How could Brazilian maize production affect global grain prices? Grain market daily

Friday, 19 March 2021

Market Commentary

- London wheat futures (May-21) fell £1.25/t yesterday to close ay £198.75/t. This is the first time the may-21 contract dropped below £200.00/t since 10 February. This is a total loss of £5.50/t Thursday – Thursday. The Nov-21 contract lost £3.50/t over the same time period, closing at £166.25/t, yesterday.

- Chicago maize markets were unfazed by the three days of US flash sales of maize this week to China, totalling of 3.08Mt. May-21 futures slipped back by $4.52/t from the previous close, to $215.16/t yesterday.

- Soyabeans also continue to slide on the news of rains arriving in Argentina and increased plantings in the US. May-21 futures are on track for their second weekly decline and lost $9.37/t yesterday to close at $511.51/t.

- On Thursday, oil prices fell for a fifth consecutive day and posted the biggest daily loss since April. This is due to increasing coronavirus concerns in Europe and a strengthening US dollar.

How could Brazilian maize production affect global grain prices?

La Niña has been a key driver of markets this season, causing extreme dryness in South America. However, rain has arrived in northern Brazil, with Sorrisso in Mato Grosso declaring a state of national emergency due to excessive rainfall.

This rain is further delaying the harvest of the late planted soyabean crop. In Mato Grosso, on Friday, just 73% of soyabeans had been harvested compared to 100% in the region, this time last year. The delayed harvest is also hampering planting of the Safrinha (second and largest) maize crop.

Drilling in Brazil is now the most delayed for a decade. Just 75% of the Safrinha maize crop was planted by the end of last week (12 March), compared to 89% this time last year, according to AgRural. The end of February marks the end of the ideal planting window for maize in Brazil, with the middle of March usually the limit for planting. However, with 25% left to plant farmers are determined to get maize in the ground due to the current high prices.

Despite delayed planting usually dampening yields, last week Conab increased their Safrinha production estimate by 2.7Mt to 82.8Mt, due to a predicted increase in planted area. The Safrinha maize area was increased by 320Kha, to 14.67Mha. Total maize production for 2020/21 is now estimated by Conab at 108.0Mt, 5.4% higher than the 102.5Mt harvested in 2019/20. Favourable weather in the coming months will be key if this is to come to fruition.

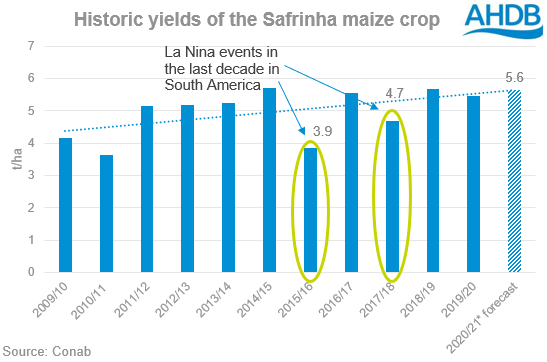

Conab currently forecast Safrinha yields at 5.6t/ha, if realised this would be the third largest yield on records going back to 1979/80. With a large area still to go in the ground, in less than ideal conditions, and the effects of la Niña to contend with, record yields seem improbable.

Looking at the 2015/16 and 2017/18 La Nina events, there is an average deviation from the trend yield, of 0.9t/ha. Applying this to Conab’s yield for 2020/21, of 5.6t/ha, would give a yield of 4.7t/ha. Multiplying this reduced yield by the 14.68Mha area estimate, gives a production figure of 69.5Mt, over 13Mt lower than Conab’s current estimate. While we may not see such extreme deviation in yields in 2020/21, this shows the importance of good conditions during the Safrinha crops development, this season.

If reduced yields are seen the supply and demand picture globally would tighten, and leave smaller ending stocks for maize. This would support maize prices going into new crop, and in turn, support all feed grains globally.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.