Market Report - 29 November 2021

Monday, 29 November 2021

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

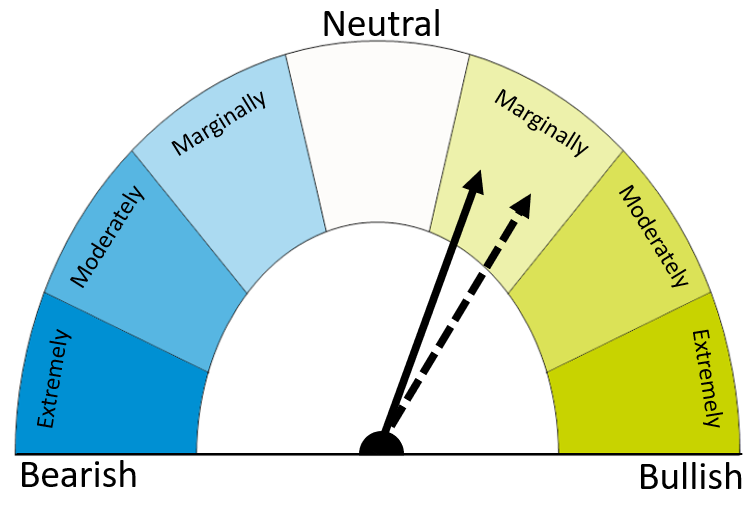

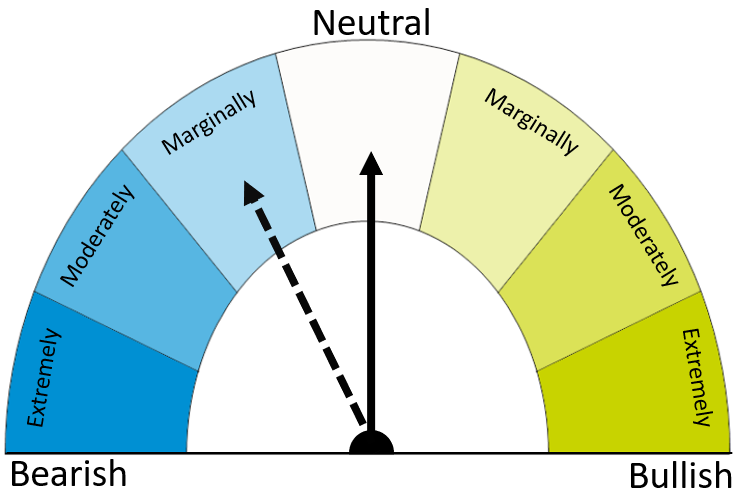

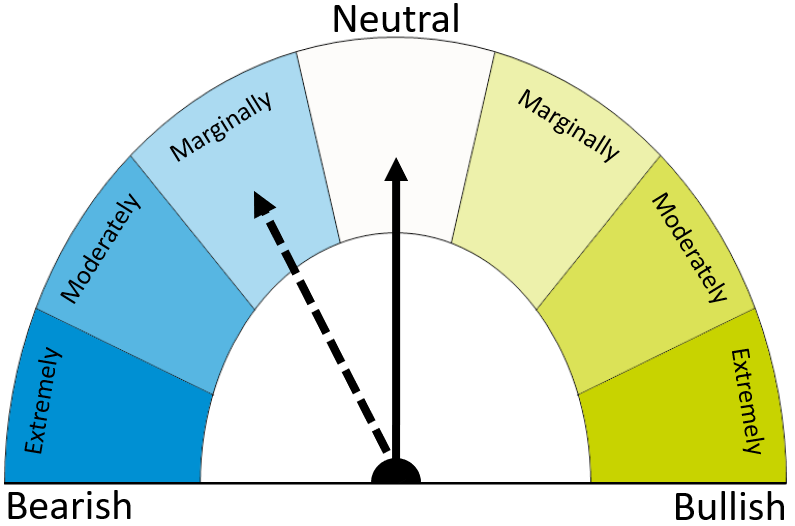

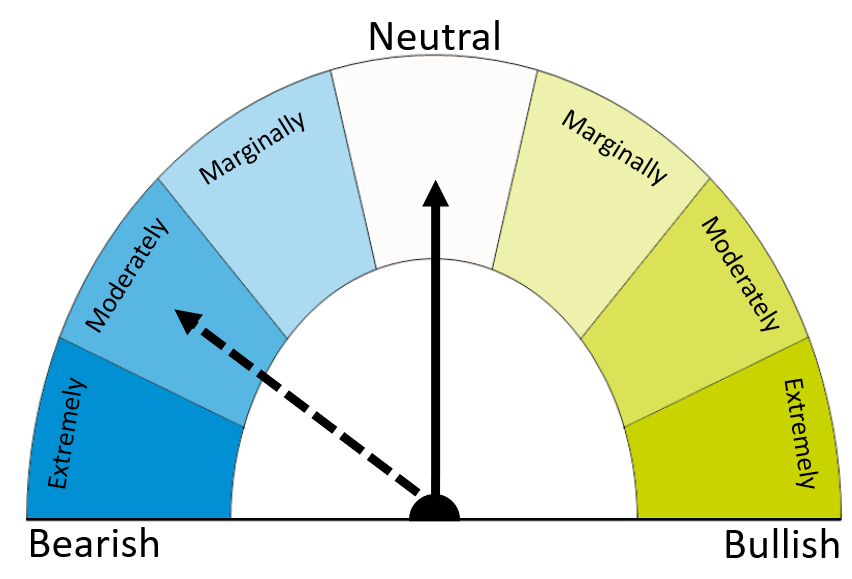

The dials in this report reflect the analyst’s view of the possible direction in markets. The two-week (solid line) and six-month (dashed line) outlooks are based on the best available information at the time of writing. Please note, these views do not constitute trading advice and direction of markets may change due to new information since the time of writing.

Wheat

Maize

Barley

Tight global wheat supplies continue to support global wheat prices. Longer-term, a key watchpoint is the outlook for maize, which could potentially impact wheat prices, especially feed values.

Record South American crops could bring some much-needed supplies in 2022. But, markets are likely to be nervous until the crops are harvested.

Barley continues to track wheat markets due tight global supplies.

Global grain markets

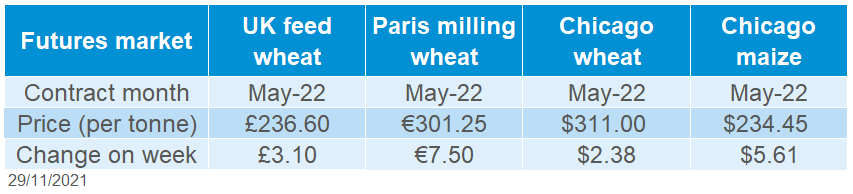

Global grain futures

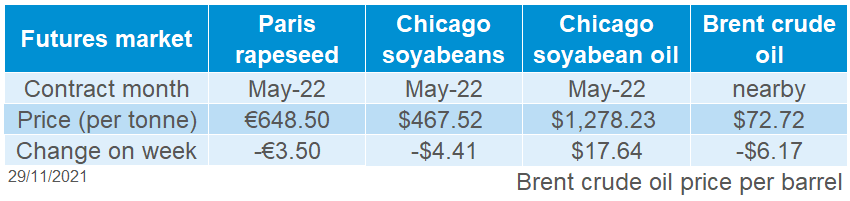

Global wheat futures (May-22) rose last week due to ongoing worries about global wheat supplies. Prices eased back from mid-week onwards, due to reduced trade as the US markets closed on Thursday for Thanksgiving and worries about the new COVID-19 variant.

The EU-27 will export 32.0Mt of soft wheat in 2021/22 (EU Commission). This is up 2.0Mt from last month and 4.6Mt more than last season but still below 2019/20’s 36.8Mt. The result of this is lower closing stocks. Strong demand for European wheat is one of the factors supporting UK prices, which could persist given the Russian export tax is set to rise again this week.

A La Niña weather event is in progress according to the Australian Bureau of Meteorology. The Australian harvest is being disrupted by rainfall, a common feature of a La Niña in Australia. Early reports suggest good yields but the rain is causing concern for quality. This could be supportive of milling wheat markets.

Some of this support could be tempered if there continue to be positive results from the Argentine wheat harvest. Yields are improving as harvest progresses in the central regions.

An important factor in the weeks ahead for all grain prices will be the South American maize crops. These crops are forecast to account for 8% of global grain output this season. La Niña has the potential to reduce rainfall here. But so far, early crops are off to an encouraging start and were boosted by rain over the weekend.

Chicago maize futures for May-22 also rose last week. On Friday, the US reported new export sales totalling 1.43Mt of maize in the week ending 18 November, above trade expectations.

