Irish beef: what's the current picture, and the outlook for 2021?

Friday, 12 February 2021

Production

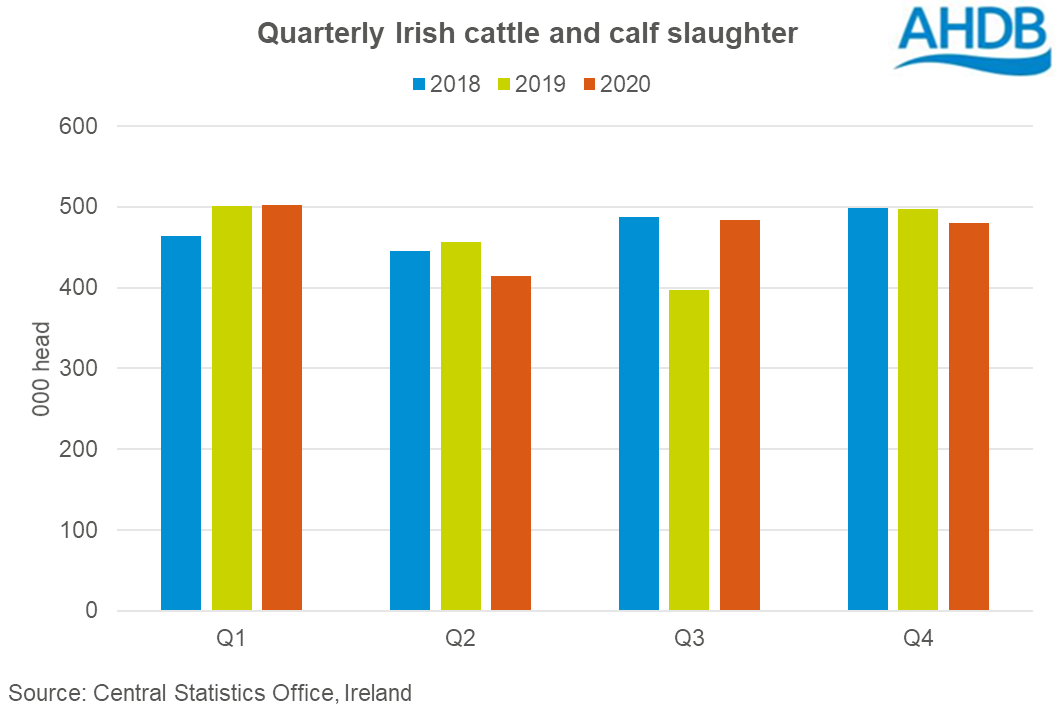

Irish cattle slaughter (incl. cows and calves) reached 1.9 million head in 2020, up 2% from the year before, according to data from the Central Statistics Office. This contributed to a 2% rise in Irish beef production for the year, with 633,400 tonnes produced.

Throughputs began the year in-line with 2019, before falling in the second quarter as COVID-19 disrupted abattoir operations and export opportunities. Much of the overall annual rise in slaughter occurred in the third quarter. However, it should be noted that during Q3 in 2019, slaughter was significantly lower due to protests at abattoirs.

Throughputs during Q3 2020 were actually relatively unchanged compared to Q3 2018. This seems to be the case for the year overall, in fact overall slaughter in 2020 was 0.7% lower than it was in 2018.

For 2020, heifer and steer slaughter were 3% and 10% higher year-on-year respectively. Slaughter of bulls (including adult bulls) fell by 29% year-on-year. Reports suggest this is partly due to a shift by abattoirs away from young bull beef. Many bull finishers also reportedly faced delays in getting their animals slaughtered in 2019, and so have moved to producing animals as steers, partly explaining the rise in steer throughputs. Cow slaughter also rose by 6%, having been notably lower in 2019.

