Arable Market Report – 10 June 2024

Monday, 10 June 2024

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

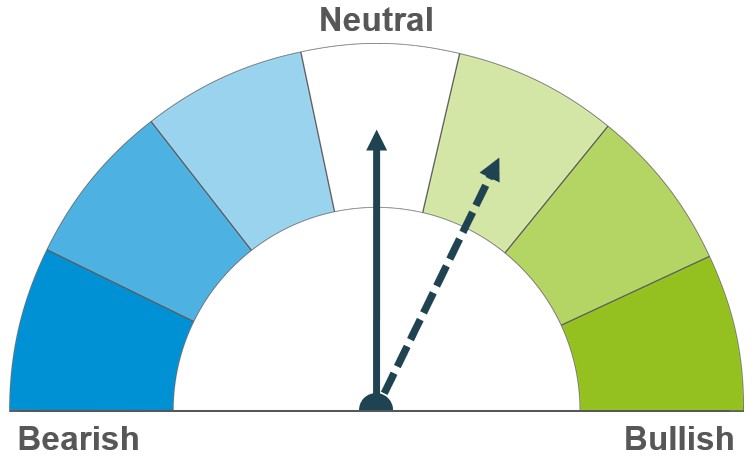

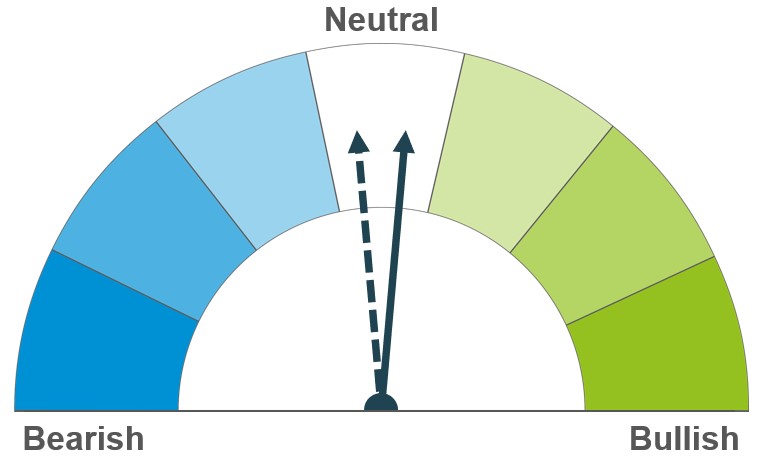

Wheat

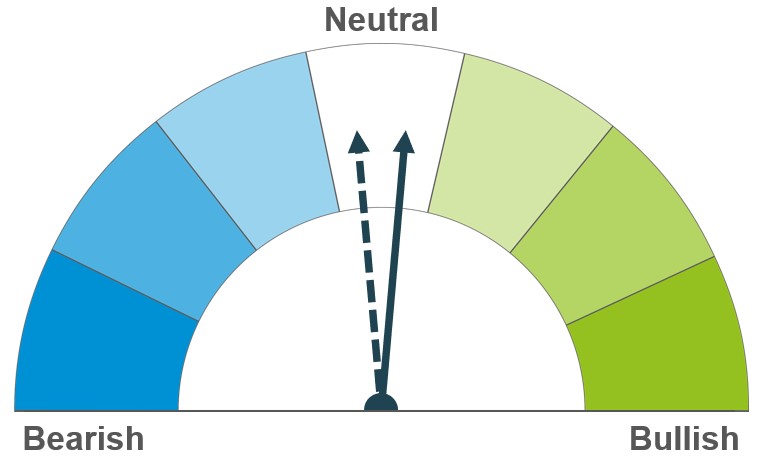

Maize

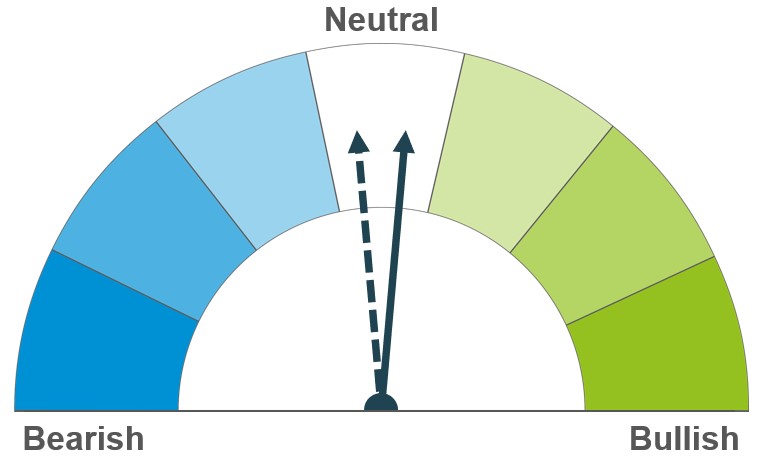

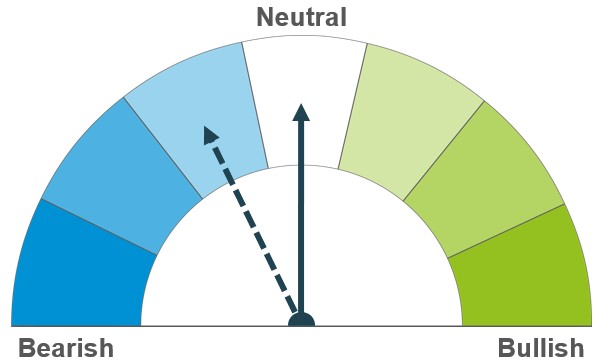

Barley

Concerns about export competitiveness and harvest pressure are, for now, outweighing crop concerns. Longer-term, the results from the 2024/25 harvests will be crucial to the outlook but unless there are further downgrades, market concerns are likely to ease.

A good start to US maize crops counters against the potential for higher export demand and revised Brazilian crop figures. Longer-term, US weather through July will be important for yields and global supplies.

Larger crops expected for key global barley exporters mean feed barley’s price direction will be more dependent on the wider grain market in the months ahead.

Global grain markets

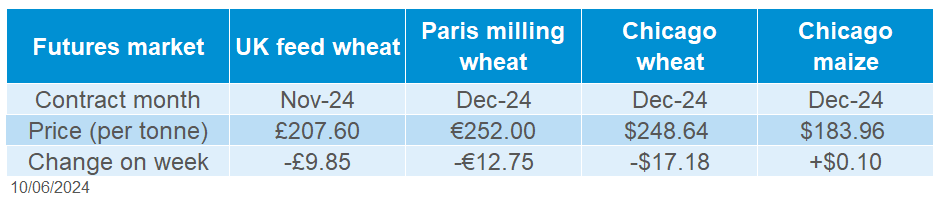

Global grain futures

Global grain prices fell around 5% last week, despite a further downgrade to the 2024 Russian wheat crop estimate. SovEcon cut its estimate by 1.4 Mt to 80.7 Mt, compared to nearly 93.0 Mt last year. However, US harvest pressure, a focus on export competitiveness and selling by speculative traders pulled markets lower.

The USDA reported that the US wheat harvest got off to a faster than expected start last week, which weighed on wheat prices. Early results are better than expected (US Wheat Associates) and the weather forecast for this week favours the harvest progressing.

Meanwhile, the proportion of French soft wheat rated good or very good improved slightly, with harvest on course to start this month (FranceAgriMer). Australia’s government also predicted its 2024/25 wheat crop will grow 12% year-on-year, with barley output up 7%. Ukraine will not revise its crop estimate until July, despite crops ripening earlier than usual due to unusually warm weather.

Worries about export competitiveness was a key feature, with tenders from Egypt, Algeria and Tunisia over the week. The tenders highlighted the continuing competitiveness of wheat from the Black Sea area, and the challenges facing Western European exports.

