Market Report - 04 May 2021

Tuesday, 4 May 2021

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Planting and Variety Survey

The AHDB Spring Planting and Variety Survey provides the only pre-harvest planting view of grain and oilseed crops. In a post-subsidy world impartial information and data is key to give a view of domestic food and feed production. This data can help with regional strategies and marketing decisions.

Play a part in creating accurate data for your industry by completing the planting survey form, click here to complete the form. Five minutes of your time can provide huge value to our great industry.

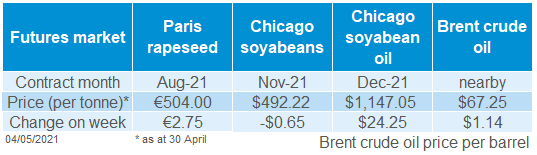

Paris rapeseed futures (Aug-21) closed on Friday at €504.00/t, gaining €2.75/t across the week. Yesterday, they closed €7.25/t higher at €511.25/t.

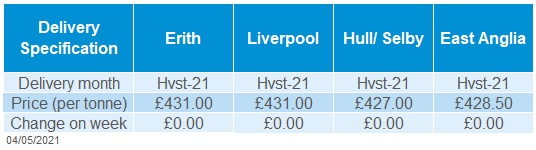

Delivered rapeseed (Hvst-21, Erith) was quoted at £431.00/t, unchanged on the week. Strengthening of sterling against the euro, by 0.12%, across the week meant domestic prices were unable to encapsulate the gains on continental markets. On Friday £1 = €1.1487 (Refinitiv).

Global rapeseed values are expected to remain supported, with the Canadian area for next year to increase, but below market expectations. Consultancy Stratégie Grains also suggested in their latest report that new-crop rapeseed prices could exceed those of 2020/21. Supplies are looking tight on the continent for the next marketing year.

Wheat

Global grain markets

Maize

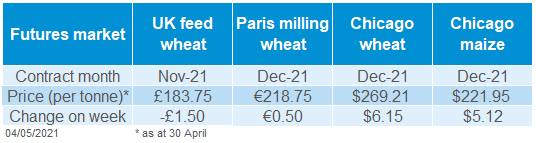

Global grain futures

Barley

Maize provides underlying support to wheat prices. But weather forecasts and crop estimates will dictate the premium to maize. Rainfall and warmer temperatures in Europe and the US could cause wheat markets to soften. Further dry weather would push prices higher.

Without substantial rain in Brazil there could be further cuts to crop estimates. This would tighten global supplies and place extra reliance on the US crop. Markets will remain tense and supported until there is more clarity. Expect further volatility.

UK focus

The wider grains complex is supporting barley prices and new crop barley’s discount to wheat is being maintained. If the weather starts to have a greater impact on spring barley crops, this could start to change.

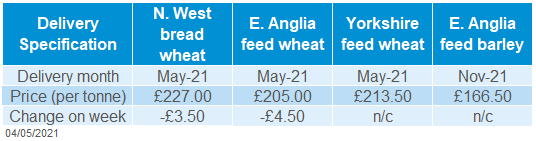

Delivered cereals

Global grain prices were volatile last week. Weather and profit-taking by speculative traders were the main drivers. There were sharp gains for old crop May-21 futures but a more mixed picture for new crop prices. The May-21 contracts are approaching their last trading days, adding to the volatility.

Dry weather in Brazil continues to cause concern for its second maize crop and so global supplies. Nearly two-thirds of the second maize crop was flowering (47%) or at grain fill (17%) on 1 May (Conab), so crops are especially sensitive to adverse weather. StoneX cut its estimate of the second maize crop by nearly 5.0Mt, to 72.7Mt, over the weekend. This is nearly 10.0Mt below Conab’s April forecast of 82.6Mt and 2.4Mt below last year’s crop. The next Conab and USDA forecasts are out on 12 May.

US prices eased back yesterday on good planting progress in the US, which was faster than the industry expected (Refinitiv). In the last couple of weeks delays to US planting had helped push up prices. As at Sunday, maize planting was 46% complete vs 17% the week before and 36% on average for the time of year. But, there are still concerns about dry weather affecting wheat and maize yields.

Elsewhere, the EU-27 2021 wheat crop is now expected to total 124.8Mt by the EU Commission. This is 1.9Mt less than the previous forecast but 7.6Mt more than 2020. This is likely to reflect the impact of cold, dry weather in parts of Europe, including France. However, good conditions are reported in Romania and Ukraine. SovEcon increased its forecast for Ukraine’s wheat crop by 0.8Mt to a record 28.6Mt (24.9Mt this year). Good Black Sea prospects could temper the global sentiment slightly.

Oilseeds

UK May-21 feed wheat futures closed as high as £210.00/t last Monday, before retreating to end the week at £204.50/t. This was down £2.65/t from 23 April. New crop prices followed a similar pattern peaking at £191.30/t last Monday but recorded a smaller Friday-Friday fall of £1.50/t. Delivered prices were lower Thursday to Thursday.

Rain over the weekend and today is welcome for crops after the fourth driest April on record, according to provisional data from the Met Office. The month also had the lowest average minimum temperatures for April in the UK since 1922.

These conditions have also affected grass growth. If cool or dry weather persists, it could increase supplemental feeding to livestock. That could mean a late boost to demand for grain this season.

Rapeseed

Global oilseed markets

Soyabeans

Global oilseed futures

Rapeseed prices are expected to remain supported, until there is a clearer outlook for harvest 2021. Values for next year will likely be supported with tight global supply for 2021/22.

Adverse weather is supporting prices. The market will be focusing on US planting progress over the next month. The split of soya and maize area will need to be watched closely, as maize prices remain supported.

Rapeseed focus

UK delivered oilseed prices

Chicago soyabean futures (May-21) closed on Friday at $577.19/t, up $11.49/t across the week.

Last week was volatile, after Chicago soyabeans (nearby) reached an eight-year high. There is still an element of uncertainty, as profit taking overwhelmed supply concerns and pressured soyabeans at times. However, the market is still supported as weather is the focus currently.

Weather concerns in North America and Europe underpinned support for oilseeds last week. However, in Argentina, dry weather allowed the soyabean harvest to progress. In Buenos Aires Grain Exchange’s latest report, the dry week meant harvest had progressed 14.4 percentage points, the harvest is now 32.9% complete. However, this is still behind this time last year when harvest was at 68.2% complete.

In the latest USDA crop progress report, released yesterday, soyabean plantings were reported to be 24% complete. This is slightly behind the average analyst’s estimate of 25% (Refinitiv), but ahead of the five-year-average of 11%.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.