EU maize, something to keep an eye on: Grain market daily

Wednesday, 25 August 2021

Market commentary

- UK feed wheat futures (Nov-21) closed up £0.50/t yesterday, to £194.00/t. UK wheat looked to take their lead from Paris wheat futures yesterday, supported by tightening wheat supplies.

- Yesterday Chicago soyabeans futures (Nov-21) made their largest daily gain since June, closing up $14.32/t to $489.28/t. Prices found strength from falling US crop conditions, with worries hot and dry weather is negatively impacting on yields.

- Also supporting oilseeds yesterday are rebounds in soyoil. This comes as US biofuel mandates are questioned.

- The possibility of another La Nina also continues to support row crop prices, threatening to bring further dryness to South America.

EU maize, something to keep an eye on.

On Monday, the EU Commission released their August crop monitoring report.

There were no huge changes visible in the yield forecasts from a month earlier. In most parts of the north-eastern and western Europe, adequate water availability and mild temperatures have improved the outlook for some crops. This included maize in France.

Though in France, Germany, and Poland especially, wet weather has been hampering winter cereals harvest. This is reported by the EU Commission to likely have an impact on both yield and grain quality. Soft wheat yield was noted as down 1.2% on the month, to 5.98t/ha. However, this is still above the 5-year average by 5%.

In Germany, the German Raiffeisen Association (DRV) said that recent dry days have allowed harvest to progress. Today, the German ministry said yields are expected to be 3.6% down for all wheat types. This is put down to a cold spring followed by hot temperatures in recent months.

With global wheat availability looking tight against rising demand, EU supply is a point to watch.

A closer look at Black Sea maize

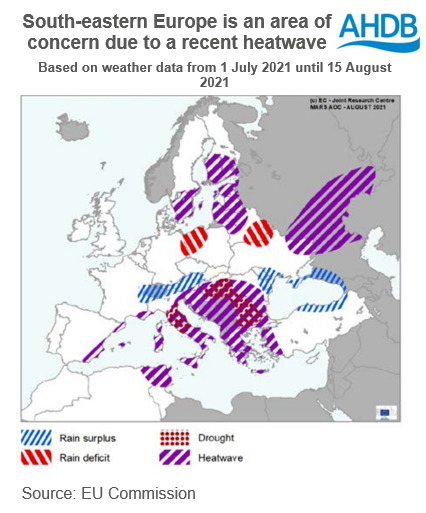

Something to note, the EU commission report detailed the hot and dry conditions that have been developing in Bulgaria and Romania. Areas of these countries are highlighted to be drought affected. Especially for non-irrigated summer crops, increasing temperatures at the end of June could have potentially had an impact on maize flower fertility.

Grain maize production in Bulgaria (5%) and Romania (23%) make up a sizable percentage of EU-27 production (5-year average 2017-2021), totalling 28% using EU Observatory data.

The forecast going forward remains to be hotter and relatively dry for the end of August, the end of the grain fill period. Currently yields for the EU-27 stand at 7.9t/ha, 2% ahead of the 5-year average. With harvest due to begin in September for maize in EU-28, more information on yields especially in drought affected countries, will be important to availability.

Why does this matter to the UK?

Should drought conditions have an impact on Bulgarian and Romanian maize production, this could tighten the picture for EU maize availability. This is despite promising French maize yields (another large EU producer).

The EU made up an average of 43% of UK maize imports over the last 5 years (2016/17 – 2020/21), of which Romania accounted for 15% of this (HMRC).

With barley domestic demand expected to remain strong this season, as well as the likelihood of exports, maize may be an alternative in the feed ration. Especially given tightening global wheat supply. Should EU maize prices rise, we may need to look to other origins. As at 20 August, Ukrainian maize (Sept delivery) was reported to be £238.60/t. This was £49.10/t more expensive than feed wheat for the same delivery.

Therefore, monitoring availability and global price of maize may be important for feed ration usage going forward.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.