Market Report - 07 March 2022

Monday, 7 March 2022

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

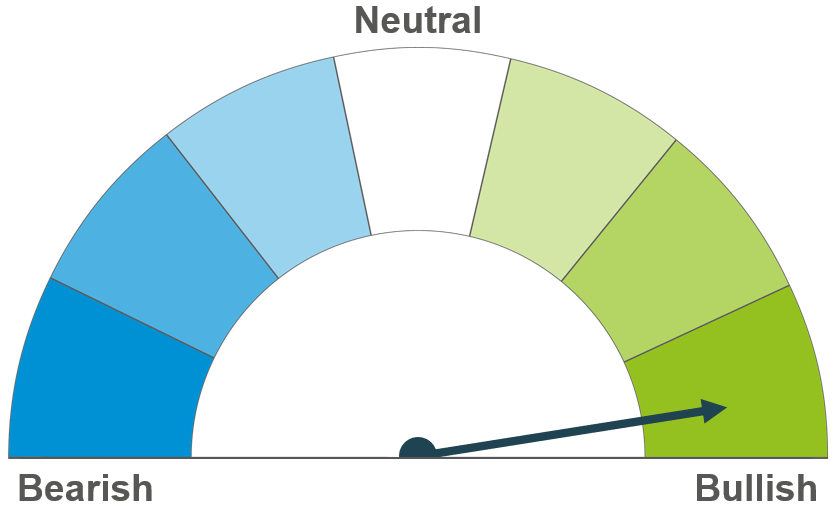

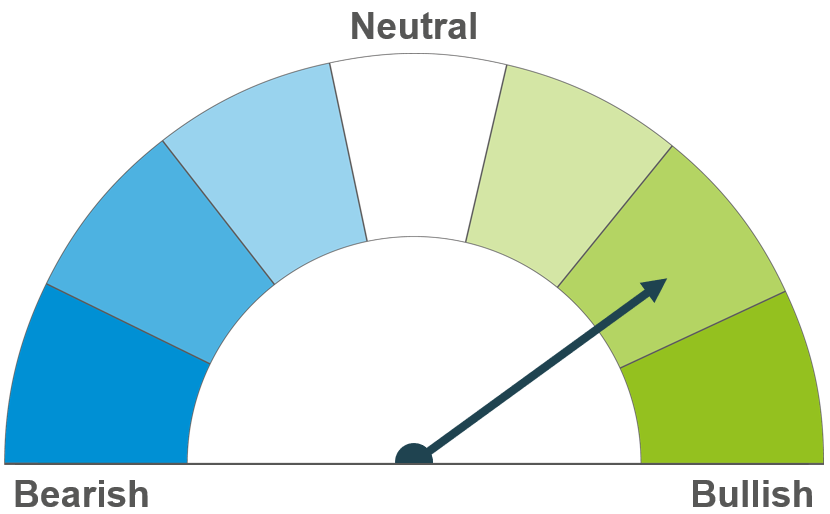

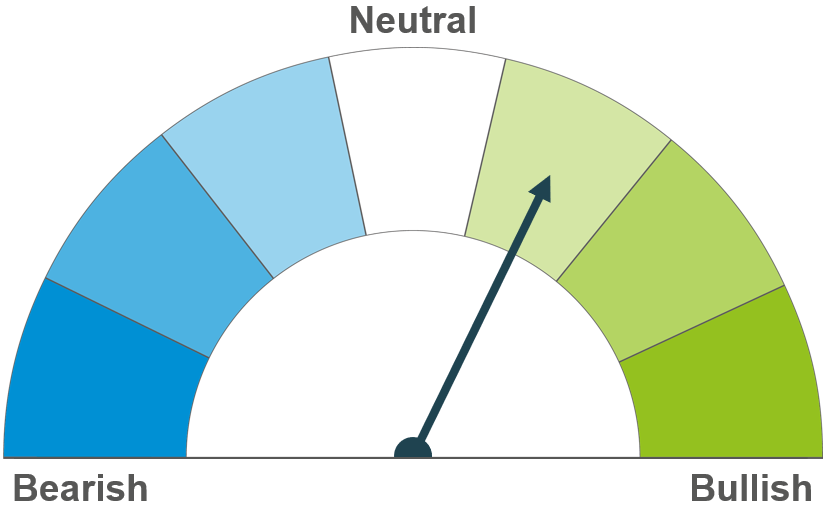

The dials in this report reflect the analyst’s view of the possible direction in markets. The two-week (solid line) and six-month (dashed line) outlooks are based on the best available information at the time of writing. Please note, these views do not constitute trading advice and direction of markets may change due to new information since the time of writing.

Wheat

Maize

Barley

Long-term outlooks remain very uncertain and dependent upon the length of the current Black Sea situation. Short-term markets remain bullish with disrupted supply from key global suppliers (Ukraine and Russia).