In addition, Turkey, the world’s fourth largest wheat importer in 2023/24, announced it would stop wheat imports from 21 June until at least mid-October. The potential for reduced global import demand weighed heavily on markets on Friday.

A change to tax rules in Brazil could make Brazilian maize less competitive and shift export demand back to the US. This news offset pressure from good US crop conditions and meant Chiago maize futures ended the week almost unchanged.

Re-positioning ahead of the next USDA estimates of world supply and demand (due 12 June, 5pm BST), is likely to be a feature this week.

UK focus

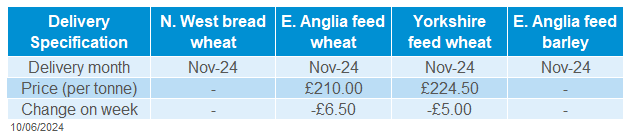

Delivered cereals

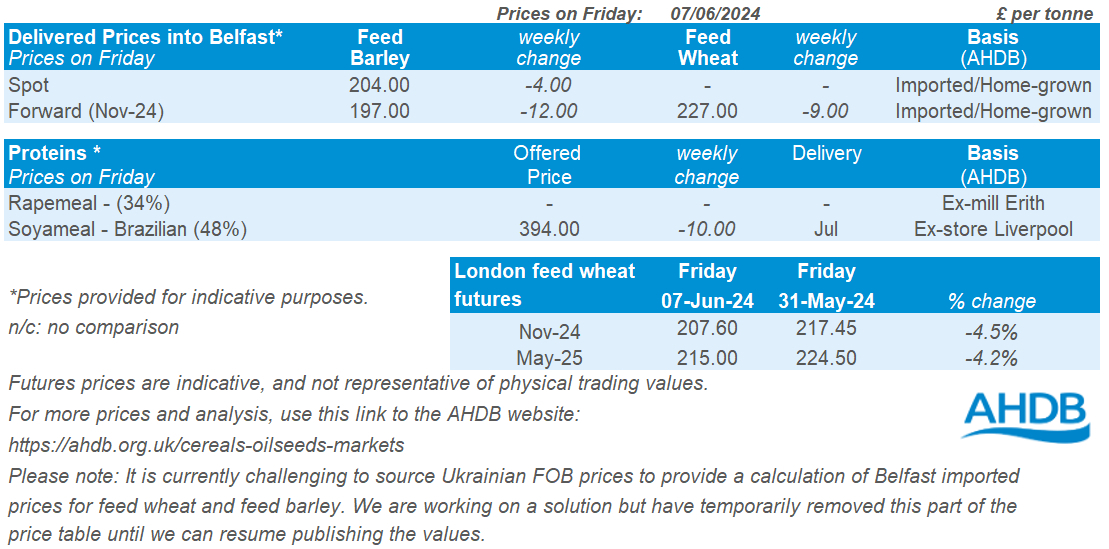

Nov-24 UK feed wheat futures lost nearly £10/t last week, under pressure from global markets.

Delivered prices also tracked lower, echoing futures market movements Thursday to Thursday. As of Thursday’s close, feed wheat delivered into East Anglia in Nov-24 was reported at £210.00/t, down £6.50/t from a week earlier.

In the latest AHDB crop report, GB winter wheat and winter barley crop condition scores edged up compared to the end of April. But the scores are still well below previous years. Weather conditions were overall more favourable than in previous months, and the warmer temperatures supported development. However, the nights were warmer too, which can have a negative impact on yields; it remains to be seen how the leafy crops translate into yields. Sunshine through June and into early July is now important to support yield potential.

Despite a very late start, spring cereal crops are growing rapidly into strong plants and generally look well, especially spring oats. Plus, 55% of GB spring barley was rated as in good or excellent condition, compared to 73% at the end of May 2023.

Usage data out last week showed higher GB animal feed production including Integrated Poultry Units (IPUs) in April 2024 compared to April 2023. There were year-on-year rises in feed for poultry feed and dairy cows, reflecting delays turning cattle out for grazing after winter. Meanwhile, cereal usage by the UK human and industrial sectors was back on year earlier levels in April.

