Milk production expectations stay muted in September forecast update

Thursday, 22 September 2022

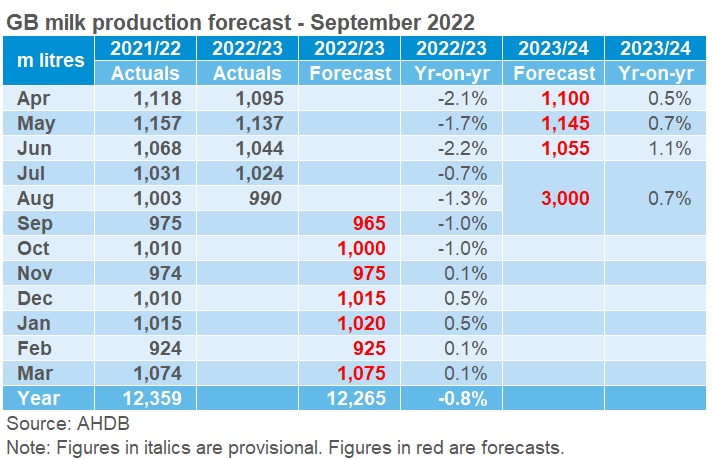

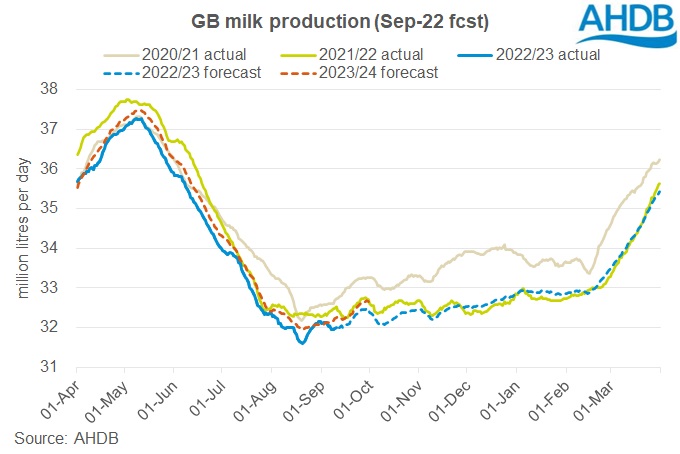

GB milk production for the 2022/23 season is now expected to reach 12.26bn litres, 0.8% less than the previous season, according to our September forecast update.

The revised projection is slightly higher (~30m litres) than predicted in our June forecast. This has been driven by herd numbers, with the July data from BCMS showing marginally higher numbers than previously estimated.

In the three months since our last forecast, a hot and dry summer has put a lot of pressure on feed supplies in some regions. According to feedback at the recent Milk Forecasting Forum, coverage for winter feed is highly variable. Anecdotally, supplies ranged from some farmers in Scotland having surplus forage, to some farmers in the south-west having to feed their already limited winter supplies through the summer.

In addition to feed pressures, high costs in other areas continue to be an issue. Fuel, fertiliser and energy prices all remain elevated. Again, exposure here is variable, but there are risks of higher costs on the horizon as contracts for previously fixed prices start to expire. While high milk prices have been helping cover these costs, price increases are starting to slow down. Additionally, global dairy markets are facing some downwards pressure as demand responds to high prices. Sustained reductions in demand could make it harder for processors to maintain high prices over the coming months.

Overall, our ‘baseline’ scenario remains unchanged from the last forecast. This assumes yields will remain subdued for the rest of the season, and there will be a little extra downwards pressure on herd sizes over the winter.

Next season

Our projection now extends to cover the first half of the 2023/24 season. Currently, expectations are for this to be around 0.7% higher than the first half of this season, but this is a tentative forecast. It assumes there will be some alleviation in cost pressures, in turn allowing for some recovery in yields.

High costs aside, the Milk Forecasting Forum highlighted some other factors which could impact future yields. On the positive side, long-term improvements in cow genetics are still happening and will grow yields over time. On the other side, chronic labour shortages in the industry will, if unfixed, limit farmers ability to increase yields due to lack of workforce.

Alternative Scenarios

For the last two forecasts, we have produced a range of potential scenarios to show what could happen if the cost/milk price balance worsens from our baseline assumptions. With half the 2022/23 season now set, the potential variation in production is reduced, limiting the uncertainty, and therefore the need to model different scenarios.

However, it was put forward at the milk forecasting forum that this winter still has the potential to be a crunch point for farm finances. Because of this, there is a chance we could see higher rates of destocking that have so far been avoided. We have modelled this potential impact using our previous 'very high impact' scenario for destocking, which set cow retention rates 2 percentage points below the long-term average, but kept yield expectations in line with the baseline forecast. In this scenario, milk production for 2022/23 could fall to 12.15bn litres, 1.7% below last season. This would be equivalent to 110 million litres less milk (-0.9%) than our baseline projection.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.