GB pig prices: continuing the recent downtrend

Wednesday, 15 November 2023

Key trends

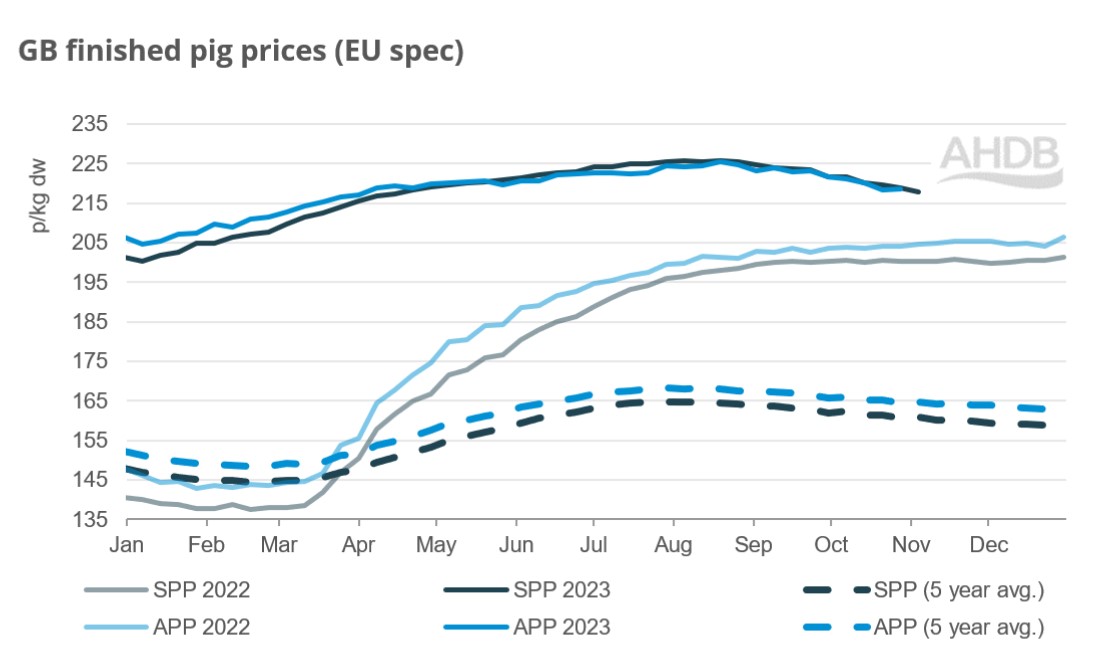

- GB pig prices are continuing the downtrend witnessed since the end of August.

- Demand remains suppressed, due to the cost-of-living crisis, with GB retail purchase volumes down 2.6%.

What’s happening to prices?

GB pig prices have eased over the last two months. The EU spec SPP has declined 3.95p over the last four weeks and is currently at 217.78p/kg (w/e 04 November). Prices are still well above the 5-year average and also above last year’s levels.

One of the factors behind these price declines is falling pig prices in the EU marketplace. GB prices are strongly influenced by those across the EU, with the EU the main supplier of imported product. The EU average reference price has been under pressure for nearly four months, after the peak was recorded at 215.45p/kg for the week ending 23 July. Since then, prices have fallen by 30.7p/kg. The volatility in the EU market has been more pronounced than the price declines we have seen in the UK.

Falling demand is key

Weak domestic and international demand continues to be another driver for downward price moves. Within GB, rising geopolitical uncertainty, inflationary pressures, and the cost-of-living crisis has meant consumption of most proteins is under pressure. According to Kantar Worldpanel data only poultry meat is in growth compared to the previous 52 weeks, with its low price point per kg attracting shoppers to switch from other proteins. As a result, the volume of pig meat purchased through retail has fallen by 2.6% for the 52 weeks ending 1 October 2023. More expensive products such as roasting joints and chops and steaks have experienced the biggest falls, which has not been offset by growth in bacon, sausages and mince.

There is some positive news from the foodservice market in GB, where pork consumption is in growth and continuing to recover from Covid. However, overall consumption is in decline when both retail and foodservice is combined, by 1.3% year-on-year for the 52 weeks ending 03 September 2023 (AHDB estimates based on Kantar data).

Supplies are also a factor

Despite the wider market conditions for production remaining well back compared to 2022, the position of supplies could also be providing some price pressure. GB estimated clean pig slaughter as of 4 November is reported at 152,000 head, with GB estimates suggesting a slight increase in numbers in October, when compared to September average numbers. This is combined with some moderate increases to carcase weights. The increase in carcase weights is most likely following seasonal trends with cooler weather supporting growth.

These factors may add to the available supplies. Under the current market scenario, particularly the pressure from the EU marketplace and lower demand, it may continue to suggest some easing in the marketplace.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.