Human and industrial cereal usage round-up: Grain market daily

Friday, 3 February 2023

Market commentary

- UK feed wheat futures (May-23) gained £2.05/t yesterday, ending the session at £233.75/t. New crop futures (Nov-23) closed at £227.50/t, a £1.60/t rise over the same period.

- UK prices tracked upward US price movements yesterday on the back of technical buying, however reminders of strong export competition specifically from the Black Sea region capped any major gains.

- Paris rapeseed futures (May-23) closed at €544.25/t yesterday, gaining €3.25/t over the session. New crop prices (Nov-23) rose €1.75/t over the same period, to close at €543.25/t.

- Rapeseed markets continue to feel support from rising soyabean prices, as dry conditions in Argentina impact the country’s soyabean crop. Read more on this in Tuesday’s GMD.

Human and industrial cereal usage round-up

Yesterday, the AHDB published the latest UK human and industrial cereal usage figures, which includes information on cereal usage by flour millers, brewers, maltsters and distillers (BMD), and oat millers, up to December.

In our latest UK supply and demand estimates released last week, barley usage in the domestic human and industrial sector was estimated to be on the rise down to strong BMD demand. Though for wheat, maize and oats, human and industrial usage forecasts for the 2022/23 season were pulled back slightly from previous estimates.

With ongoing factors including the cost-of-living crisis, what’s the picture for the first half of the season?

Total flour production up on the year

Total flour production between July and November was up 1.4% on the year, at 2.41Mt. The month of December this season saw a 1.8% yearly rise in total flour production.

The ‘total flour production’ figure does include production by the bioethanol and starch sectors. Wheat usage in starch production and distilling is expected to rise this season, on the back of increased capacity. For bioethanol, it is assumed both UK bioethanol plants will be in operation this season, but they are not expected to be running at full capacity, partly due to longer maintenance periods. With high input costs and significantly lower bioethanol prices, bioethanol demand remains a key watch point for this season.

To give us an indication of production by flour millers specifically, we can subtract the ‘other flour’ figure from ‘total flour production’. Using this calculation, between July and December this year, production by UK flour millers (excl. other flour) was up 0.2% on the year, but down 0.5% on the previous five-year average (2017/18 – 2021/22).

However, while total flour production looks to be on the rise, total wheat milled this season up to December is down 0.8% on the year, and for the month of December it’s down 1.1%. For the rest of the season, flour production by millers is expected to remain stable, though miller’s wheat usage is forecast down slightly on the year, driven by higher extraction rates because of higher specific weights.

Going forward, the impact of the cost-of-living crisis on flour demand and some premium and alternative products, remains a key area to watch.

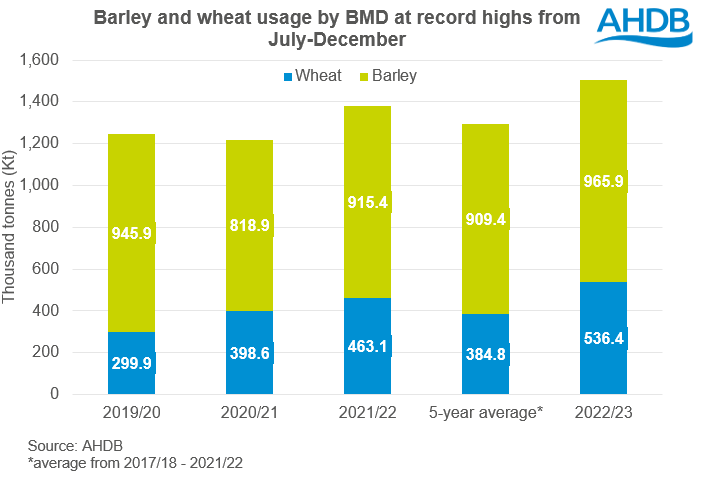

Barley usage in BMD sector highest on record

Total wheat and total barley usage by brewers, maltsters, and distillers (BMD) reached record highs (using data since 1990/91) in the first half of this season. Barley usage this year-to-date is up 5.5% from the same period last season, and up 6.2% on the period five-year average for this period. Wheat usage saw even bigger climbs, and is up 15.8% on the year, and up 39.4% on the previous five-year average.

An analyst insight back in July outlined that in previous recessions, the frequency and intensity of spirit consumption actually increased, and while beer sales could decline should we follow historic trends, the impact likely won’t be felt any time soon. Recessionary fears and rising costs will remain a watchpoint for this industry, but cereal usage is expected to be strong for the remainder of the season, with increased capacity seen in Scotland too.

Oats milled up on the year

Finally, total oats milled from July to December (first two quarters of this season) saw a yearly rise of 5.6%. However, this is 2.2% below the previous five-year average.

Looking forward over the rest of the season, it’s expected that oat usage by the human and industrial sector will see a yearly increase pegged at 513Kt in last week’s supply and demand estimates, up 2% on the year. Though this outlook was pegged back slightly (6Kt) from the previous November estimate.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.