GB milk production forecasted to decline in 2022/23

Thursday, 24 March 2022

Executive summary

We are starting the 2022/23 production season from a unique position of weakness. Not only are milk deliveries running 4% below last year’s levels, but farmers are facing an extraordinary amount of pressure on cash flows. Prices for feed, fertiliser and fuel, the three largest cost categories for dairy farmers, have all rocketed in recent months, putting huge pressure on working capital and margins.

As we enter the peak production period, seasonality adjustments will reduce milk prices on many contracts. This will add even more pressure to bank balances and further discourage milk production over the spring months.

The current forecast is a best-case scenario for the year, as the risk of negative margins grows as reliance on purchased feeds increases as the season progresses. Unless milk prices keep pace with mounting expenses, yields will continue to fall off from already low levels.

With such volatility on so many fronts, we will continue to monitor the market and revisit these forecasts as events unfold.

2022/23 production forecast

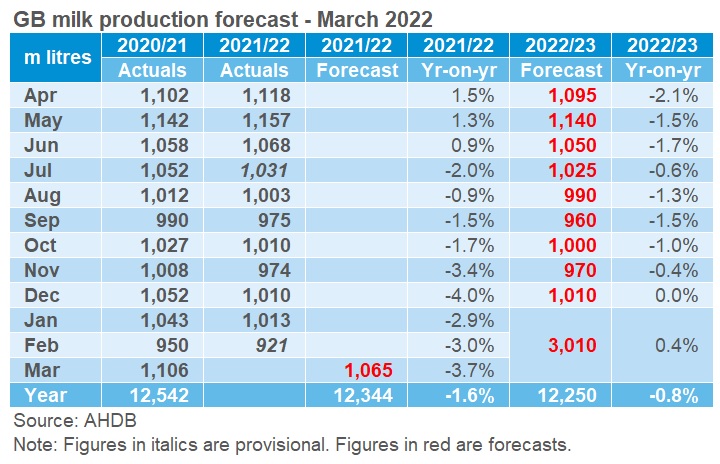

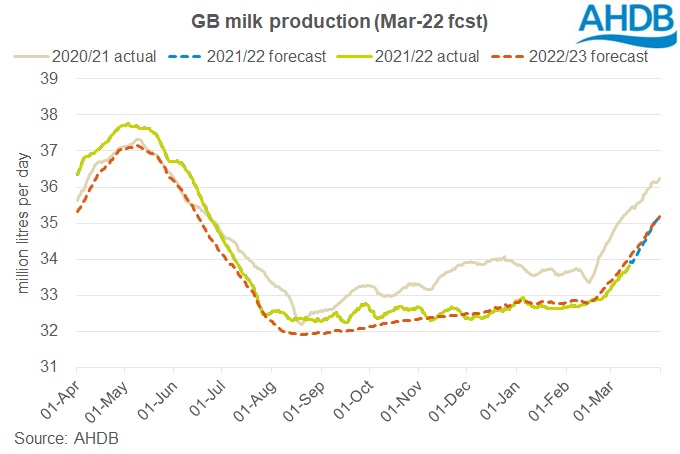

GB milk production is projected to total 12.25bn litres for the 2022/23 season, 0.8% below where we expect 2021/22 to finish. It is another uncertain year for farmers, with many moving parts that could impact production, but this forecast provides a baseline of what we could see based on long-term trends and recent circumstances.

The 2021/22 season is forecast to reach around 12.34bn litres, 1.6% below 2020/21. Although spring 2021 was reasonably strong, production fell quickly after the peak, and high input costs weighed on production in the latter half of the season. Cost pressures are likely to continue to impact production through the upcoming season, particularly come autumn and winter when reliance on bought-in feed is likely to be higher.

The forecast is based on two key variables – the size of the milking herd, and milk yields.

The milking herd has been in long-term decline, and this is expected to continue. Youngstock numbers have been rising since 2020, and these heifers will start to age into the milking herd this year. However, the consensus at the milk forecasting forum was that farmers won’t expand their herds in the upcoming year. As well as the pressures of high variable costs, costs of building new infrastructure are also running high. Overall, this is expected to result in a slight lift in the number of cows culled in the upcoming season – both to reduce the cost of keeping less productive cows, and to make room for incoming heifers without expanding.

We have also reduced our projections for expected yields. Prior to last year, yields had been improving at an average rate of 2.3% a year, helped by long-term improvements in genetics and best practice. However, yields have been down year-on-year since November. Given the uneasy balance between costs and milk prices, we have reduced our yield expectations for the upcoming season.

Overall, this puts production through the spring flush more in line with 2020 than 2021, and the back end of the season similar to last year, when yields were lower.

However, the war in Ukraine and sanctions against Russia are adding additional uncertainties to how the year will progress – on top of the usual wildcard that is the British weather and the impacts of policy change on farm payments.

Given this uncertainty, we will be looking at what could happen to production under different cost scenarios over the next few weeks, and continue to review our forecast on a regular basis.

Find out more about how we forecast on the Milk Forecasting Forum page

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.