Exports remain stalled from key global supplier, Ukraine. This adds a bullish sentiment to markets. Further to that, supply uncertainty lingers with planting of the South American safrinha crop underway.

Barley markets tends to track wider grains and therefore the rise in wheat markets will likely translate into barley to at least some extent. Demand could try to shift to barley for feed rations but with tight availability this may not be possible.

Global grain markets

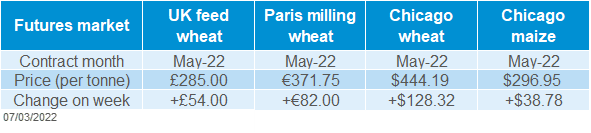

Global grain futures

Market sentiment continues to be dominated by the situation in Ukraine. As the war continues, markets stay volatile, setting more records across several contracts. Last week, US markets gained substantially, particularly wheat. Chicago wheat futures (May-22) gained $128.32/t (40.6%) Friday-Friday, closing the week (04-Mar) at $444.19/t. The nearby Chicago contract (wheat) closed Friday at $495.26/t an additional $21.68/t from the day before, an all-time high, surpassing the 2008 peak of $470.32/t.

Paris milling wheat (May-22) gained €82.00/t (28.3%) from Friday-Friday closing the week at €371.75/t. During Friday’s trade, the contract surpassed the €400/t mark reaching as high as €406.75/t. The market remains extremely volatile though, trading within a €56.50 range on Friday.

Ukrainian ports are closed and will remain closed until the Russians withdraw, according to Ukraine’s Maritime Administration. This said, Ukraine's state-run railway operator is preparing to continue agricultural exports into neighbouring countries Romania, Poland, Hungary, and Slovakia.

Russian trade is also limited by sanctions put in place by many key market players.

Although it is too soon to predict the knock-on effects longer-term (into 2022/23), it is certainly something that needs keeping an eye on. If the war continues for another month, then it will indeed have an impact on next year’s grains supply. Although much of the Ukrainian wheat crop is planted in Winter, yields may well be affected by lack of inputs in Spring.

Aside from this, Ukraine is a key player in global maize markets accounting for c.15% of global maize exports (5-year average). By 21 February there was still a significant volume (13.7Mt) of the anticipated Ukrainian export campaign (33.5Mt) left to leave the country. Not only this, but we are approaching the planting window for maize (Apr/May) and therefore the 2022/23 crop could well be substantially affected.

US conditions remain drier than usual too. This could have a negative impact on the winter wheat crop currently moving towards the heading stage.

