May dairy market review

Wednesday, 14 June 2023

Milk production

GB milk deliveries continued to record year-on-year growth through May, albeit now slowing, with estimated volumes up 0.5% on the year at 1,141m litres. Production reached the spring peak on 5 May but to a fairly subdued level. This leaves monthly production down by 0.8% against our March forecast.

The growth in milk production had been driven by a favourable milk to feed price ratio over the autumn and winter, with favourable weather last autumn. However, the reductions in milk prices since the beginning of 2023 teamed with higher than normal input costs are now putting a brake on production. The drying ground enabled more turnout and reports of a good first cut, but a potential drought on the horizon could stymie production further. The Met Office reported that for the month of May UK overall rainfall was only 55% of the average.

With yields still above last year, we have forecasted marginal growth for milk deliveries in the 2023/24 season (+0.5%). However, this heavily depends on the extent of milk price declines, as tightening farm margins plus difficult weather could potentially lead us to see higher destocking rates. The forecast will be revised later in June.

Compared to previous years, more dairy producers have left the industry. Our most recent survey of major milk buyers estimated that there were 7,500 dairy producers in GB as of April 2023. This is a reduction of 380, or -4.5%, from the previous year.

Global milk production in March declined by -1.1% year-on-year, averaging 816m litres per day. Growth in production was seen across the UK, USA and New Zealand, while decline was noticed in the EU, Argentina and Australia. This tipped the global picture into the negative for the first time in 8 months. The EU-27 were responsible for much of the decline with deliveries down by 2.3%, primarily driven by France, Hungary and Spain.

EU are forecasting a drop of 0.2% in milk production for 2023. This is in response to a declining dairy herd and lower prices forecast to drive a decline in production in the second half of the year, despite good yield growth.

Wholesale markets

Prices on dairy wholesale markets have been mostly weakening in all key markets since the summer of 2022. Cheese fared well in the USA on good retail and foodservice demand. Oceania will be entering their lower production phase shortly, and the market undertone remains steady to firm. Overall demand remains lacklustre around current levels, with no real rush to buy. EU product prices were anywhere from 32% to 48% lower year-on-year. The exception to this is in cheese prices, which have declined in recent months but remain 9.3% above year earlier levels.

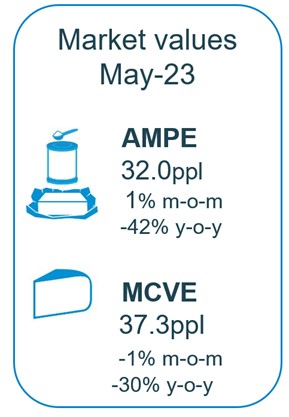

As of May, milk market values (which is a general estimate on market returns and the current market value of milk based on UK wholesale price movements) continued to nudge down: in the UK they are now around 17ppl lower than a year earlier, with AMPE and MCVE down by 42% and 30% respectively.

Input costs

The latest Agricultural Price Index (API)[i] shows that the rate of inflation in prices paid for goods and services has eased since peaking in the autumn. Although this will be welcome news to farmers, pressure on margins remains as price inflation continues to sit at historically high levels with the key inputs maintaining a higher rate of inflation than outputs.

Farmgate milk prices

The latest published farmgate price was for April, with a UK average of 39.4ppl. Since then however, market-related farmgate prices have continued to decline in response to the reduced market returns and higher milk availability.

In the first six months of this year, cuts to milk prices (excluding aligned) have ranged from 9.5ppl and 17.0ppl, with further cuts expected for July. Aligned contracts on the whole fared better, losing only between 0.26 and 0.77ppl in June.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.