Irish beef outlook 2022: what could it mean for the UK market?

Wednesday, 26 January 2022

Bord Bia has recently released its outlook for the Irish beef sector in 2022. What could these predictions mean for the UK market?

Production

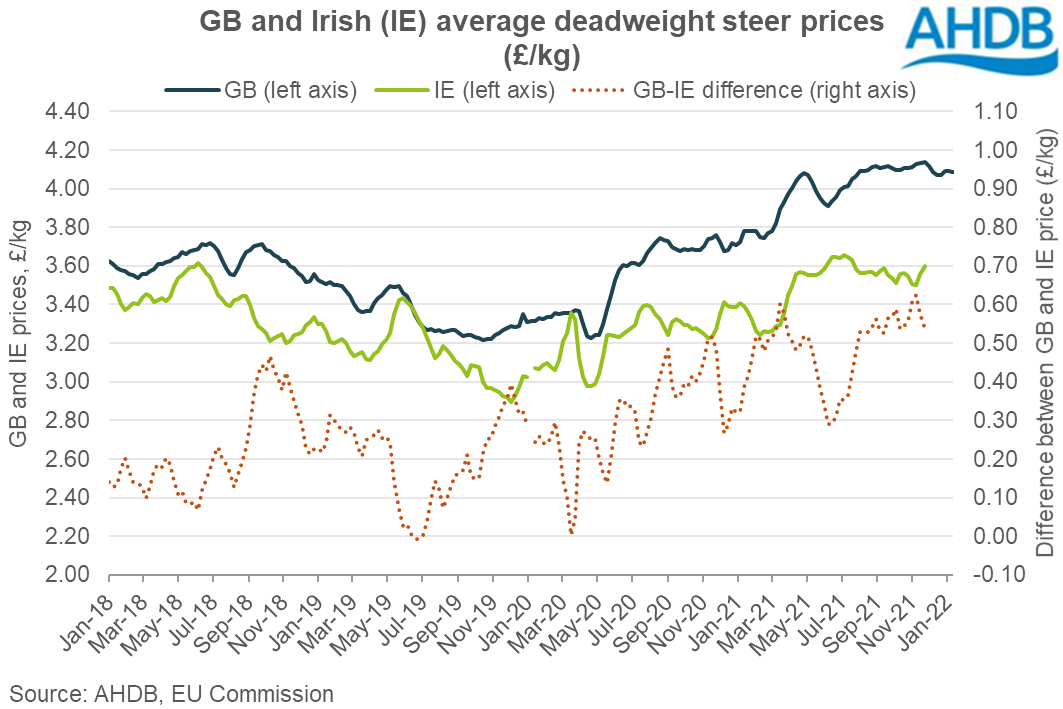

According to Government figures, Irish cattle throughputs fell by 6% (98,000 head) in 2021 to 1.7 million head, as cattle supplies remained tight. This helped keep Irish cattle prices supported through the year, with the 2021 average deadweight R3 steer price at €4.31/kg, up 12% (43p/kg) from the year before (EU Commission). However, strong GB prices have meant that the gap between GB and Irish cattle has been generally widening.

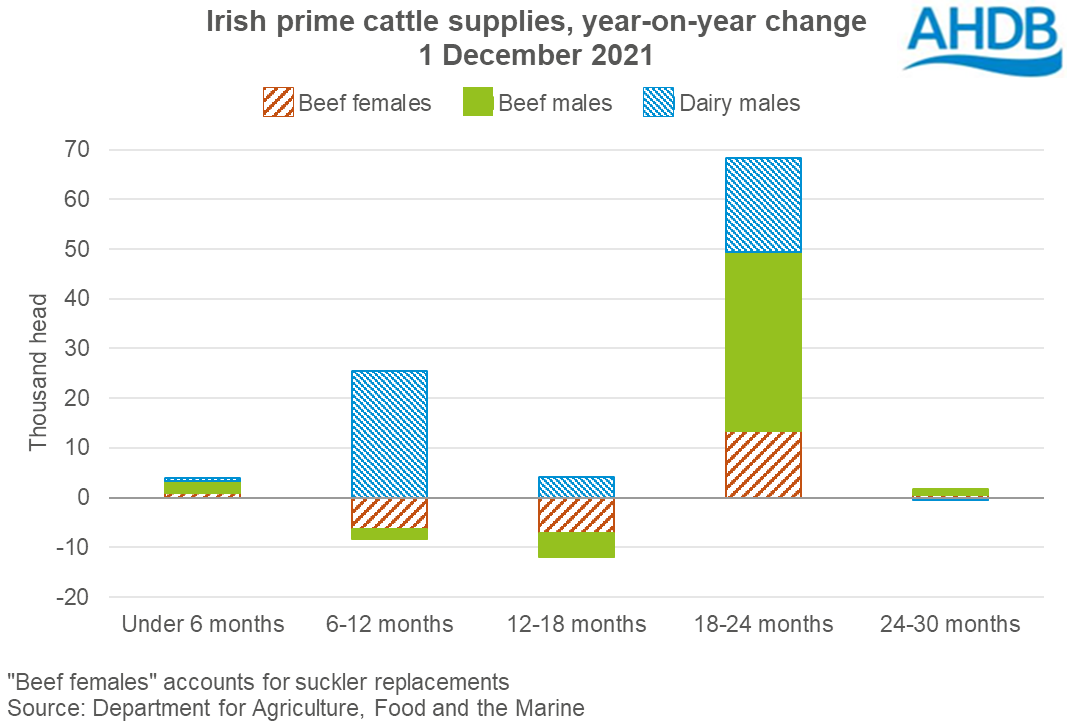

For 2022, Irish cattle slaughter is expected to show some recovery, by an estimated 70-80,000 head (+3-4%). Population data would suggest that the majority of 2022 production growth will be later in the year, with an increase evident in numbers of cattle aged 18-24 months. Bord Bia report that supplies are forecast to remain relatively tight for the first half of the year, constrained by numbers of older prime cattle.

Trade

Total Irish beef exports fell by 12% in volume in 2021, according to Bord Bia. Several factors were behind this. Firstly, volumes imported into the UK were severely reduced in the first quarter, following the EU exit deadline at the end of 2020. Secondly, on the global market, the suspension of Brazil’s beef exports to China later in the year meant that significant volumes of beef became available for shipping elsewhere, reducing import requirements for Irish beef. In addition, the US also experienced greater domestic production later in the year due to drought-related de-stocking, having a knock-on effect on Ireland’s exports.

Looking ahead, the global beef market is expected to remain on the tight side, due to lower production in several key nations, and robust import demand from Asia (particularly China). China suspended Irish beef exports in 2020 due to BSE, but if access can be regained, this could be a valuable outlet for Irish product. From our own forecasts, more beef is expected to be sold through the UK foodservice (eating-out) market in 2022, although not as much as pre-pandemic levels due to business closures and people working from home on a more permanent basis. These factors are expected to be positive for Irish exports in 2022.

So what could this mean for the UK?

A forecast rise in production of price-competitive Irish product, and expectations of greater demand for beef from the UK eating-out market will likely make Irish imports increasingly attractive in 2022. From a price point of view, any shift in beef demand from retail back into foodservice could likely exert some pressure on demand for home-grown cattle. However, UK cattle supplies are expected to remain on the tighter side for the first half of 2022, which should offer support to prices.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.