Irish beef outlook 2023

Friday, 3 March 2023

Ireland is the largest supplier of beef to the UK, with Irish product continuing to be a mainstay in the UK market. According to Bord Bia’s 2023 Irish beef sector outlook, c.90% of the value of Irish beef exports go to the EU and UK marketplace. With the UK making up 43% of the total value of Irish beef exports at €1.1 billion in 2022, any change in production or trade across the Irish sea could impact domestic prices here. So, what can we expect in 2023?

Production

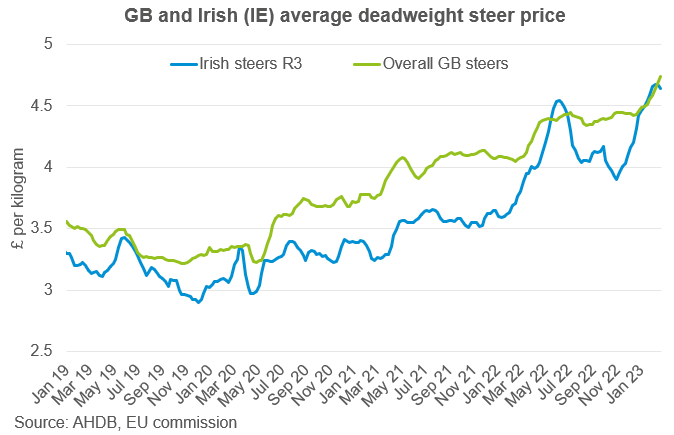

In 2022, Irish cattle throughputs were up 7% year-on-year at 1.82 million head (Bord Bia) with cattle finished younger in H2 2022, reducing the need for additional feed or fodder. This is due to high input costs squeezing margins as knock-on effects from the war in Ukraine resulted in high energy and on-farm costs. Demand for Irish beef supported prices in 2022, averaging £4.06/kg (up 15.9% year-on-year) due to tight supplies in the UK and EU, with herd contractions causing EU production declines of 0.6% in the first half of the year (H1). As a result, the gap between Irish and GB beef prices (pound sterling) closed, with Irish prices exceeding GB prices for the first time in 5 years, from the end of May-June.

According to Bord Bia, Irish cattle throughputs are forecast to fall by 3-4% (50,000-60,000 head) in 2023, mainly in H1 due to the smaller herd size. Although, we could see a recovery later in the year. With tight supplies expected globally in 2023, predominantly due to reduced production in the northern hemisphere, prices are set to remain historically high. Teagasc forecast that average finished cattle prices in Ireland will rise 4% year-on-year in 2023. This is despite downside pressure from inflation reducing disposable incomes and having negative implications for demand.

Trade

Although the quantity of Irish fresh and frozen beef imported to the UK decreased by 3.6% in 2022 (HMRC), the value of Irish beef imports to the UK grew by 15% (to €1.1 billion) due to inflation. Growth in both value and quantity terms was also seen with Irish exports to some major European countries; France, Germany, Italy, and Sweden as demand for Irish beef increased in 2022 due to reduced European production.

In January we saw the suspension on exports of frozen, boneless beef to China lifted. This could increase export opportunities for Irish beef, especially with the potential for Chinese demand to increase in H2 following the potential easing of COVID restrictions (Bord Bia). China has also recently suspended Brazilian beef imports due to a case of BSE in Brazil, leading to calls by the Irish Cattle and Sheep Farmers’ Association for Ireland to fill some of the export gap left by Brazil. Depending on the duration and impact of Brazil’s suspension, we may see greater competition for Irish beef on the export market in the short-term. Ireland are also developing exports to other Asian markets such as Thailand.

How might Irish beef markets impact the UK in 2023?

Despite food price inflation potentially limiting shopper spending, tight beef supplies from the expected Irish, EU and global production declines could continue to support prices. Looking forward, could we see Ireland try and diversify its beef export markets by moving some product away from well-established supply chains, as wider global disruption in the beef market causes volatility and opportunity? Or will the slight declines in EU production continue to hold a buoyant trade and offer more value for product? These factors remain key watchpoints as we move further into 2023.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.