High prices starting to bite into feed demand? Grain market daily

Thursday, 2 December 2021

Market commentary

- Global grain and oilseed prices stabilised or picked up to varying degrees yesterday. Prices fell at the end of last week and start of this week due to fears about the impact of the new COVID-19 variant on the global economy. These fears reportedly eased slightly yesterday, and the US announced new export sales of maize and soyabeans.

- May-22 UK feed wheat futures lost another £0.25/t to £228.25/t, but the Nov-22 contract gained £0.50/t to £200.00/t.

- Paris rapeseed prices picked up more. The May-22 contract gained €15.50/t to €634.25/t, while the Nov-22 contract gained €7.00/t to €537.00/t.

- The latest AHDB fertiliser prices survey confirmed further sharp rises in October, especially for Ammonium Nitrate. You can find the latest guidance on nitrogen applications, including a handy calculator, here.

High prices starting to bite into feed demand?

Margins are under pressure in several animal sectors due to higher feed, energy, fertiliser, and labour costs. It looks like this is starting to bite into demand for compound feed.

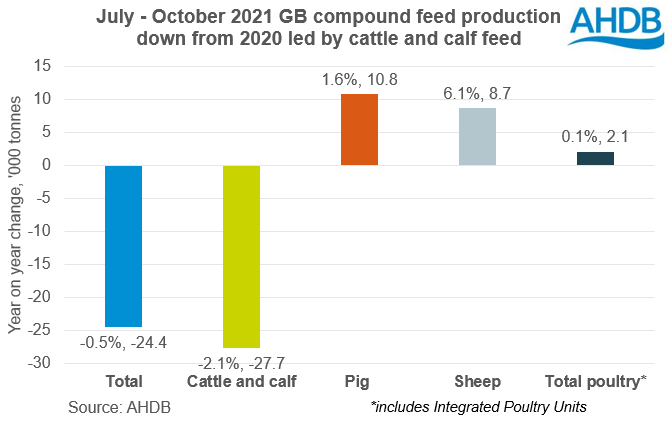

The latest AHDB animal feed production data shows that in October total compound feed production, including Integrated Poultry Units (IPUs), fell 4% from October 2020. This means that for the season so far (Jul-Oct) production is now down 0.5%.

The declines were led by cattle and calf feed production, which is back 2% compared to the first four months of 2020/21. In comparison to last year production has slowed more as the season has progressed. Output was down 4% year on year in September and down 6% in October.

Profitability in both the dairy and beef sectors is being pressured by high feed and other input costs. It seems this is now translating into lower production and use of compound feed. More forage production could also be contributing to the easing in compound production, after good grass growth this summer.

Meanwhile, margins for pig producers remain negative. As a result, there are increasing expectations of a decline in pig availability as we progress through 2022. But, so far total pig feed production is still up 2% year on year (Jul-Oct). This is due to a rise in finishing feed production (+9%), likely linked to the backlog of pigs waiting for slaughter. If pig numbers do drop as we move into 2022, pig feed production could also reduce.

Demand from the poultry sector also fell in October (-3% vs October 2020). There were declines for broiler, layer, and turkey feed. However, the season total is so far broadly static. This will be an important area to monitor going forward.

Similarly, sheep feed production was down year on year in October (-1%) but remains up 6% for the season to date (Jul-Oct).

Impact on grain markets

Animal feed is a key part of demand for cereals in the UK. Weaker than expected demand could mean weaker UK prices for feed grains, while stronger demand would support prices.

Currently AHDB forecasts that total cereals demand in animal feed, including on farm usage, at 13.0Mt in 2021/22. This is 247Kt or 2% less than last season mainly due to an expected drop in compound feed production.

The outlooks for the livestock and poultry sectors are key for how animal feed demand will change into the latter part of the season. AHDB next forecasts the outlook for the livestock sectors in January, and the pages will be updated here. We will take this information and more into account when we make the next forecasts of UK cereal demand on 27 January.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.