Oilseeds

Rapeseed

Soyabeans

Crop conditions in Canada and Europe remain in focus, with rapeseed continuing to extend its premium over soyabeans. Forecasts of declining rapeseed stocks offers support longer-term.

Planting is nearing completion in Canada after earlier delays, though crop conditions in Australia and the EU remain watch points. While the price premium for rapeseed over soyabeans seems to have stabilised for now, the prospect of tighter global rapeseed supplies still offers support relative to soyabeans longer-term.

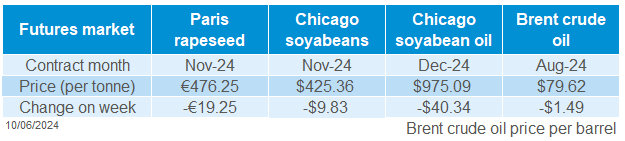

Global oilseed markets

Global oilseed futures

Nov-24 Chicago soyabean futures felt overall pressured last week (Friday-Friday), falling $9.83/t to close at $424.53/t. Despite the slight rebound midweek due to the news of the new tax regime in Brazil, prices were weighed on through the week by favourable US planting progress and the uncertainty around global demand.

USDA’s crop progress report last week showed that soyabean planting in the US is ahead of the five-year average. By June 2, 78% of soyabeans had been planted, up from 68% in the previous week. The USDA’s first assessment of crop conditions will be a watchpoint in tonight’s report.

The demand for soyabeans remains a watchpoint. LSEG reported that both Egypt and Saudi Arabia saw a significant decline in soyabean imports in the first eight months of the 2023/24 season. Egypt’s soyabeans imports fell 13% to 1.4 Mt, marking a 51% reduction relative to the five-year average, Saudi Arabia’s soyabean imports declined by 28% to 208 Kha during the period.

The National Oilseed Processors Association (NOPA) revised its US soyabean crush estimate for April up by 2.0% from its previous estimate. But this is still down 13.7% relative to the record achieved in March.

The Brazilian government’s introduction of a new tax rule offered some support to the market midweek. The measure is aimed at tightening the use of tax credits and could result in a 4% reduction in prices paid to soyabean farmers (Abiove). This could potentially weaken the competitiveness of Brazilian soyabeans for export in favour of US soyabeans.

Today, LSEG reported that China, the world largest oilseed buyer, imported 10.2 Mt of soyabeans in May. This figure falls 11.6% short of the import levels during the same period last year. While there is an expectation of larger imports in June, the impact of flooding on the Brazilian harvest and the new tax rule could pose a constraint.

Rapeseed focus

UK delivered oilseed prices

Despite the slight rebound on Thursday, Paris rapeseed futures were pressured overall last week on the back of a weak oilseed complex, technical selling and profit taking. The Nov-24 contract ended Friday’s session at €476.25.00/t, down €19.25/t on the week.

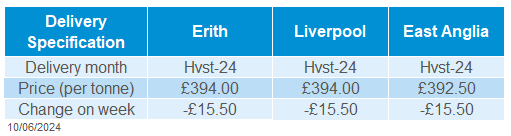

Domestic delivered prices followed Paris futures movement last week. Rapeseed delivered into Erith for November delivery was quoted at £405/t on Friday, down £15.00/t on the week.

Whilst uncertainties continue regarding the EU’s rapeseed production due to adverse weather and acreage shift, the Canadian canola (rapeseed) crop is progressing well. A crop report from Saskatchewan, the largest producing province of canola in Canada, shows planting progress is now at 94%, up from 77% the previous week. Albeit this falls below the five-year average of 97% due to crop damage caused by frost and hail.

Despite crops improving through May, GB oilseed rape crops are still likely to have limited yield potential this year for many growers. Across GB, 49% of winter oilseed rape is rated as in a good or excellent condition, slightly up from 47% at the end of April but still below last year’s 63%.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.