Lamb market update: Why haven't prices risen for Easter?

Friday, 2 May 2025

Spring last year saw record high lamb prices as demand grew around in-line with traditional trends. These price trends have not re-materialised this year. This article looks at the supply and demand factors that have caused the lamb price to ease so far in 2025.

Key points

- The lamb price has fallen over the past five weeks, despite the end of Ramadan and Easter occurring in this period

- Both supply and demand factors have contributed to this decline

- An elongated festive period has reduced the intensity of consumer demand for lamb

- A higher carryover of heavy old season lambs has reportedly weighed on average prices in recent weeks

Sheep meat is an incredibly seasonal market, with demand for lamb and mutton being driven by the religious festivals of Ramadan and Easter in the spring when we would normally see prices peak.

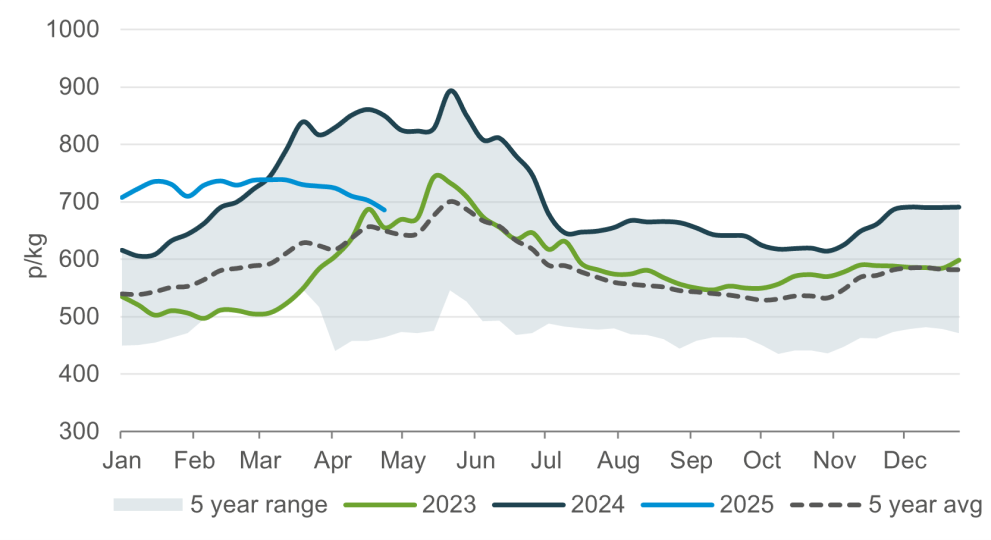

We certainly saw this last year, when average lamb deadweight prices reached record-breaking highs of 893 p/kg in May 2024.

However, we have now past Easter and Ramadan this year and have not seen similar price trends. Indeed, the overall GB deadweight SQQ lamb price has been tracking steadily downwards for the past five weeks to stand at 686 p/kg for the week ending 26 April 2025.

GB deadweight lamb SQQ (overall)

Source: AHDB

Notes: Old season lambs reported until 3rd Monday in May, new season lambs then reported for the remainder of the year.

The reasons behind this contrast from last year can be attributed to both supply and demand.

On the demand side, this year consumer demand was more protracted as Ramadan occurred from the 28 February to the 31 March, and Easter was on the 20 April, with approximately a month between them, whereas last year Ramadan ran from March 10 to April 8 with Easter coinciding on the 31 March – creating a very condensed demand period which drove up farmgate prices sharply. Strong lamb sales were helped by promotional activity, but also less price-focus among some consumers.

Indeed, Kantar retail performance data for the first quarter of 2025 shows that lamb volumes were down 15% year-on-year (12 weeks to 23 March), as Easter was outside of this period this year. In our latest lamb market outlook, we wrote about how we anticipate weaker domestic demand this year generally as consumers face a level of economic uncertainty.

On the supply side, we have also seen a much higher carry-over of old season lambs this year, which are currently weighing on average prices according to market reports. This could be down to several reasons, namely the fact that last year was largely a difficult year for sheep farming due to the poor weather. This impacted lambing, grass growth and worm burden, likely holding back lambs from sale earlier in 2025.

This influx of older, heavier lambs is evidenced in the GB average carcase weights, which were slightly up in January and February, but were tracking well above the five-year average in March.

Sheep meat trade dynamics may also be having an influence over current GB prices. Import volumes from New Zealand and Australia – where prices are tracking well below our own – are up significantly on the year. This may at least be counteracting the effect of the reduced GB clean sheep slaughter that we have seen in the year to date (-3.8% from Jan-March 2024). Meanwhile, export volumes have been relatively flat.

What is the outlook for the rest of the season?

In the future, barring any geopolitical shifts that could see significantly more Southern Hemisphere lamb on the UK market, we would expect lamb prices to settle back down into their standard rhythms and sit within the five-year average. Initial reports indicated that weather conditions have made this year’s lambing season more favourable than last, which should offer some stability domestically moving forward.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.