Lamb slaughter lower than forecast, will this continue?

Friday, 30 April 2021

By Charlie Reeve

Lamb slaughter lower than forecast, will this continue?

Back in January, we released a series of Agri-Market Outlooks looking at our expectations for 2021. We will now have a look over the lamb market outlook to see how well it has performed three months on.

Key takeaways from January forecast

In the January Lamb market outlook, we forecast a decline in sheep meat production of around 4% during the course of the year. We anticipated both export and import volumes to contract slightly, with falling production levels leaving less product available for export. We also suggested that limited global supplies may offer a level of support to prices.

How did this forecast compare in reality?

Lamb slaughter

In January we estimated that overall lamb throughput in 2021 would total 12.5 million head, 4% below year-earlier levels. This was based on a high proportion of lambs from the 2020 crop being slaughtered as new season lambs in 2020 driven by uncertainty last autumn around future trading arrangements with the EU-27. This in turn tightened supply, leaving less old season lamb available during the first few months of 2021. Old season lamb slaughter was forecast at 3.6 million between January and May 2021, 7% lower than last year.

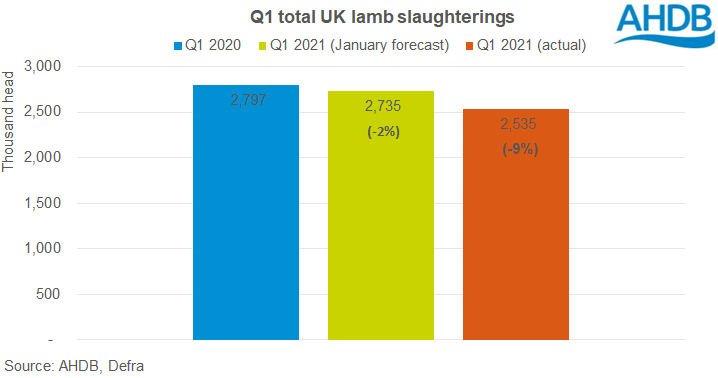

Overall lamb slaughterings during Q1 2021 dropped by 9% (262,000 head) year-on-year to total 2.54 million head. The January forecast had estimated a 2% drop during Q1 2020. This larger than expected decrease was likely to be due to fewer lambs being available than previously anticipated. There are no signs so far of more lambs coming forward in Q2 to compensate for the lower throughput early this year. Weekly slaughter estimates for April have been very low up to now.

The 2021 lamb crop is still anticipated to be similar to levels seen in 2019 and 2020. The December census figures back up our assumption in January that the breeding flock has remained relatively unchanged, which points towards a similar lamb crop. We continue to believe that later this year lambs may not be as quick to come forward as in 2020, which will mean slaughter remains below last year’s levels.

Adult sheep slaughter

We also estimated that ewe slaughter would reach 1.5 million head, an increase of 7% on the year. Based on the first three months of 2021, estimated slaughter of ewes and rams totalled just 277,000 head, 27% (102,000 head) fewer than during the same period in 2020. It is unclear at present what is behind this major reduction in cull ewe throughputs, although there is some speculation that more ewes are perhaps being kept on for breeding due to the current high farmgate prices.

Sheep meat production

The January lamb market outlook estimated that UK sheep meat production during 2021 would be 4% lower year-on-year, totalling 285,000 tonnes.

Based on the first three months of 2021, actual production has been down 10% year-on-year, totalling 59,000 tonnes. This is, of course, lower than expected, considering the stronger declines in both lamb and adult sheep throughput recorded. At present, it looks like this will mean that annual production also falls by more than expected in January.

Trade

*As of January 2021 data, the way HMRC collects trade data has changed, which will be reflected in the trade statistics. Comparisons between this and historic data should be treated with caution, and may well be subject to future revisions.

The January forecast expected a contraction in trade volumes for imports and exports of 2% and 4% respectively.

The reduction in imports was anticipated to be driven by a tighter supply of sheep meat available in the global market due to limited supplies available from Australia and New Zealand. Asian markets were also expected to remain an attractive option for these exporters.

Based on data for the first two months of 2021, import volumes have fallen so far. However, this was predominantly due to lower imports from Ireland. Volumes received from both New Zealand and Australia increased during January and February. However, Australia and New Zealand have actually reported shipping less product to us so far this year. As it can take a while to be shipped across to the UK, this may come through in the March trade data and could show a decline in volumes.

In 2021, export volumes were expected to fall year-on-year by around 4% overall. A heavier decline was anticipated for early in the year, especially in Q1 when a 14% drop was forecast. This is due to the implementation of new rules and increased border checks when exporting to the EU.

A declining trend has been seen in the trade data so far, with exports during January and February falling notably on the previous year. In January, when the new trading regulations were first implemented, exports of sheep meat fell by over 50% year-on-year to 3,500 tonnes carcase weight equivalent. In February, exports fell by 28% compared to the same month last year, totalling 4,600 tonnes.

When will the next outlooks be released?

Our next Agri-Market Outlooks are due to be released in July. In the meantime, you can read a longer-term outlook for UK red meat markets here.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.