Malting barley demand impact to last into 2020/21: Analyst's Insight

Thursday, 14 May 2020

Market Commentary

- Global grain and oilseed prices declined yesterday as markets continued to process the forecasts for large global crops and rising stocks in Tuesday’s USDA report. There was also rain in Germany, which will benefit yield potential after recent dry weather, with more forecast for the weekend.

- However, UK feed wheat futures (Nov-20) were only down £0.75/t yesterday, closing at £163.60/t after sterling fell to its lowest level against both the US dollar and euro since late-March. This reduced the impact of global price falls on the UK market.

- Paris rapeseed futures (Nov-20) closed at €370.75/t, a drop of €2.50/t from Tuesday’s close.

Malting barley demand impact to last into 2020/21

Last month, we investigated how the measures taken in the UK to counter the coronavirus spread were likely to reduce malting barley demand in 2019/20. Now we’re five weeks down the line, I’m looking at what new information is available and how the impacts could last into the 2020/21 marketing season.

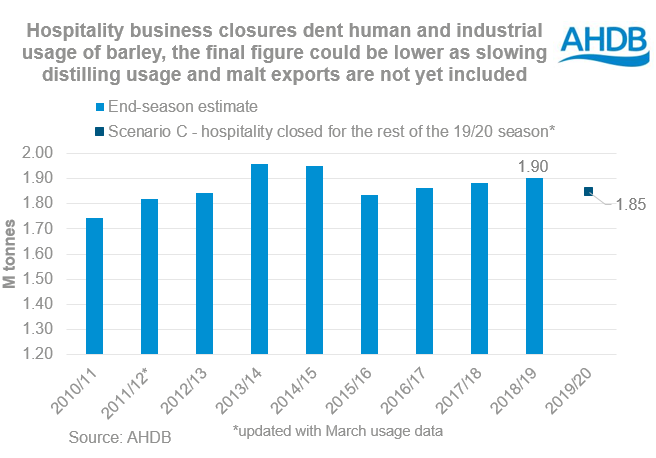

To recap, last month we focused on the reduction in demand for malting barley to serve the brewing sector in the food service industry. We used the February estimate of Human and Industrial (H&I) usage from the UK balance sheet, and removed the food service element (assumed to be 14% of total H&I barley usage) starting mid-March, for three different periods of time.

So where are we now?

We know that hospitality businesses, including pubs, won’t re-open before 4 July in England. Decisions about lockdown are devolved, but timelines haven’t yet been announced for Scotland, Wales and Northern Ireland. However, it seems unlikely that hospitality businesses in any part of the UK would re-open (excluding for deliveries) before the end of this crop marketing season on 30 June.

This means that for brewing, the most extreme of the scenarios we highlighted last month (our scenario C) is the most likely to occur. When that scenario is updated to include the actual March usage data, it would equate to 84kt of ‘lost demand’ from brewing alone. This is a slightly steeper drop than the original scenario C, indicating that demand was impacted before the formal closure of the food service sector on 23 March.

We also know that a number of distillery sites had to close temporarily while they worked to put in place suitable social distancing measures, while others reduced capacity. This will have reduced demand from the distilling sector for malt and so malting barley. Although some distilleries are now starting to re-open, it’s difficult to quantify how much demand is being lost at this time.

Also, around 13% of the malt produced in the UK is exported. July - March exports are 11% lower than the same period in 2018/19, down further on the 6% decrease recorded in July-December. As the state of the global economy and beer consumption will impact malt exports, these are areas to monitor going forward.

In short, the total amount of malting barley used by the H&I sector will be lower than the ‘scenario C’ we produced last time, but we currently don’t know by how much. The next estimates of UK supply and demand will be published on 28 May and usage data for April on 4 June. These will give us more insight in to the full impact.

Stock impact?

As we highlighted last time, most barley purchases from the 2019 crop would have already have been made. Therefore, any impacts will likely be felt in terms of stock carried forward into 2020/21. This in turn will reduce purchases from the 2020 crop.

Looking ahead to 2020/21

In terms of demand, much depends on how the virus circulates and spreads, and what impact the predicted global recession has on beer consumption, both in the UK and overseas.

While it’s possible that some hospitality businesses will re-open from 4 July in England, it won’t be all of them. Also, we don’t have timelines yet for Scotland, Wales or Northern Ireland. In addition, social distancing measures are likely to reduce the amount of customers that can be served at any one time by each business. As such, it’s reasonable to assume that the amount of malting barley needed for brewing for the food-service sector will be reduced in the early months of the season, if not longer.

To try and place some context on this, we’ve looked at H&I usage of barley over recent years. H&I usage of barley has varied between 1.83Mt and 1.95Mt over the past 5 seasons (2014/15 – 2018/19), averaging 1.90Mt per year or 36.5Kt per week.

Approximately 31% of barley is used to produce beer and 45% of beer demand is sold through the hospitality sector, including pubs. So we can assume that the hospitality sector accounts for 14% of total H&I barley usage. This would suggest that for each week the hospitality sector alone remains closed, it could mean in the region of 5Kt of lost demand for malting barley.

We know that the 2020 crop will be large because of the area planted. However, variety mix and final quality will be key to the availability for malting and so premiums. You can help us understand both the final area and variety mix by spending five minutes completing our 2020 planting and variety survey – click here to complete the survey.

At this stage we can only assume average quality, so if this is confirmed, availability looks set to be higher at a time when demand will be lower. A balance of this sort is likely to put pressure on premiums.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.