Lamb prices show recovery from seasonal dip

Friday, 9 December 2022

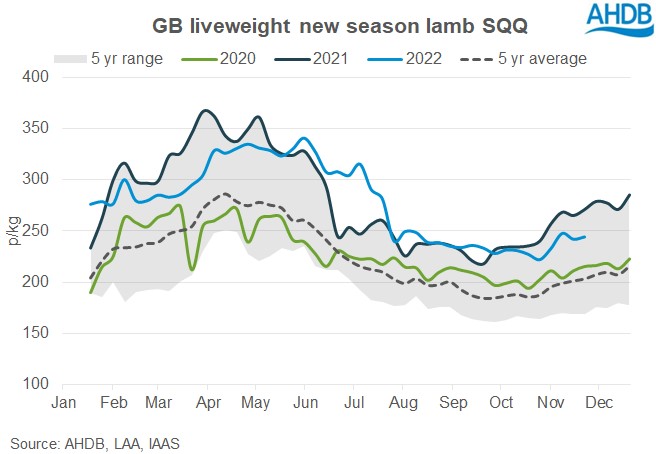

Liveweight

Average GB liveweight prices recovered in November following the seasonal declines seen over the past three months. Prices increased steadily through the month, as is typical as we approach the holiday season. Prices for NSL SQQ in November (w/e 5 Nov – 3 Dec) averaged 242.68p/kg, 6.5% (14.7p) up on October prices. Despite the upwards move, the average price across the month remained 25.7p (9.6%) lower than in November last year.

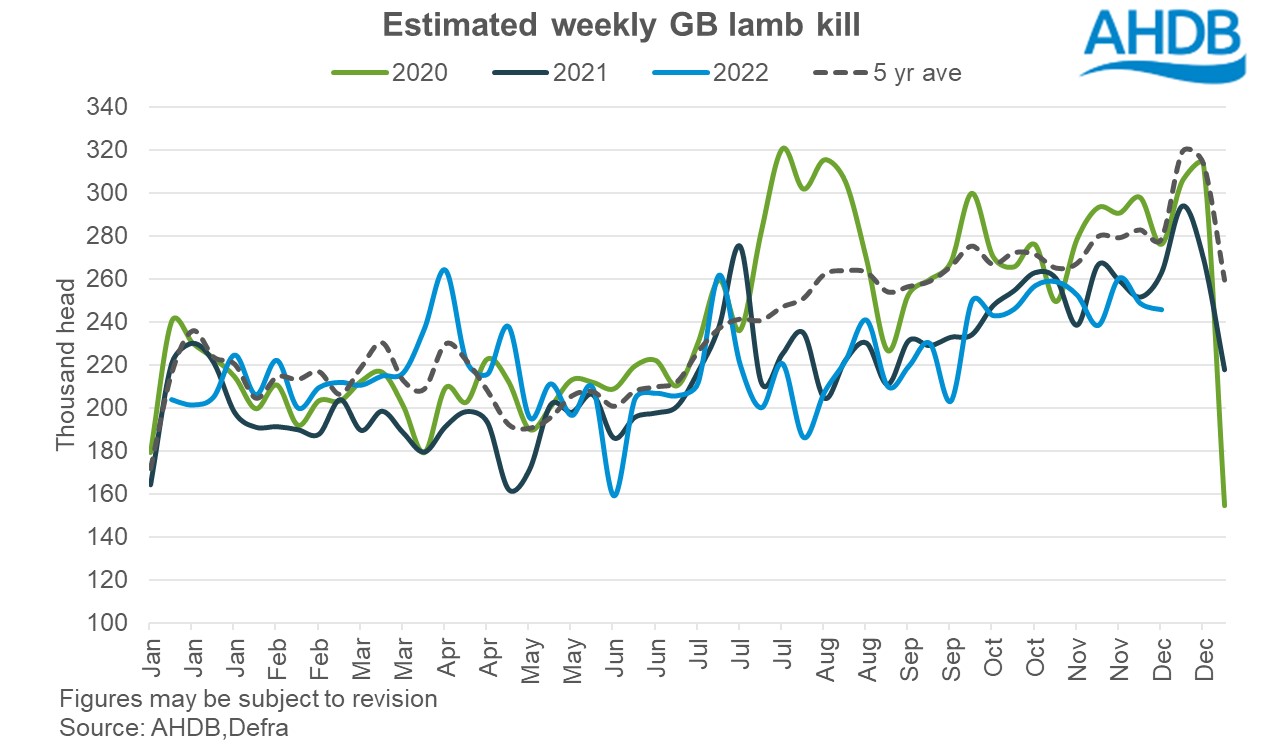

Total throughputs of lamb at market were estimated at 113,000 per week through November, 5% more on average per week than in October. This has been put down to a higher number of producers sending forward fattened lambs ready for Christmas meat demands.

