Lower UK maize imports in 2021/22? Analyst's Insight

Thursday, 16 September 2021

Market commentary

- UK feed wheat futures climbed yesterday with reports that Russian farmers could plant less winter wheat for harvest 2022. The Nov-21 contract rose £3.95/t to £189.95/t. The Nov-22 contract gained £1.55/t to £178.05/t, a new high for the contract.

- Planting of winter grains in Russia is slower than last year due to dry weather. This, together with more interest in oilseeds and the export tax, could shrink the winter wheat area. IKAR forecasts the area to fall 0.5Mha to 17.3Mha, while SovEcon points to a drop of 0.5-1.0Mha.

- Nov-21 Paris rapeseed futures reached the contract’s highest price to date of €590.00/t, after rising €3.00/t yesterday. The market continues to process the cut the Canadian canola (rapeseed) crop announced on Tuesday.

- The gains were limited in soyabeans as China bought Brazilian soyabeans for shipment in the peak US shipping season, reportedly due to the issues with Gulf ports after Hurricane Ida.

Lower UK maize imports in 2021/22?

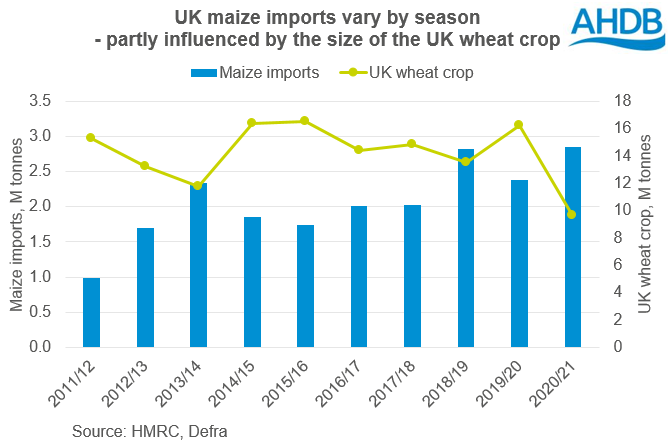

Maize imports into the UK are a feature of every season, but the amount varies. The amount depends on UK wheat (and to a lesser extent barley) availability and the cost of importing maize.

Last season the UK imported a record 2.86Mt, more than in even 2018/19 (2.83Mt) partly due to the small UK wheat crop (9.7Mt). UK wheat prices rose relative to global grain prices, including maize. Meanwhile, during the early months of the 2020/21 season, there was optimism for Brazilian maize production. In September 2020, the USDA forecast the 2020/21 Brazilian crop at 110.0Mt; now it’s estimated at 86.0Mt.

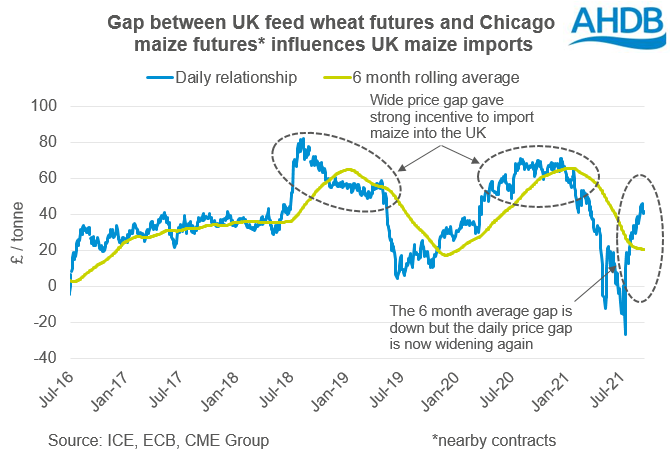

For the first six months of last season, UK feed wheat futures were more than £60/t above Chicago maize futures. This price gap and the challenge of securing UK grain after a small crop made imports attractive.

There is a good relationship between the rolling 6-month average price gap and the 6-month rolling average UK imports. The price gap needs to be sustained to make it worth changing grain e.g. in animal feed rations. It also takes time to buy and ship the grain to the UK.

Uncertain outlook for 2021/22

A rebound in the UK wheat crop in 2021 could reduce import requirements, though the market still looks finely balanced. So, grain imports still look set to be required at a higher level than in net-exporting years. But, could this be maize imports?

Currently, the 6-month rolling average price gap is down to around £20/t. Chicago maize prices rose sharply in late 2020 and early 2021, due to the issues with South American crops.

This price gap implies lower maize imports in the months ahead, due to reduced price attractiveness.

AHDB’s new import parity calculations also suggest that maize currently looks too expensive compared to UK delivered prices.

A recent fall in maize prices has started to widen the gap once more. If sustained, this could lead to an increased incentive to import. But’s there’s plenty of uncertainty whether this gap can be sustained. These factors include:

- EU-27 maize production may not be as large as forecast

EU-27 countries supply over 42% of the UK’s maize imports, with Ukraine supplying a further 27% (2016/17 – 2020/21). Early forecasts for production across the bloc were very good. However, hot and dry weather developed in Bulgaria and Romanian during August. Any cuts to these crops could lift EU maize prices and make it less attractive to the UK. Ukraine’s crop is still expected to be large. But, less availability from the Black Sea region overall, could still make maize less attractive.

- Weather worries for South America

Global maize stocks are expected to recover slightly in 2021/22, but this depends on record South American crops. Farmers in South America look set to expand the area planted with maize, but the potential for another La Niña creates uncertainty. The final size of the US maize crop will also influence the market, as harvest gets underway.

Against this, we have ongoing logistical issues in the UK. Difficulty in securing and moving grain around the UK could make imports more attractive at a narrower price gap than in other seasons. This could be more evident for users of grain based at or near ports. However, there’s no guarantee this grain would be maize.

Concluding thoughts

Limits to the volume of maize imports could mean imported wheat looks more attractive. It could also mean that more barley stays in animal feed rations for longer, despite the gap between feed wheat and feed barley prices closing in recent weeks.

The USDA currently forecasts the UK to import 2.4Mt of maize in 2021/22, in line with the five-year average. However, the USDA also estimates the UK wheat crop at 15.0Mt and wheat imports at 2.0Mt. If the UK wheat crop is smaller than this as recent AHDB analysis suggests, we may need higher imports of grain.

It will be important to track the cost of importing grain into the UK over the coming months, to understand how our domestic picture may change. AHDB’s new UK import parities report, out each Tuesday afternoon, can help with this.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.