USDA forecast big stocks on the horizon: Grain Market Daily

Wednesday, 13 May 2020

USDA forecast big stocks on the horizon

Yesterday, the USDA released their first new-crop supply and demand estimates for global grains.

Whilst the market isn’t initially shocked by these, the context does frame a longer-term bearish view to grain markets with growing global stocks and increases in production.

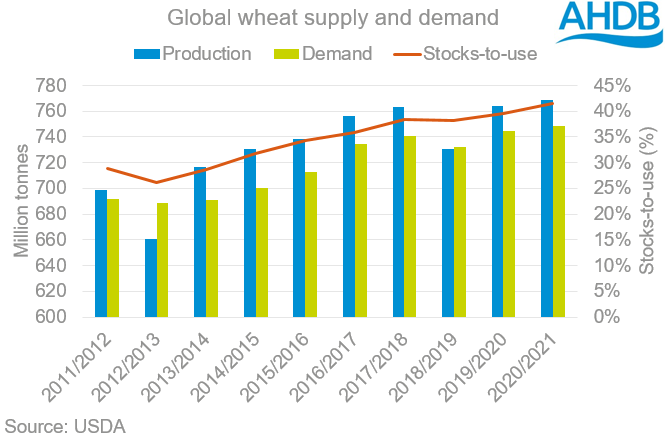

Wheat

- Global wheat production is forecast at 768.5Mt, 4Mt higher year-on-year.

- Global demand sees a modest increase to 753Mt.

- Global wheat ending stocks for 2020/21 are forecast at 310Mt, a 15Mt increase on the 20/19/20 season.

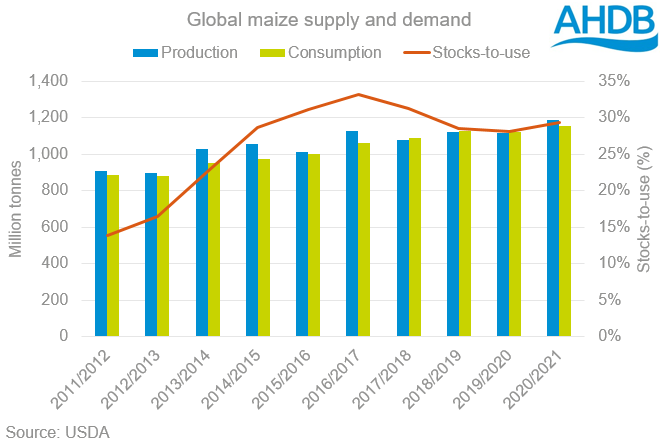

Maize

- Global maize production is forecast at 1,1186Mt, a massive 72Mt increase from 2019/20

- US maize production is the main increase with a 406Mt crop forecast, increasing by 59Mt on the year as plantings rapidly outpace last year’s rain interrupted spring

- Global maize demand is seen up 41Mt to 1,161Mt, but this does not prevent a 25Mt increase in global maize ending stocks to 339Mt.

Soyabeans

- Global soyabean production is forecast to rise to a record 362Mt, up 26.6Mt on the year.

- The report highlights expectations of a large rise in South American soyabean production, with output in Brazil and Argentina up a combined 9.5Mt.

- Global demand is forecast to increase by just 13Mt, to 360.7Mt. However, stocks expected to fall, with an increase in international trade and renewed stock building in China.

Putting this into context

Whilst this is the first new-crop update that we have seen from the USDA, weather can still play a part in changing production forecasts. However, the increase in stocks and larger production does highlight a significant bearish mood for the market in the longer-term. Large maize production in the US is likely to weigh on global market for the next year, especially with slow demand from US ethanol refineries in the light of coronavirus stalling global economic progress.

And what about the UK?

From the UK’s point of view, we can’t forget that the pull of the global market will always outweigh domestic markets in the longer-term. This USDA report highlights a significant price risk to feed grains with the rebound in maize production. Given the UK is likely to be a net-importer of grains in 2020/21, the potential for cheap maize to undercut domestic values remains.

Despite a smaller UK crop this year, we can’t let this cloud our judgement of price potential being negatively impacted by a bearish global market.

This will also impact the price outlook for barley considering we forecast a large UK barley potential yesterday, the need to export into an oversupplied global feed grain market will weigh on values.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.