January 2026 dairy market review

Thursday, 19 February 2026

Milk production

Domestic

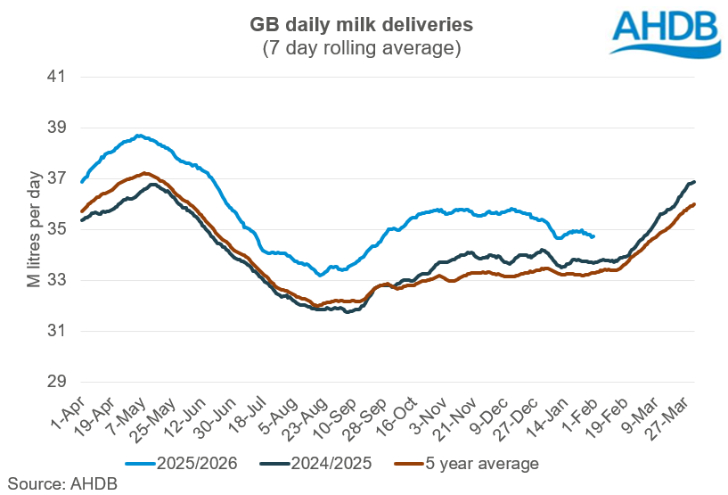

GB milk deliveries in January totalled an estimated 1,080 million litres, up 3.3% compared to the same period in 2025.

Daily deliveries averaged 34.83 million litres. Production for this year’s milk season so far (April to January) sits at 10,913 million litres, up 5.4% compared to the same period in 2025.

We are now also annualising against a period of growth in January 2025. GB milk production is actually 5.4%, or 55 million litres above January 2024.

Milk supplies have been running well ahead of the 5-year average since Autumn 2024. For the milk year to date, GB milk supplies are 5.4% or 504 million litres up on last year.

Figure 1. GB daily milk deliveries

Source: AHDB

The graph shows GB daily milk deliveries, using a 7‑day rolling average, from 1 April to 27 March.

The vertical axis shows million litres per day, ranging from 29 to 41 million litres. Three lines are shown:

- 2025/2026 (blue, top line)

- 2024/2025 (dark grey, middle line)

- Five‑year average (orange, bottom line)

Our January reforecast from the Dairy Market Outlook for 2026 predicted GB milk production for the 2025/26 season was forecast to record a new high of 13.49 billion litres, 4.9% more than the previous milk year, before beginning to contract in 2026/27.

After the flush we should see market signals begin to be registered in the production numbers. We should start to see some year-on-year decline, but we will still be annualising versus a very high base and there is likely to still be more milk for demand well into 2026.

Encouragingly, January milk production was slightly lower than forecast.

The GB milking herd totalled 1.63 million head as of October 2025, the lowest October number recorded, and a 0.9% decline compared to the same month the previous year.

The GB herd total stood at 2.51 million head, a year-on-year decline of 1.3%. A fall was seen across all age groups with the exceptions of the 4–6 years and 6–8 years age groups.

The average age of a cow in the GB milking herd now stands at 4.56 years, very slightly older than last year’s figures.

The milk to feed price ratio (MFPR) continues to be well in the expansion zone incentivising farmers to push production.

However, milk price announcements have been falling since November and have meant as much as 15ppl decline for some. However, this has been variable by contract and those on organic or retail-aligned contracts have not yet seen much decline.

Declines in headline prices will be partially offset by strong milk composition with fat and protein in the milk still running at very high levels.

Organic milk supplies

GB organic milk deliveries have soared ahead alongside the strong growth in total GB milk deliveries volumes.

Volumes have shown year-on-year growth since March 2025, with the latest GB organic delivery estimates (January) showing a 10.7% year-on-year for the month.

This makes the milk year to date at 32.9mn litres above the previous year or 11.1%.

However, in comparison to the 2021/22 year supplies are still behind by 21%. Again, this growth is reflective of industry pushing recovery back to normal levels, rather than oversupply.

The widening gap between conventional and organic milk prices suggests stronger demand for organic milk and need to maintain organic milk supplies

Global

The latest global production data estimate shows global milk flows now increasing sharply in most regions.

Global milk deliveries averaged 856.5 million litres per day in November, an increase of 36.2 million litres per day (+4.4%) across the selected regions, compared to the same period in the previous year.

Milk deliveries in the EU averaged 377.1 million litres per day in November, a substantial increase of 17.8 million litres per day (+4.9%) year on year, and the strongest November on record.

Low input prices, good forage quality and elevated milk prices for most of the year boosted volumes.

This was driven by Germany, up 180 million litres (+7.5%) for the month of November, followed by France, up 112.3 million litres (+6.3%), and the Netherlands, up 75.6 million litres (+7.3%).

