Limited growth in meat retail sales in France recently

Thursday, 23 July 2020

By Bethan Wilkins

In Britain, we’ve seen meat retail sales grow significantly since the “lockdown” was first implemented back in March, closing eating-out venues. We estimated that, for red meat overall, the volumes could roughly compensate for the lost eating-out sales. However, the retail response in France seems to have been more subdued, particularly in the most recent period. This is especially relevant for the British lamb market, as about 10-20% of UK lamb production is exported to France.

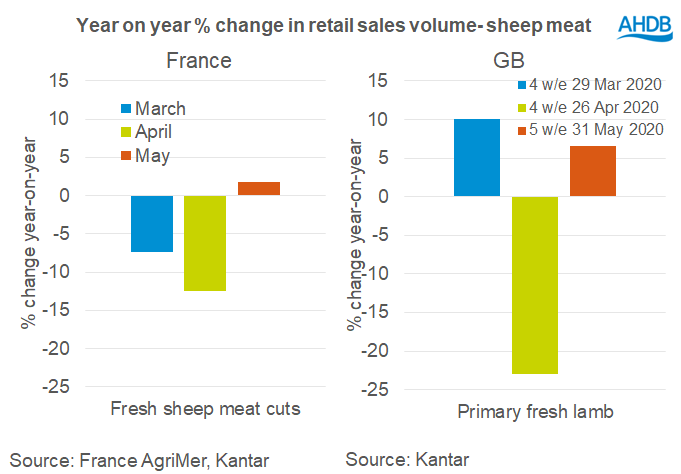

Looking at sheep meat sales over the past few months, sales have compared to last year as follows:

The data published by different countries is not broken down in exactly the same way, so direct comparisons are difficult. However, it seems that both countries saw a particular drop in lamb sales during April. Easter has fallen in April for the past two years and is normally a key time for lamb consumption in both the UK and France. This year, the coronavirus restrictions limited family meal occasions, depressing demand.

Although sales in April alone were affected more in Britain, some growth has been recorded here in the surrounding months. Significant growth is yet to be seen in France. This may have been limiting French import demand overall. From our perspective though, limited exports from New Zealand in recent months may mean UK exports have not been as affected. Industry reports suggest the UK is potentially gaining some market share.

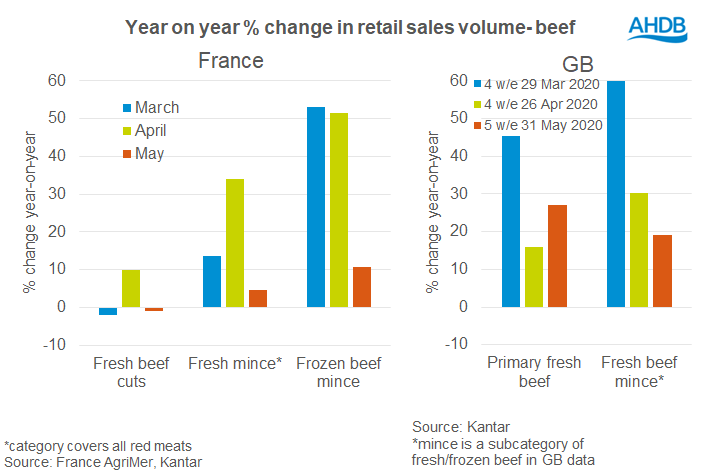

French demand does not influence the other British red meat markets as directly. Nonetheless, France still accounts for just under 10% of UK beef exports, and it also imports from Ireland, the UK’s key import supplier. French demand will ultimately have some effect on both our export prospects and competition from imports.

Beef cuts in France have recorded minimal sales uplift overall. This category is primarily made up of roasting joints, which in Britain have also recorded stagnant sales. Mince and burgers have been supporting beef sales here, and mince sales were also strong in France, at least initially. Note that the frozen beef mince category is about half the size of fresh beef cuts, with fresh mince in between the two.

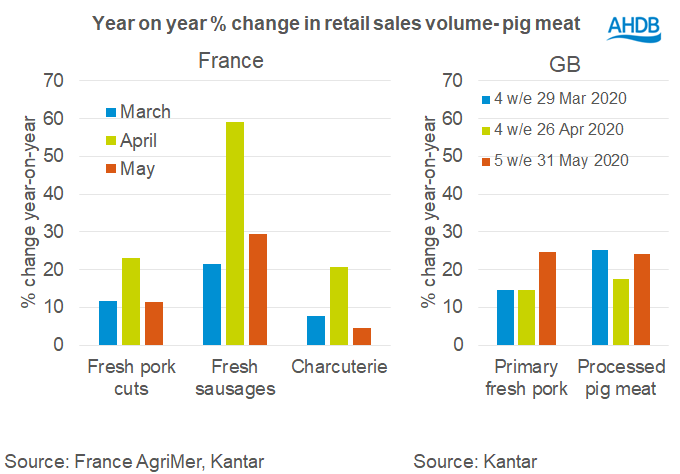

The UK imports about 60% of its pig meat consumption from Europe. While very little pig meat comes directly from France to the UK, the EU market is very interconnected and France is a significant pig meat producer and consumer.

Charcuterie is a large meat category highlighted in the French data, accounting for about a third of meat and poultry volumes purchased overall. This rises to nearly 40% if fresh sausages are included. Increased charcuterie sales rapidly fell away in France during May. Fresh sausages have shown sustained growth, but this category alone is much smaller.

While not entirely equivalent, the closest comparison for GB is the processed pig meat category (mainly bacon, sausage and ham). While this only accounts for about 20% of the market by volume, it has shown sustained growth. An increase in hot breakfasts is thought to be supporting processed pig meat in Britain.

Better retail demand for pig meat here is perhaps one of the reasons pig prices have held up more in Britain since the coronavirus pandemic.

These figures do not cover the period when eating out venues began to reopen, which was at the start of June in France and early July in England. We would expect to see further erosion of the retail sales growth after this. The extent of the drop, and effect on the market overall, will depend on how this balances against growing demand in the eating-out sector.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.