Global milk supplies forecast: modest growth expected in 2024

Thursday, 1 February 2024

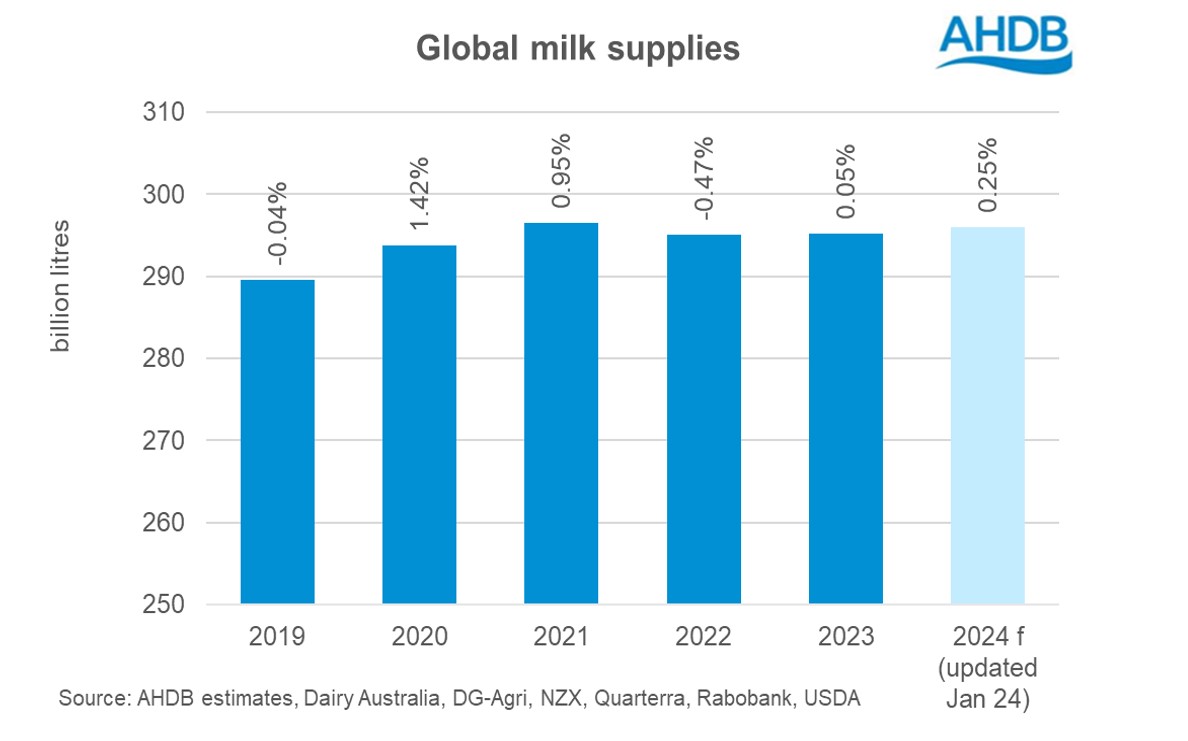

According to latest estimates, global milk production across the key producing regions is expected to grow modestly by 0.25% in 2024. This is slightly higher than the 0.05% increase recorded in 2023. Although production is likely to increase, there is expected to be variability across key regions.

Overall, dairy markets in 2023 softened due to weaker underlying market fundamentals. There was an underwhelming milk supply growth in 2023, according to Rabobank. Disappointing Chinese import demand contributed to overall lack of movement on the demand side and lower prices than the previous year.

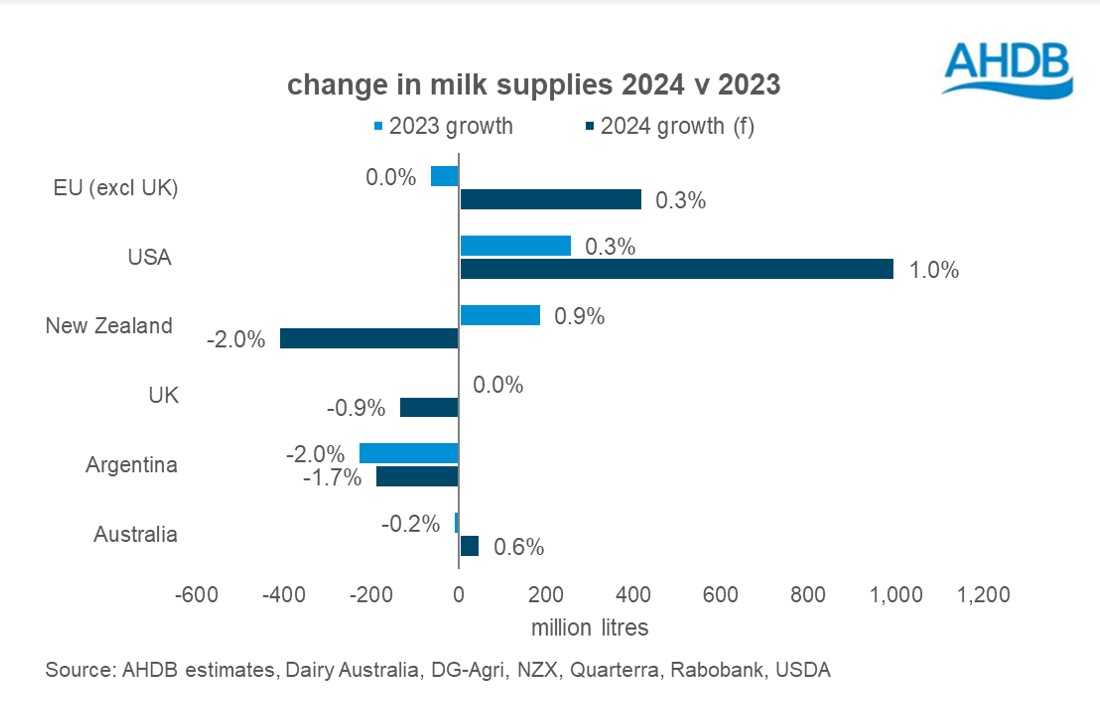

However, with some recent recovery in prices, even at fairly low levels, milk production is expected to see some growth in some of the key exporting regions with the exception of the UK, Argentina and New Zealand. The USA (1.0%), EU (0.3%) and Australia (0.6%) are forecasting some growth. The decline in herd size in the US, seen between March–October 2023 is slowly stabilising and cow numbers are expected to increase in 2024 in response to the recovery in milk prices in the USA. Increase in milk volumes in the EU will be supported by an increase in domestic and food service demand as reduced inflation and rising salaries increase disposable income.

Australia is likely to reverse some of the production losses in 2023 going into the new year. Firmer milk prices, coupled with good export demand, are likely to boost production.

On the other side, volatile weather conditions paired with weakening consumer demand are expected to drive lower production in Argentina. In New Zealand, the new conservative government budget will mean a cautious approach for farming and this will impact milk flows during the season. In the UK, production for 2024 is estimated to be 0.9% lower given tightening margins and lukewarm consumer demand.

According to Rabobank, prices are likely to firm up towards long-term averages in the first half of 2024. Considering the modest growth in production, returning demand will be necessary to drive the market. In addition, the continuing conditions (that could cause some weather challenges for southern hemisphere producers), China’s economic recovery and geopolitical instability in the Middle East are also other important factors to look out for this year.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.