US production was up 11.9 million litres per day (+4.5%) year-on-year driven by disease recovery, increasing herd size, yields and improved margins. Growth was also recorded in New Zealand (+2.4%) and Argentina (up 8.1%).

Australia was the only market to see decline.

Rabobank are estimating global production from the big seven exporters to finish 2025 at 2.2% up.

They expect growth to slow in 2025 to 0.12% as commodity values and milk prices weaken. Dairy Australia have predicted further decline of 2% in their year-end report.

Looking further ahead the EU published their medium-term outlook which predicted annual growth of approximately 0.1% per annum over the coming decade.

Dairy trade

Total UK dairy export volume for Q3 2025 increased 5.5% year-on-year totalling 294,000 t, driven by powders, whey and whey products, cheese and butter. Total UK dairy export value stood at £529m, up 13.7% year-on-year.

Export volumes of milk and cream and yoghurt shrunk in volume but grew in value while exports of cheese are at the highest level for Q3 seen in the last six years.

Imports declined slightly during the period due to lower imports from Ireland and New Zealand year-on-year.

Stocks of dairy products grew in Q3 2025 in the UK due to more milk driving more production. Cheese stocks have grown due to more production and more imports but butter stocks have tightened slightly due to lower imports.

Imposition of provisional tariffs on EU dairy products will make it costlier for China to import from Europe and could pave the way for other major global exporters like the USA and Oceania.

Although, these have now settled at a rate lower than initially anticipated. This could open the door for the US. On the other hand, EU products previously destined for China could land on the shores of the UK instead.

The UK is the most dominant importer of the EU dairy products and more displaced products on the UK market or going to potential third-party export markets like South-east Asia or the Middle East, could pressurise prices further.

Full-year 2025 trade data will be published during the week commencing 23rd February.

Wholesale markets: January

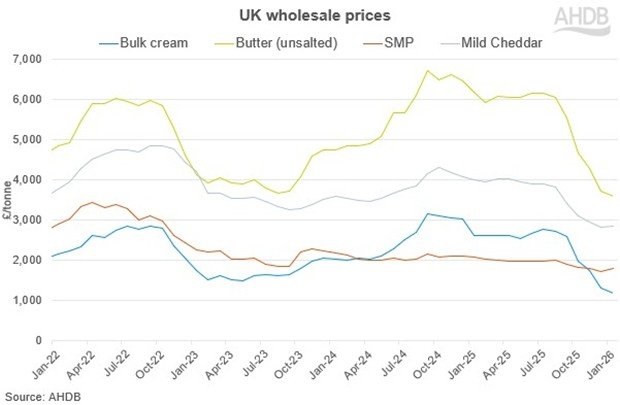

January brought a more mixed picture on commodity markets than seen in recent months.

While cheese and skim markets enjoyed a modicum of recovery, fats continued in the doldrums even discounting the dire week between Christmas and January.

High milk supplies both here and on the continent are proving particularly influential on the fats market.

Bulk cream

Bulk cream prices continued to be under severe pressure and have lost, on average a further £127/t, or 10%, to take it to £1,185/t.

That the average is as high as this belies some extreme prices seen over the festive period which saw distress loads of cream available as low as 70-85p/litre.

The price recovered from there entering the 1.20s but have come under pressure again in the past week due to continued milk volume pressure.

There is a significant premium to European prices which are reported as sitting under £1/l due to an excess of milk coming from the highest producing regions.

Butter

Butter prices are currently disconnected from cream prices in that it is not losing quite as much value.

Again, butter was pulled down over the festive period to as little as £3,200/t but did not collapse (unlike cream) and has since seen some recovery. However, on average butter has lost a further £110/t or 3% since last month.

The position of cream drags the butter price down which is also afflicted by reportedly high stock levels. Despite lack of activity the price has settled into a comparatively narrow range at these lower levels.

The average price for the month was £3,600/t with the market reported to be ‘deathly quiet’. Butter has now lost over half of its value since the peak.

Mild Cheddar

Mild cheddar is seeing little trade in the market but there is some sense that the market has stabilised and even tightened slightly.

Mature is said to be tighter due to previous dispersals of curd and mild to ease cashflows which has supported the price for mature.

Mild cheddar has regained £30 of value and sits at £2,860/t with traders operating in a narrow range. Strong supplies globally are likely to keep the market in check.

SMP

SMP has performed the best of all commodities, starting nearer to bottom they are now seeing some demand returning due to comparatively more competitive global prices.

There has been some global return of demand due to a belief by buyers the market has bottomed out, and it is time to cover positions. The proximity of Middle East trade event Gulfoods and the ONIL tender is also awaking some interest.

SMP has therefore moved up £80/ or 5% to £1,810/t.

Since then, early February has seen some price fluctuations due to a ‘short sqeeze’ driving some temporary demand but some of this has already dissipated.

The latest GDT (Global Dairy Trade) auction results have been surprisingly positive in the first three auctions of the year.