For the 5-week period (w/e 5 Nov – 3 Dec), throughputs were 6.4% lower than a year earlier, in line with the general reduction in throughputs we’ve seen this year. Year to date, throughputs for both new and old season lamb have totalled 5.15 million head, up by 1.6% on 2021.

Cull ewe prices also trended up through November, peaking at an average of £82.50 in the week ending 3 December. The average price paid for the 5-week period was £77.20, up £9.80 (14.5%) on the October average of £67.40.

Throughputs of cull ewes were estimated at 43,300 per week through November. This is 14.9% (7,600 head) down on the weekly average for October, which may have been supporting the higher prices.

Whilst favourable weather this autumn created a flush of grass and helping to combat some of the inflationary pressure put on farmers inputs, this may have had less to do with the reduced market throughput each week than the historic seasonality of cull ewe markets (peaking in October and easing towards Christmas).

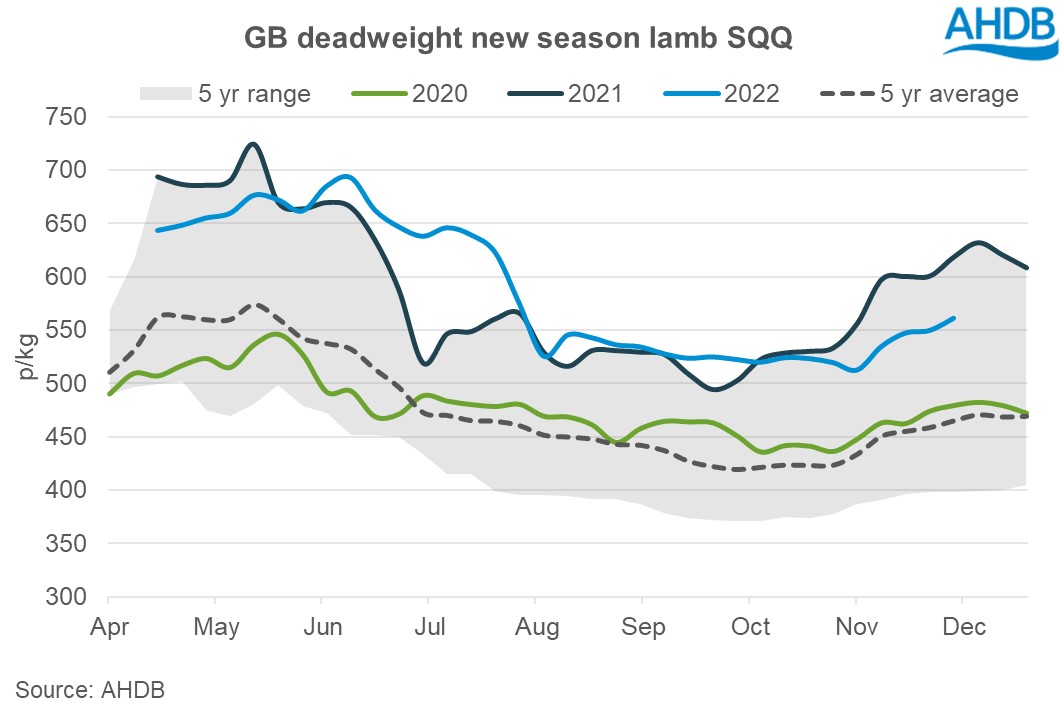

Deadweight

GB deadweight NSL SQQ prices also saw an uplift in November following a period of relative stability in prices over the past three months. Prices averaged 541p/kg for the five-week period, 19.3p (3.7%) up compared with October’s average. Prices fell below year earlier levels in October, and remained back on 2021 throughout the month. However, the monthly average remained almost 20% up on the 5-year average.

Average weekly slaughter numbers were estimated at 245,700 head per week for the 5-week period (w/e 5 Nov – 3 Dec). This was 2% back on the weekly average slaughter numbers for October.

In the year to date, slaughter numbers were up 2% on the same period last year, with 10.6 million head processed.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.