at £229.00/t.

- Paris rapeseed (May-22) soared yesterday, closing at €825.75/t, up €70.25/t from Monday’s close. The Nov-22 contract closed the day at €694.50/t, gaining €35.25/t from the previous day.

- Oil markets continue to climb. Crude oil (May-22) gained another $7.00/barrel to close yesterday at $104.97/barrel. Malaysian palm oil (May-22) also jumped another $112/t, closing yesterday at $1,613/t.

Bull run continues into 2022/23

The Black Sea region is vital to global wheat supply, hence the market reaction to the current situation. Between Russia and Ukraine, they account for 29% of global exports.

In Ukraine, over 73% (23.5Mt) of their 2021/22 wheat crop (32.0Mt) was expected to be exported (UkrAgroConsult). That equates to 12% of global wheat exports (USDA). According to UkrAgroConsult data, Jul-Feb 21st wheat exports total 18.5Mt. Ukrainian ports are currently closed, and Ukraine’s Maritime Administration said they will remain closed until the Russian invasion ends. Therefore, whether the final 5.0Mt will be exported is under question.

This will directly affect Indonesia and Egypt, the top 2 buyers of Ukrainian wheat. However, they will now be looking to source wheat from elsewhere when global stocks are already tight.

2022/23 wheat crop concerns

The Ukrainian State Statistics Service’s winter wheat plantings forecast is 6.54Mha, down 5.3% year-on-year. Although historically they have often underestimated plantings in February versus final estimates, these were made pre-invasion. This means they may not be revised up like they usually are. The winter crop makes up most of the Ukraine’s wheat area, so planting of the spring crop is less of a concern but maximising winter crop potential is.

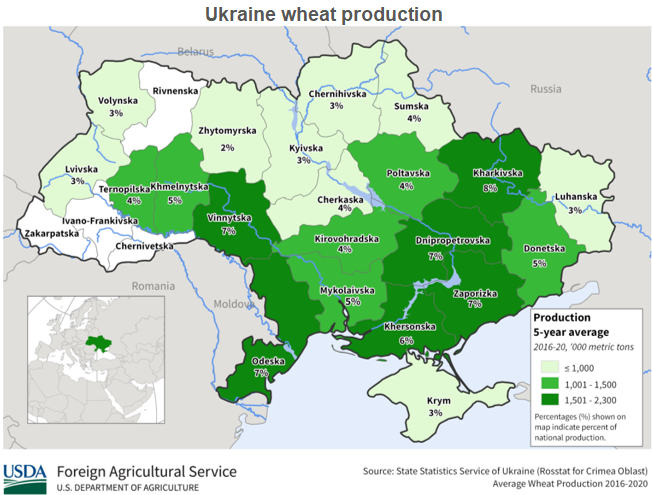

The map below shows where wheat is grown throughout Ukraine. Whilst Russian invasions are targeting cities, the knock-on effect is currently unquantifiable.

There could be limitations to fieldwork. Rightly so, farmers may well have bigger priorities. Availability of inputs (namely fuel and fertiliser) is also under question. Not only availability but cost too, which could impact farmers decisions. Therefore, crop potential could be hampered.

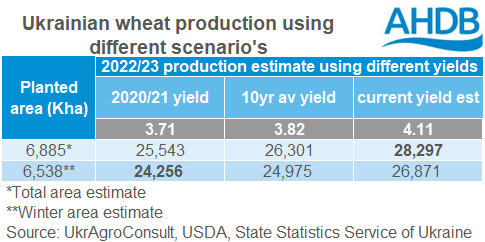

UkrAgroConsult estimated 2022/23 wheat production at 28.30Mt, already 11.6% down year-on-year (Feb-22, pre-invasion). Minimal inputs could knock yields back significantly. The table below demonstrates what differences could be seen in Ukrainian wheat production and therefore global supply in 2022/23. If only the winter wheat area (estimated by the State Statistics Service) makes it to harvest, and yields drop to 2020/21 levels, production would be cut by 4Mt.

What does this mean for the UK?

Linking back to the start, the Black Sea region is vital to global wheat supply, which will have a ripple effect. Yesterday, new-crop UK wheat futures (Nov-22) closed at £229.00/t, the highest close price ever for this contract. This morning, it has gained more ground, trading as high as £238.00/t (12.30pm).

If there is ongoing disruption in the Black Sea region it will inevitably continue to support UK prices into the new marketing year (2022/23).

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.