More export competition for EU wheat after Turkish ban? Grain market daily

Tuesday, 11 June 2024

Market Commentary

- Nov-24 UK feed wheat futures lost £3.80/t yesterday to settle at £203.80/t, while the May-25 contract lost £4.00/t to close at £211.00/t.

- Global wheat futures slipped yesterday, following pressure from the US winter wheat harvest, with reports of a quicker than average start. Additionally, Russian wheat export prices have declined following Turkey’s decision to deny wheat imports until mid-October. European wheat futures also fell, due to concerns that Turkey’s import ban could weaken global demand.

- Nov-24 Paris rapeseed futures settled at €478.25/t yesterday, up €2.00/t from Friday’s close.

- European rapeseed prices once again followed Chicago soyabean futures higher yesterday. This comes as the canola futures ended firm on Monday but were unpinned by spillover support from higher prices seen for US soyabeans and the wider oilseed complex. The USDA’s most recent crop condition report was released yesterday afternoon, with 72% of U.S. soyabeans rated as being in good to excellent condition, above the 10-year average.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

More export competition for EU wheat after Turkish ban?

The Turkish government announced last week that it will stop wheat being imported into the country from 21 June to until at least 15 October. This has added to the pressure in the global wheat market, particularly for European wheat futures. Read more about the recent market trend in yesterday’s Market Report.

The aim of the ban is to protect Turkey’s domestic wheat producers from declines in global prices due to harvest pressure. But the ban could also have implications for the global market.

Turkish wheat imports

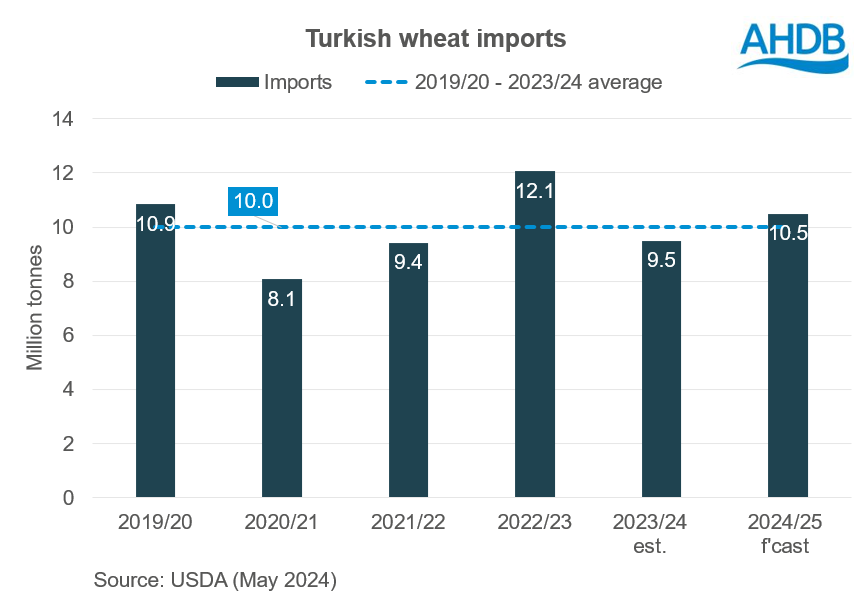

Turkey is amongst the top five largest wheat importers in the world, importing 10.0 Mt of wheat each year on average (2019/20 – 2023/24, USDA). Russia and Ukraine are usually the largest suppliers of wheat to Turkey.

In the first seven of the 2023/24 season in Turkey (June 2023 – January 2024), Turkey imported 6.45 Mt, of which 5.33 Mt (83%) came from Russia (Turkish Statistics Institute). A further 0.89 Mt (14%) came from Ukraine.

While Turkey has a very high bread consumption per capita, this does not drive the import pace. Since May 2023, imports of wheat have been subject to a 130% tariff, which is prohibitive. However, if the imported wheat is processed into flour or pasta which is exported, the import tariff on the wheat is reduced to zero.

Turkey is the world’s leading flour exporter and one of the biggest exporters of pasta (US attaché). Since 2018, only exports made from imported grain are allowed. But it’s now been announced that from 21 June to 15 October 2024, Turkey will allow exports of flour (from Turkish grown wheat), under a license system.

Market impact

In the first few months of 2024, greater competition from Russian wheat was a key factor in pressuring wheat prices, along with selling by speculative traders. High Russian export availability, coupled with the disruption to trade through the Suez canal, meant more Black Sea grain was looking for homes in key European export markets.

Turkey’s halt on wheat imports could potentially mean more Russian and Ukrainian wheat competing into traditional EU export markets. This is why the announcement has pressured prices. However, this impact is subject to Turkish wheat product exports being maintained using domestic production and stock level, or there could be a displacement effect on demand.

There’s also a caveat around Russian and Ukrainian crop sizes. Smaller crops for these top producers could reduce the overall exportable level and offset the impact of the Turkish ban.

* Please note that a clarification has been added to Friday’s Grain market daily about UK crop conditions at the end of May. While the warmer days supported crop development, nights were also warmer, which can have a negative impact on yields.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.