Trade

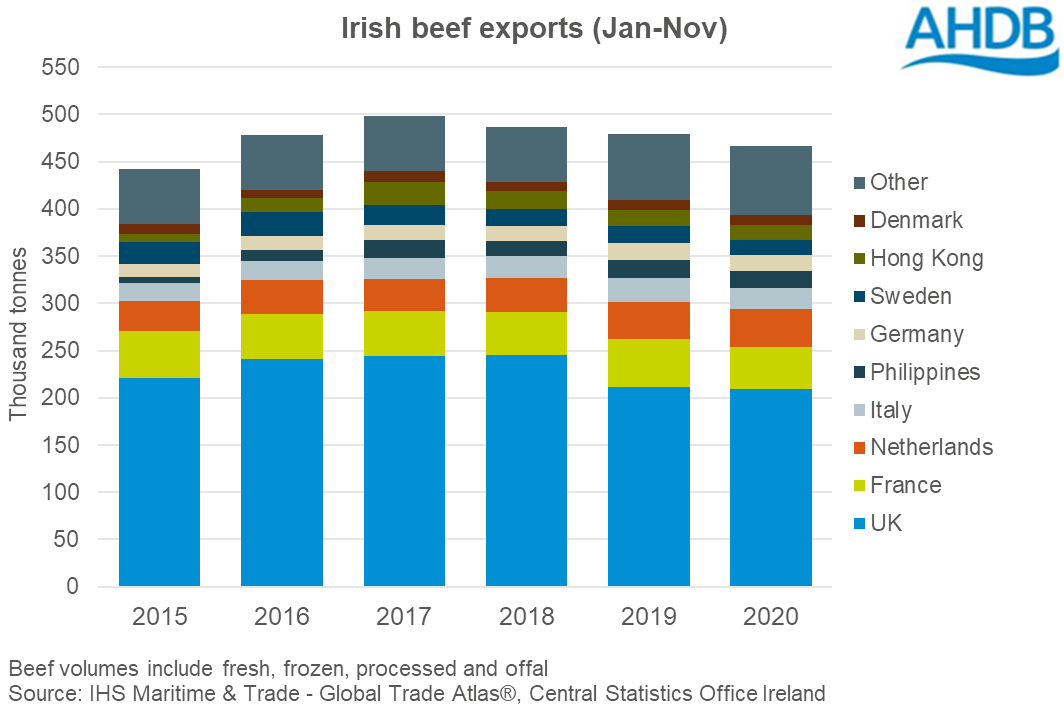

The quantity of Irish beef (including fresh, frozen and offal) exported globally during the first 11 months of 2020 fell by 3% on the year, as COVID-19 disrupted eating-out markets across Europe. A total of 466,700 tonnes were exported, with a marginally weaker average unit price giving the shipments a total value of €2.1 billion (-3% year-on-year).

During the period, shipments to the UK fell by 1% year-on-year to 208,800 tonnes, the lowest volume since 2013. Growth in volumes during the second half of the year largely outweighed losses in the first half. The total value of these shipments rose by 2% year-on-year to €920.2 million (£824.5 million).

Exports to the EU-27 fell by 8% to 178,600 tonnes, with declines to all major trading partners apart from the Netherlands, volumes of which remained unchanged year-on-year.

Trade to non-EU countries was more mixed. Shipments to the Philippines, Ireland’s key non-EU destination for beef, fell by 5% year-on-year. However, notable year-on-year growth was seen in exports to Japan, the US and Canada, albeit from low bases. Irish beef exports to mainland China were suspended in May due to an atypical BSE case, before which they were growing strongly, having obtained market access in 2018. Despite expected growth in Chinese foodservice in 2021, the benefit to Irish exports will depend on when trade can resume.

