Irish beef prices above GB for the first time in three years: Beef market update

Friday, 5 September 2025

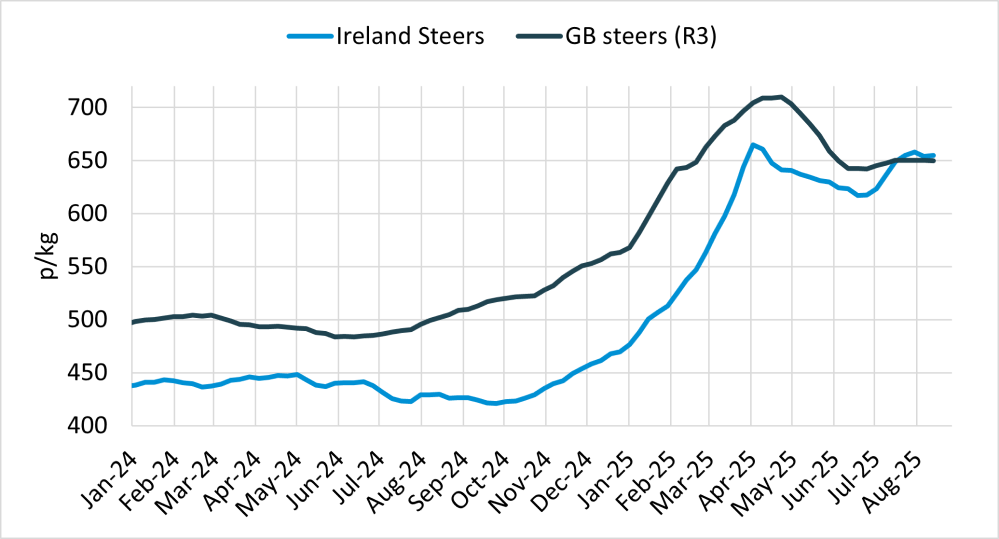

The price differential between GB and Irish prime beef has closed in the last few months, after reaching its widest gap in February of this year. Irish prime prices have now been higher than those in GB for the past four weeks. In this article we examine the market factors behind this volatility.

Key points

- Irish prime cattle prices have moved higher than their GB equivalent in recent weeks.

- Tightness in Irish supply is driving these higher prices, with prime slaughter down 19% YoY in the last four weeks.

- This strength in Irish prices may be lending support to the GB price and contributing to the stability seen in recent weeks.

Prime prices

Both GB and Irish prime cattle prices saw exceptional growth in the early part of 2025. GB prices fell away quite steeply and then appear to have stabilised in recent weeks, whereas we have seen smaller falls followed by a price rally in the Irish market. This has resulted in Irish prime prices sitting above the GB equivalent for four weeks.

The last time that the prices intersected was in May/Jun of 2022, where the Irish price sat higher than GB for only five weeks.

Irish and GB R3 steer prices

Source: European Commission, AHDB

Production

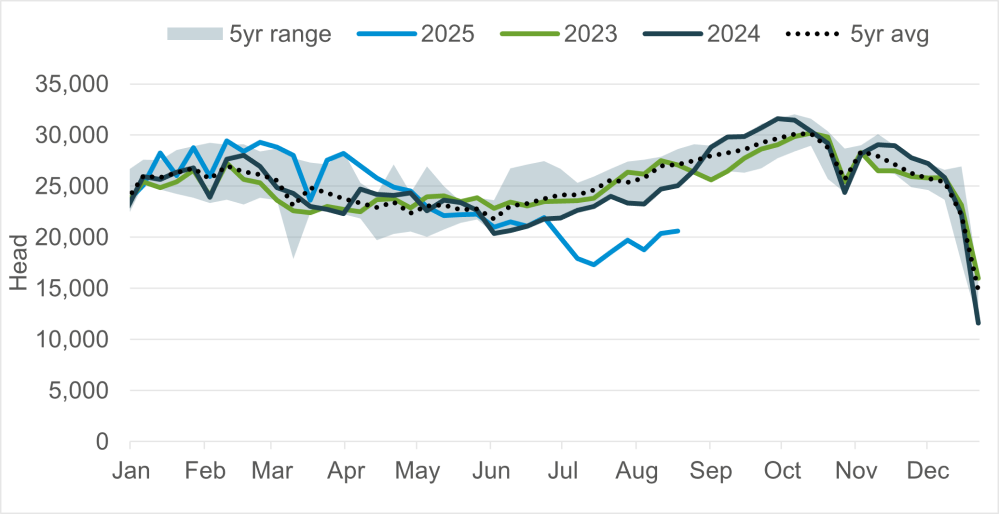

The major driver of the recent strength in Irish beef prices has been tightness in supply. Weekly prime kill has fallen significantly in recent weeks, with throughput down 19% year on year in the four weeks ending 25 Aug.

Irish prime cattle kill, weekly

Source: DAFM

This tightness in supply has been accelerated by strong prices and demand for cattle driving higher than forecast kills in the early part of this year. This demand has been reflected both domestically and in export markets with H1 figures showing a year-on-year increase in Irish export volumes to its three top markets; the UK, France and Netherlands, alongside growth to other EU countries.

This is combined with a longer-term structural decline in the Irish beef herd, which has also reduced supplies available. As at 1 July 2025, the Irish beef herd stood at 4.12 million head, a 3% fall on the year, with the greatest declines in animals aged 18-30 months. This both illustrates the current supply challenge and indicates it is likely to continue, as there are lower numbers of cattle in the pipeline.

What’s the outlook?

Bord Bia are forecasting a 5% year on year decline in Irish prime cattle supply for 2025. With higher kills already seen in the early part of the year, it is expected that contraction will be felt more strongly in the coming months.

What could this for the GB beef market?

The strength in the Irish price in recent weeks is likely supporting the stability we have seen in the GB price, given domestic demand is taking a hit as price increases impact volumes in retail.

Higher Irish prices and lower supply may limit volume of Irish imports into the UK. Indeed, in H1 we have seen total beef volumes from Ireland down 4%, with declines across fresh, frozen and processed products.

Looking ahead, supply outlooks on both sides of the Irish sea would point to sustained support for cattle prices. Seasonally we would expect some uptick in beef demand heading into Q4 as schools return and Christmas procurement approaches. However, we expect inflationary pressures to keep demand subdued to previous years. How price inflation in beef is managed across British and Irish lines will be crucial to maintaining volume sales, and we will monitor closely the impact on consumer purchasing and the wider market.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.