GB milk production forecast updated for June 2022

Thursday, 30 June 2022

Foreword

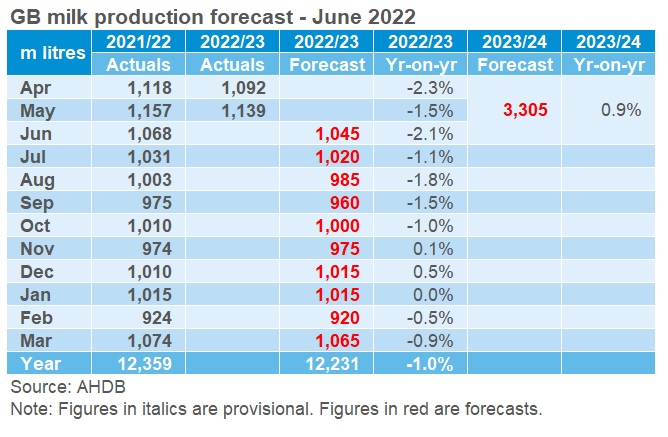

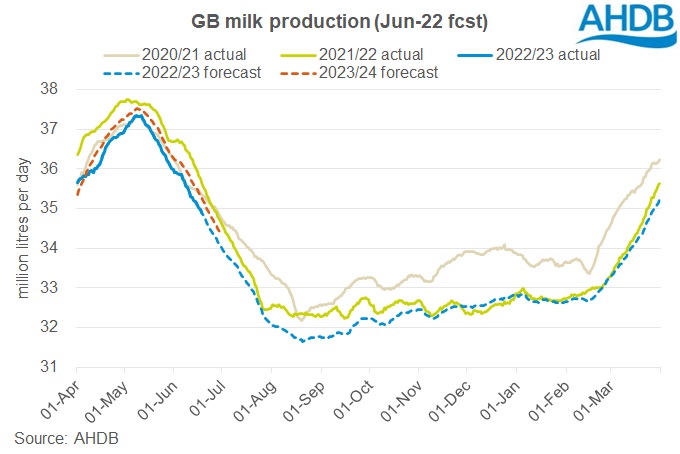

AHDB’s quarterly update to its baseline forecast for GB milk production shows 2022/23 milk production is expected to be down 1.0% from last year at 12.23bn litres.

In the three months since our last milk production forecast, there has been little improvement in the pressures facing the industry. Extremely high input costs remain, exacerbated by the continuing conflict in Ukraine. Milk price increases so far this year have helped to offset some of these higher costs. However, they have not yet encouraged higher production, with yields remaining subdued into June. Whether the higher prices will be enough to alleviate the pressure on farm margins as we move into the second half of the milk year remains unclear.

The current forecast is a baseline, and likely a best-case scenario for the year, as demands on working capital are likely to increase as we move into the latter part of the season. The alternative scenarios explored earlier this year remain applicable as uncertainties remain over price direction and availability of key inputs. These will be revisited as part of our summer Agri Market Outlook, due out in late July, along with the latest insight on feed and fertiliser markets.

2022/23 baseline milk production forecast

Our June baseline forecast for GB milk production in 2022/23 is 12.23bn litres, 1.0% below 2021/22.

This is slightly lower than our March forecast. Milk production for the season so far has been relatively close to the forecast. Updated herd data showed a larger herd in Q2 than had been projected, although the herd is still in long-term decline. However, this in turn means yields were a little lower than projected, leading to a reduction in expected yields for the current milk year.

In terms of farm finances, milk prices have been rising steadily throughout the first half of the year, with announcements for further increases into September. This should help farmers cover the rising input costs. There remains a risk that finances will remain pressured as we move into the second half of the year when feed costs increase, restricting any move to actively increase yields.

The situation continues to remain volatile, with the outlook for the second half of the season particularly uncertain, both in terms of cost and availability of inputs and the supply response to higher milk prices. The alternative production scenarios we explored following the March forecast remain applicable, although we will revisit them as part of our summer Agri Market Outlook.

Our projection now extends out to spring 2023, where we’re currently projecting a small improvement on this year’s spring but with cost pressures still limiting growth. However, with little clarity on the pace of input cost inflation, and the extent to which milk prices will cover these, it remains difficult to forecast that far ahead.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.