Argentine wheat improving as harvest advances: Grain market daily

Friday, 26 November 2021

Market commentary

- UK feed wheat futures (May-22) closed at £239.50/t yesterday, down £0.50/t. The Nov-22 contract was unchanged at £210.00/t.

- There was reduced trade in European markets yesterday. The US markets closed for the Thanksgiving holiday yesterday, limiting market direction. Many in the US take a long weekend, so volumes are likely to be limited again today.

- Paris rapeseed futures (May-22) fell €3.50/t to €663.25/t yesterday, approx. £559/t. The Nov-22 contract fell €0.50/t to €574.00/t, approx. £484/t.

- Sterling fell to its lowest level against the US dollar yesterday since December 2020, with £1 = $1.3320 (Refintiv). This follows worries about the new COVID-19 variant of concern and a potential tightening of US monetary policy. The pound also retreated against the euro (£1=€1.1884), but remains relatively strong against that currency so far.

Argentine wheat improving as harvest advances

There are positive yield reports from central Argentina as the wheat harvest advances. The better yields in the central region are offsetting poorer results from the north of the country.

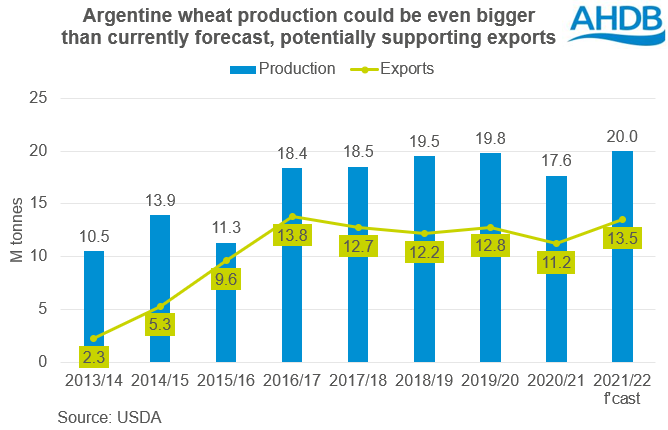

The 2021/22 wheat harvest is now 33% complete, and there is optimism about yields from the southern areas too. As a result, the Buenos Aries Grain Exchange increased its forecast of the 2021/22 Argentine wheat crop by 0.5Mt to 20.3Mt yesterday.

This would be 2.3Mt more than the 17.0Mt harvested last year. It’s also slightly above the latest (Nov) forecast from the USDA of 20.0Mt, which is already a new record.

This said, wet weather is forecast over the weekend, which could stall harvest progress. However, the forecast rain would be welcome for the growing early maize and soyabean crops. Currently, all eyes are on soil moisture levels as these crops start to approach their yield critical growth stages.

The next couple of weeks will bring a far better understanding of Argentine wheat yields, quality and subsequently export availability.

According to the USDA, Argentina is currently forecast to export 13.5Mt of wheat this year. Global wheat supplies are already tight this season and are being compounded by concerns about Australian quality. So, any potential increase in availability from Argentina, even if small so far, is welcome.

A larger Argentine crop, if the quality is confirmed, could temper some of the potential support in global markets from the Australian situation. However, it all depends on quantity and what’s already priced in.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.