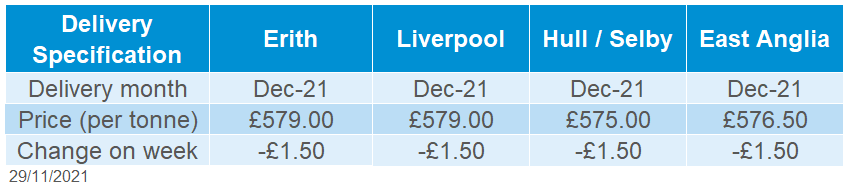

UK focus

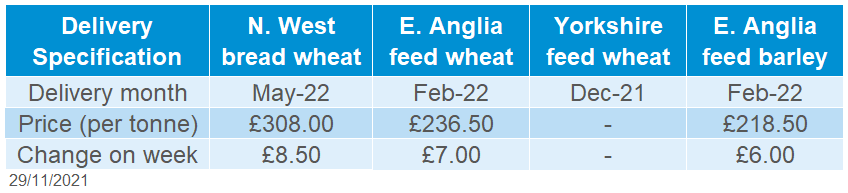

Delivered cereals

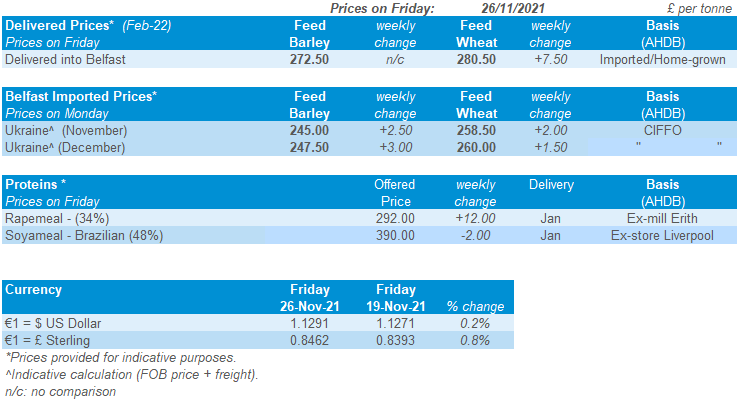

UK feed wheat futures (May-22) rose last week, following the trend set by global prices.

Domestic wheat supply and demand remains tight. The latest estimates show an even tighter picture than forecast last month due to lower imports, while demand remains robust. UK maize imports are also forecast to fall 26% from last season to 2.12Mt. Currently, import pricing of Black Sea maize is not competitive against domestic cereals. The estimates also included the first projections for oats and updated projections for barley.

Sterling weakened against both the euro and US dollar last week. On Friday £1 was worth €1.1792 and $1.3340 (Refinitiv). While the pound is still relatively high against the euro, it fell to its lowest level against the dollar for 12 months on Thursday. Weaker sterling can often mean support for UK prices relative to global or European levels.

Oilseeds

Rapeseed

Soyabeans

Global rapeseed supplies remain tight this marketing year, trading at the top of the oilseed complex. This means rapeseed’s ability to climb is limited, without bullish news for other oilseeds. A more bearish outlook for soyabeans longer-term could drive market sentiment.

There is a positive outlook for South American crops as the majority of Brazil’s soyabeans were planted in a timely manner. Markets will now focus away from the US and towards the development in South America.

Global oilseed markets

Global oilseed futures

Last week, oilseeds market sentiment was dominated by worries over the new COVID-19 variant (Omicron), causing broad-based selling in commodities.

With few buyers willing to step into the market from Tuesday to Friday last week, commodity funds were net sellers of soyabeans. Chicago soyabeans futures (May-22) ended down 0.93% across the week.

Despite covid concerns, demand for US soyabeans remains strong. In the week ending 18 November 1.56Mt of sales were confirmed, up 13% from the previous week. China are cited to be the main purchaser.

In edible oils, Chicago soy oil (May-22), despite pressure on Friday, ended 1.4% up week-on-week. Meanwhile Malaysian palm oil futures (delivery in 3 months) were down 4.1% across the week (in dollar terms, Refinitiv). Palm oil’s narrowing spread to other oils has dampened fresh sales, which could impact Malaysian exports in December.

Nearby Brent crude oil futures closed Friday at $72.72/barrel, dropping 7.8% across the week. This is after speculation that OPEC+ may pause an increase in outputs in response to the new coronavirus variant.

Rapeseed focus

UK delivered oilseed prices

It was a volatile week for Paris rapeseed futures (May-22) last week. They closed Friday at €648.50/t, down €3.50/t across the week, but losing €14.75/t on Friday’s trading. Gains earlier in the week partially compensated for this loss.

Delivered rapeseed (into Erith, Dec-21) was quoted at £579.00/t, down £1.50/t across the week. Meanwhile, harvest-22 delivery into Erith was quoted at £480.00/t, with no comparison to last week.

The week-on-week loss was softened on our domestic market as sterling weakened (-1.0%) against the euro across the week. Friday’s close was £1 = €1.1792 (Refinitiv).

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.