Australian weather woes: Grain market daily

Wednesday, 24 November 2021

Market commentary

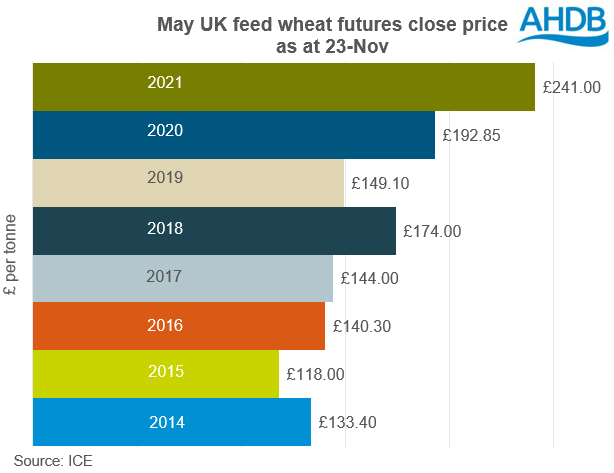

- UK feed wheat futures (May-22) closed yesterday at £241.00/t as global wheat markets rise on the back of Australian weather news (read more below).

- US maize futures continue to drift. Throughout November, Dec-21 Chicago maize futures have traded in a $15.00/t range and yesterday’s gain closed trade at $228.54/t.

- According to Russian Federal Service for Veterinary and Phytosanitary Surveillance data, Russian wheat exports are down 18% year-on-year to 17.2Mt for the period 1 Jul-18 Nov.

Australian weather woes

Australian harvest is underway but despite it often being thought of as a drought country, rain is causing issues for harvest 2021/22.

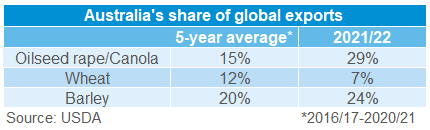

Australia is an important player in the global supply of grains and oilseeds. This is particularly true this year (2021/22), as supplies from other major exporters shrink. The USDA predict the top 5 wheat exporters (Russia, EU, US, Canada, Ukraine) have cut 2021/22 wheat production by 10.0Mt combined year-on-year. As a result, Australia is relied on more heavily this year moving from 6th largest exporter to 4th position in 2021/22.

Due to the recent rains in Australia, wheat futures have been accelerating to even greater levels. Yesterday, the UK feed wheat May-22 contract closed at £241.00/t, gaining £14.75/t from Tuesday-to-Tuesday. This sits £80.95/t above the 5-year average (2016-20) May contract price for the time of year and historically high in the lifetime of UK feed wheat futures.

The rain in Australia is adding even greater concern for milling wheat markets. Global supply was already tight, with significant reductions to the Canadian crop alongside quality issues from France. These factors, coupled with supply constraints from Russia in the form of floating taxes and export quotas, meant good quality Australian wheat was required to ease the picture slightly. However, quality from Australia is coming in lower than anticipated, with weak protein levels. Some are predicting that the Western Australian crop will now be 50% standard white wheat compared to the 25% it usually is, but this remains unfounded so far. As a result of reduced milling wheat prospects in Australia, there looks to be minimal relief to global markets.

Paris milling wheat futures have reacted to this news; yesterday’s nearby contract (Dec-21) surpassed all previous records for any Euronext contract reaching €312.25/t throughout the day and closing at €311.50/t. Today’s trading has already bypassed this, at the time of writing. The May-22 contract closed at €305.00/t, up €17.75/t Tuesday-to-Tuesday.

Global prices, particularly for milling wheat, are likely to remain supported until northern hemisphere new-crop harvest nears, with limited options of old-crop.

To keep an eye on physical domestic prices, visit our ex-farm prices page or our delivered prices page updated on Mondays and Fridays respectively.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.