UK focus

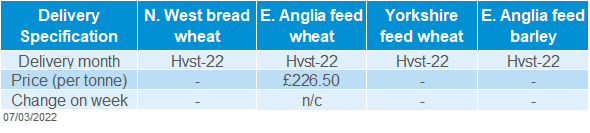

Delivered cereals

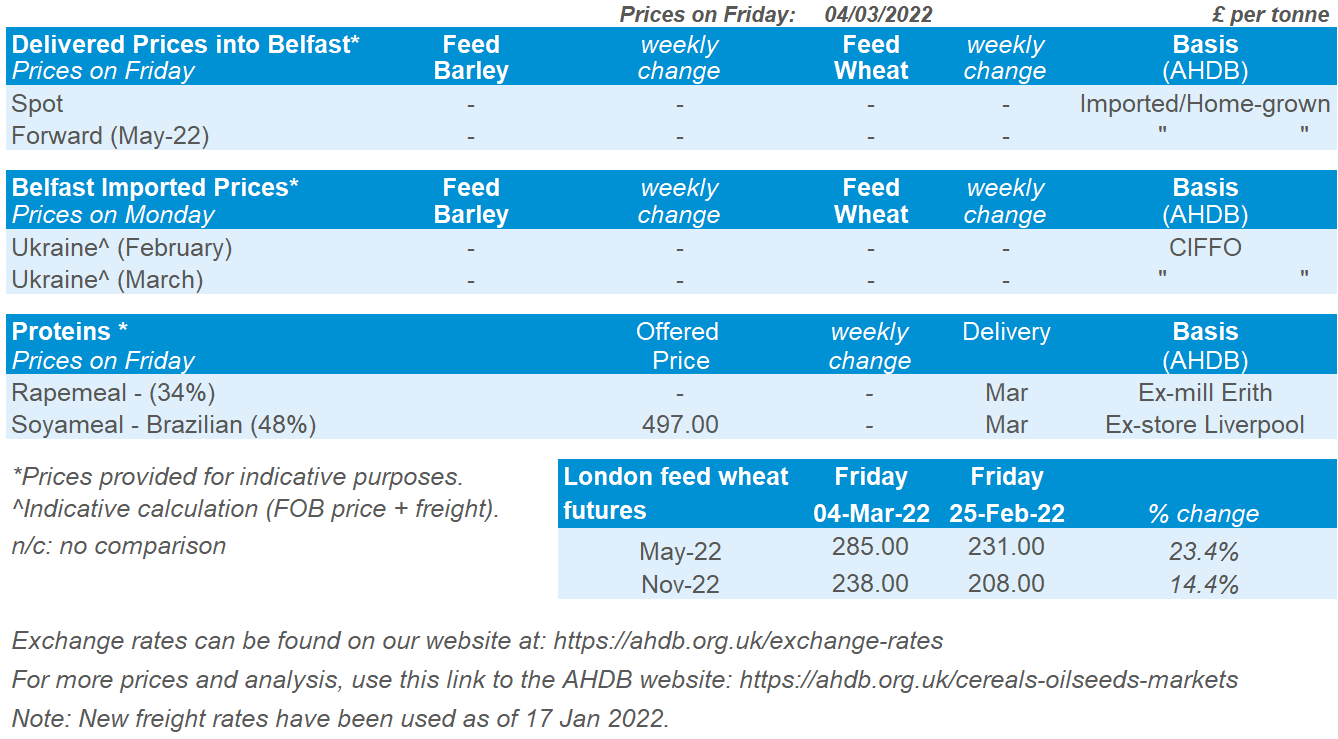

UK feed wheat futures (May-22) followed global markets upwards. The contract closed Friday (04-Mar) at £285.00/t after trading as high as £300/t earlier in the day. At Friday’s close, the contract was up £54.00/t (23.4%) from the previous Friday. It has continued to climb this morning, trading at £314.00/t by 12 noon (07-Mar), but volumes are low at just 50 contracts.

The new-crop (Nov-22) contract also closed higher on the week (+£30.00/t, 14.4%), at £238.00/t. Also gaining more this morning, trading at £258.00/t by 12 noon (180 contracts traded).

Physical trade remains relatively sparse, and markets are so volatile that representative prices are difficult to come by.

In the AHDB’s delivered survey on Thursday, feed wheat for November-22 delivery into East Anglia averaged £231.50/t up £30.50/t from two weeks before but followed futures market moves.

Oilseeds

Rapeseed

Soyabeans

Regardless of recent tensions in the Black Sea region, supplies of rapeseed are tight for this marketing year. Issues with sun oil exports out of the Black Sea region, will further support rapeseed as processors source alternatives.

Soyabeans move up with the general bullish oilseed complex. South American harvests are well underway, and the longer-term sentiment will somewhat depend on sunflower plantings in Ukraine. US planting will also be one to watch although a little way off yet.

Global oilseed markets

Global oilseed futures

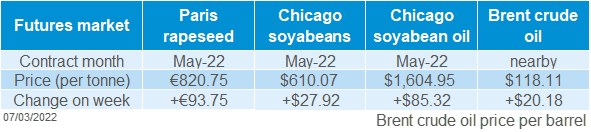

The bullish spur in commodity markets continues as closure of Ukrainian ports combined with sanctions against Russia has supported oilseed prices across the week. Chicago soyabean futures (May-22) climb 4.8% across the week to close at $610.07/t.

From a reduced Canadian canola crop, to South American drought, to now constrained exports out of the Black Sea region, means that support continues for oilseeds. With the EU sourcing 35-45% of their sun oil from Ukraine and stocks piles expected to last 4 to 6 weeks, shortfalls could be expected on the European market (FEDIOL).

Further to that, shortages could be expected for the next marketing year as Ukraine’s spring planting season is schedule to start in the coming months. This could impact sun oil production from the key producer.

Shortages from the Black Sea region are leading buyers to source alternative vegetable oils, such as soy and palm oil, adding support to the overall complex. End of February Malaysian palm oil stocks dropped 11.4% from last month, to be estimated at 1.38Mt, the lowest in over 10 months (Reuters survey). Malaysian palm oil board data is scheduled to be released this Thursday (10 March).

Adding further support is energy prices. Nearby brent crude oil closed Friday at $118.11/barrel, up 20.6% across the week. For a further overview on energy markets, be sure to read Duncan’s article.

Rapeseed focus

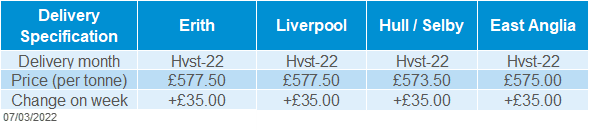

UK delivered oilseed prices

New-crop Paris rapeseed futures (Aug-22) closed Friday at €704.75/t, gaining €66.75/t across the week. Delivered rapeseed (into Erith, Hvst-22) was quoted at £577.50/t on Friday, gaining £35.00/t across the week.

Gains in our domestic market were suppressed compared to Paris as Sterling strengthened (+1.7%) against the Euro to close Friday at £1 = €1.2109.

Northern Ireland

Please be aware, current market conditions are extremely volatile. We have been unable to publish import and delivered prices this week.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.