Analyst insight: What does the ‘cost of living crisis’ mean for UK flour demand?

Thursday, 8 December 2022

Market commentary

- UK feed wheat futures (May-23) climbed £3.05/t over yesterday’s session, closing at £244.00/t. New crop futures (Nov-23) closed at £230.00/t, gaining £2.25/t from Tuesday’s close.

- UK wheat prices tracked global markets up yesterday as bargain buying added strength to Chicago wheat futures. The May-23 Chicago wheat contract gained $7.35/t yesterday, ending the session at $279.13/t.

- Chicago soyabean futures (May 23) climbed $5.60/t yesterday, closing the session at $545.31/t. The Nov-23 contract closed at $513.90/t, climbing $4.41/t over the session.

- Soyabean markets ticked higher on the back of continued dryness in Argentina, as well as expectations of demand recovery from China, due to an easing of COVID-19 restrictions in the country.

What does the 'cost of living crisis' mean for UK flour demand?

In the UK, inflation rates began to rise in 2021 following increased spending after the pandemic and have continued to climb this year following the invasion of Ukraine leading to soaring energy prices. In October, the UK consumer price inflation rate hit a 41-year high of 11.1% up year on year (Refinitiv). On Monday, the Confederation of Business Industry (CBI) forecast that Britain’s economy is on track to shrink by 0.4% in 2023, as energy prices surge, inflation remains high, and companies put investment on hold. The CBI also predicted that inflation rates will be slow to come back down, averaging 6.7% next year and 2.9% in 2024.

With inflation rates at multi year highs and the subsequent increase in the cost-of-living, we explore what impact this could have on wheat demand by the UK flour milling industry going forward.

Consumption trends

As explored in a recent AHDB consumer insight article, at the moment consumers are still eating at home more than before the COVID-19 outbreak. It’s thought that we have now reached a new level of in-home consumption, averaging 5.8 billion occasions in August 2022, compared to the average of 5.2 billion occasions pre pandemic (Kantar Usage).

It’s expected that current consumption behaviours are shaped more by the pandemic than the cost-of-living crisis. However, due to higher prices, consumers are looking for ways to save money on food and grocery shopping and are, therefore, trading down and buying fewer items. Many consumers also say they are looking to reduce spending on eating out. Anecdotal reports suggest that this new level of out of home consumption will likely continue or increase further as consumers aim to cut costs by eating in.

What does this mean for demand going forward?

Looking back at flour production by UK flour millers during the pandemic, when out of home consumption dropped in 2020/21, the total amount of flour produced was down 7% on the year at 4.5Mt. This does include production by the bioethanol and starch sectors, which we are unable to split out, as full season data was not published for ‘other flour’ (largely made up of production of bioethanol and starch) due to confidentiality constraints. However, this does give a good indication of the downward trend in flour production by the industry.

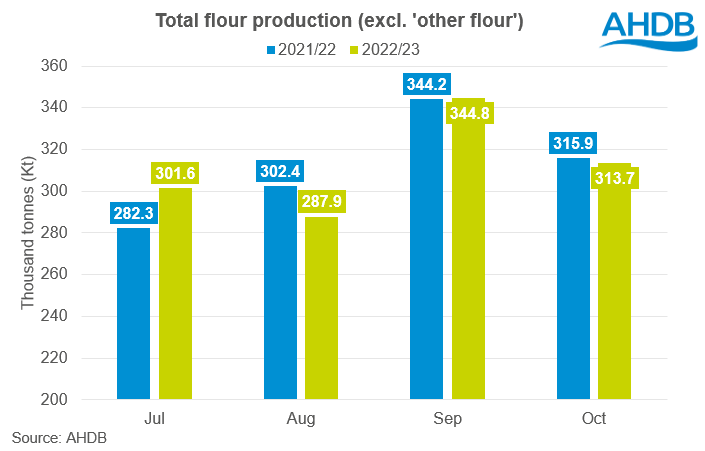

Full season data is available for 'other flour’ production for 2021/22, as well as data for this season to date. As such we can subtract the ‘other flour’ category from ‘total flour production’ to give a better idea of production by flour millers. In 2021/22, we saw total flour production recover somewhat from the midst of the pandemic. However, over recent months production by UK flour millers (exc. other flour) has been on the decline from year earlier levels.

In the first official 2022/23 supply and demand estimates, wheat demand by the human and industrial (H&I) sector is forecast to make up just under 50% (7.4Mt) of total domestic consumption of wheat. While H&I demand is forecast up 4% on the previous season, this is driven largely by a projected rise in bioethanol and starch demand. Demand by flour millers is actually forecast to decline slightly on the year, partly due to the cost of living crisis impacting demand for premium products and out of home consumption.

Conclusion

The impact of the pandemic, and the rate of inflation and subsequent high food prices, are seeing consumers continue to choose to eat-in more than before the pandemic. This, combined with a shift in buying habits to cheaper alternatives is filtering through to flour production and therefore wheat usage.

With analysts expecting inflation rates to recover slowly, and prices to remain high in the mid to long term, the impacts of the recession on flour demand remain a watchpoint moving forward. If demand for wheat by UK flour millers falls further than is currently expected, this could increase this season’s exportable surplus further. Though any further falls in demand by flour millers, may lead to a reduction in higher quality imports instead.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.