The auction, which is New Zealand-based but a barometer of global dairy sentiment, rose in three consecutive periods and by 6.7% in the last period.

While all products saw some recovery, SMP has been the biggest driver with returning demand and a sense of the market being at the bottom sitting at the heart of this.

Figure 2. UK wholesale prices

Source: AHDB

The graph shows UK wholesale prices for four dairy commodities:

- Green, top line = Butter (unsalted)

- Grey, second line from the top = Mild Cheddar

- Red, second line from the bottom = SMP

- Blue, bottom line = Bulk cream

Farmgate milk prices

The latest published farmgate price was for December 2025 was announced by Defra as being 40.29ppl, down 2.62 pence (6.1%) on the previous month.

The November UK price was reported as 42.91ppl, down 2.39 pence (5.3%) on October 2025.

Latest announced farmgate prices remained negative from February and into March.

Aligned liquid contracts saw stability with the exception of Muller Co-op Dairy Group which dropped their price 1.75ppl.

On non-aligned liquid contracts, all the buyers on the AHDB League table announced price cuts for February apart from Payne’s dairies which held:

- Crediton Dairy and Muller Direct made a reduction of 3.00ppl each

- Freshways made a price cut of 2.00ppl, which is the fourth consecutive month of price decline

- Pembrokeshire Creamery reduced their price by 3.17ppl

- Grahams and BV dairy reduced their price by 2.50ppl and 2.31ppl, respectively

There were more price cuts to cheese contracts mostly in the range of 2.00 to 2.50ppl:

- Belton Cheese and Saputo reduced their price by 2.50ppl each

- Wensleydale Creamery and Wyke Farms reduced their price by 2.23ppl and 2.08ppl, respectively

- First Milk and Leprino reduced their price by 2.00ppl each, which is their fifth month of consecutive decline

- Barbers and South Caernarfon Creameries also cut by 2.00ppl

Announcements on manufacturing contracts followed those of cheese contracts:

- Meadow announced a reduction of 1.00ppl for another consecutive month

- Dale Farm GB and UK Arla Farmers Manufacturing reduced their price by 1.91ppl and 1.75ppl respectively

Retail demand

During the 12 weeks ending 24 January 2026, volumes of cows’ dairy declined 0.5% year-on-year.1 Spending on cows’ dairy increased by 6.1% year-on-year, driven by a 6.7% increase in average prices paid.

Cows' milk

Cows’ milk volumes saw a 1.7% decline in volumes purchased year-on-year2, while spend saw a 6.7% increase, driven by an 8.5% increase in average prices paid.

Declines were seen for semi-skimmed, skimmed, and other cows’ milk. Whole milk continued to see volume growth, with a 2.6% increase year-on-year, due to more buyers. Other animal-sourced milk also saw volume growth.

Cows’ cheese

Cows’ cheese remained in volume growth, seeing a 1.6% increase year-on-year.2 Spend grew by 4% during this period, driven by volume gains and a 2.4% increase in average prices.

The volume increases in cheese are in part due to a successful Christmas, where cheeseboards were an important part of celebrations.

Cheddar, which represents a majority (44.8%) of all cow cheese volumes, saw a 0.7% increase. Other cows’ cheese (+11.3%) and snacking (+9.3%) also saw growth.

Cottage cheese makes up 24% of the other cows’ cheese category, but accounted for more than 58% of growth for other cows’ cheese. This growth offset declines in specialty and continental, British regionals, processed, and Stilton and British blue.

Cows' butter

Cows’ butter saw a 0.6% decrease in volumes purchased year-on-year (NIQ, 12 w/e 24 January 2026). However, spend saw a 3.7% increase year on year, driven by a 4.4% increase in average prices paid.

Block butter continues to be the only subcategory to see volume growth (+4.7%). This growth is due to consumers wanting less ultra processed and more natural foods.

However, this growth was not enough to offset the decline in cow butter spread volumes (-3.2%).

Cows’ yogurt, yogurt drinks and fromage frais

Volumes continue to see growth (+5.9%), with spend increasing 10.1% year-on-year.2 Average prices paid grew 4%.

Cows’ standard plain yogurt saw the fastest growth of 19.6% year-on-year, while cows’ fat-free yogurt saw the greatest actual growth, with an additional 4.3m kilos purchased year-on-year (+12.9%).

Cows' cream

Cows’ cream volumes saw a 0.3% increase year-on-year, with an 8.7% increase in average prices paid, and a 9% increase in spend.2

Cream also performed well due to Christmas falling within this period. Growth in clotted, aerosol, crème fraiche, double and cow cream other drove this performance. Volume declines were seen by whipping (-11.9%), single (-4.4%) and sour cream (-0.1%).

1 NIQ Homescan POD, Total GB

2 NIQ, 12 w/e 24 January 2026

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.