Prices

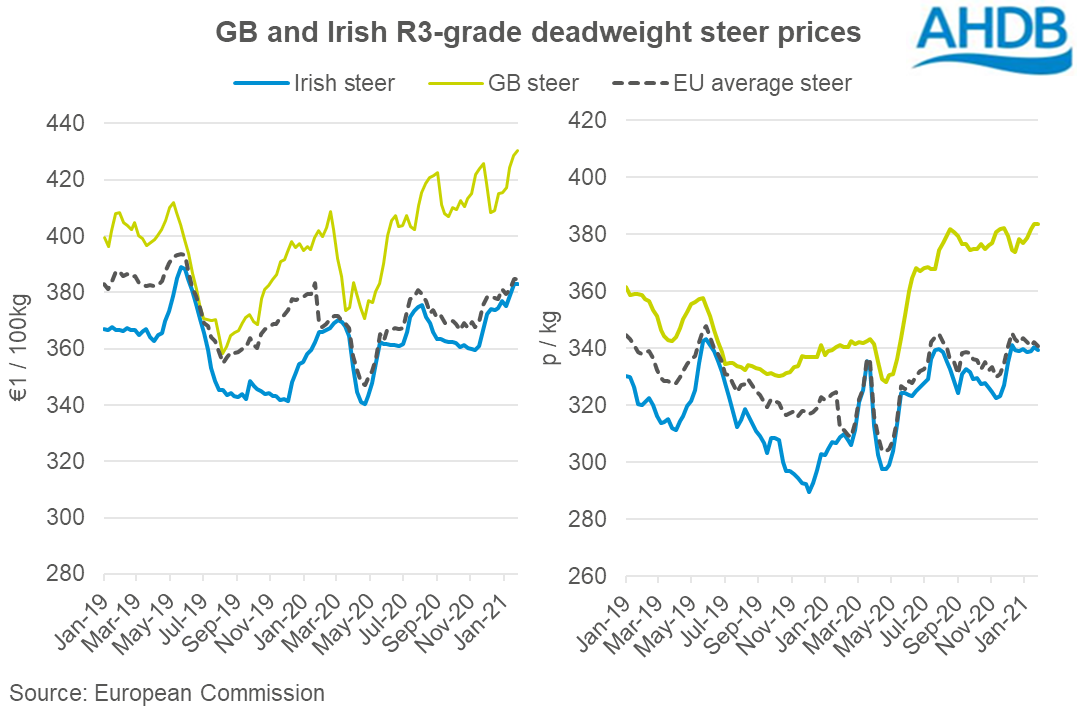

Like many other countries in Europe, Irish cattle prices generally strengthened throughout 2020. Prices took a dip in April-May time as the initial effects of COVID-19 related lockdowns and disruption were felt, but recovered in the second half of the year.

The deadweight price for an Irish R3-grade steer fell to a low of €3.40/kg in mid-April, before gaining €0.35 to peak at €3.75/kg in mid-August. Prices were supported towards the end of the year by some re-opening of UK foodservice, then Christmas buying and stockpiling before the Brexit deadline.

Despite the growth in Irish prices, the rise in GB prices has been even more marked during 2020. Prices fell to €3.71/kg in mid-April, before rising by €0.55 to peak at €4.26/kg at the end of November. Prices have continued to strengthen into 2021. In the week ending 30 January, the equivalent GB deadweight R3 steer price was €4.30/kg, €0.48 above the Irish price for the same week. Of course, as GB prices become more expensive relative to Irish prices, this makes Irish beef more price competitive.

So, what’s the outlook for 2021?

According to Bord Bia, supplies of Irish cattle look to be tighter during the first half of 2021, following higher-than-expected cattle slaughter in the second half of last year. For the full year, it is anticipated that there will be 50,000 fewer finished cattle available to slaughter. If this is realised, it could lead to a year-on-year fall in slaughter of around 3%. Indeed, during January 2021, 4.3% fewer cattle were processed when compared to the same month in 2020, according to Bord Bia. Tighter supplies may offer support to Irish cattle prices, however export demand will be key.

From a trade point of view, the main influences on demand for Irish beef will be how foodservice markets recover in the UK, and how much disruption is caused by the new EU-UK trading relationship. We forecast that UK beef imports will show some recovery in 2021, due to lower expected domestic production and partial reopening of the foodservice sector in the second half of the year. Despite new customs checks and requirements, Irish exports to the UK are expected to remain high due to the importance of the market, although the added costs may make shipments more expensive.

As for the EU, Bord Bia expect that demand for beef will remain weak, as the recovery from COVID-19 will be slow. Lower pork prices may also pressure beef consumption in some markets.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.