GB milk production expected to be flat for upcoming season

Thursday, 13 July 2023

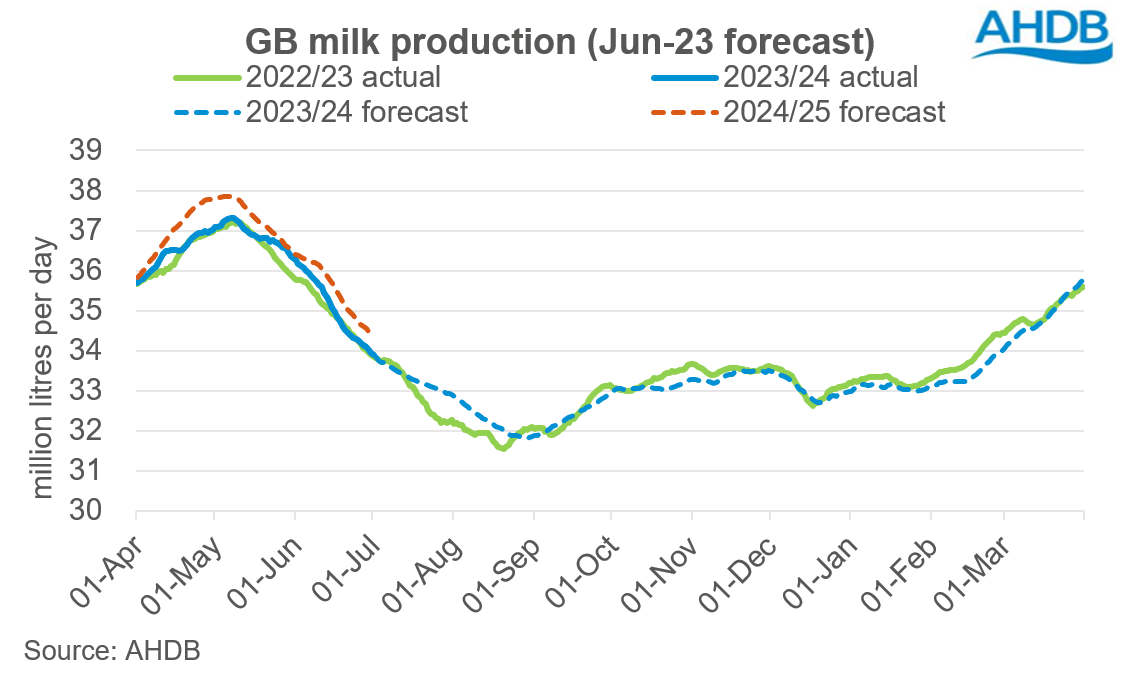

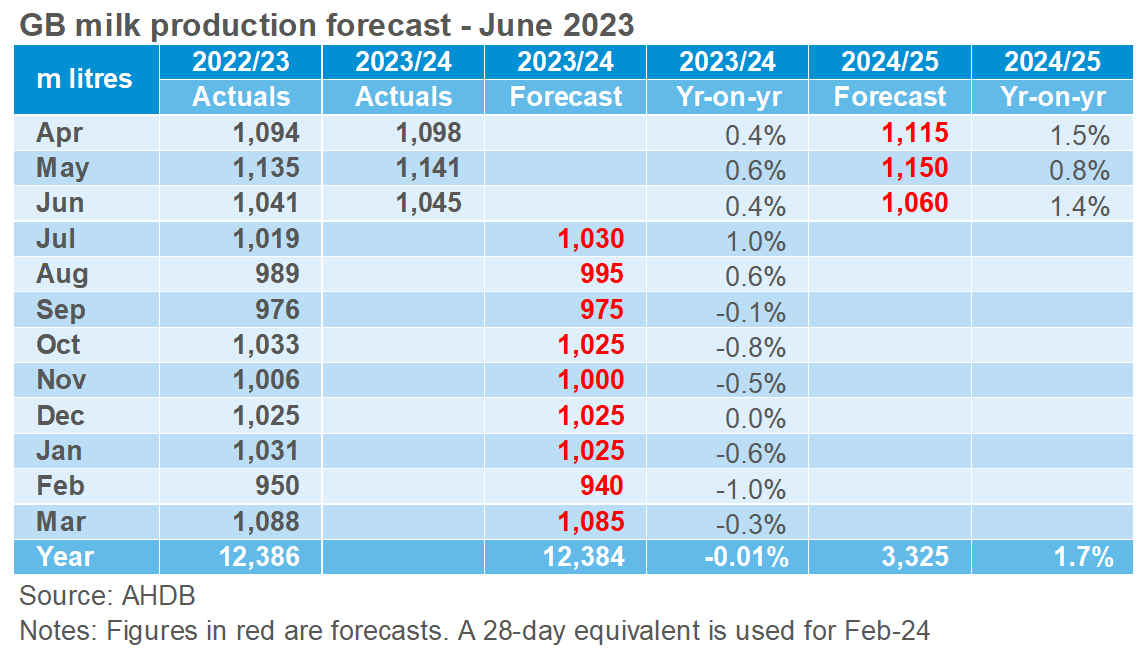

GB milk production for the 2023/24 season is forecast to reach 12.38bn litres, almost flat (0.01% decrease) compared to the previous milk year according to our June forecast update. We have revised expectations for the rest of the milk year downwards given price falls and sub-optimal weather. This is estimated to be 71m litres less compared to our March forecast.

Deliveries in the first three months of the current milk year (3,284mn litres) have been 0.5% higher compared with last year’s levels. Going forward little to no increase is expected in volumes with production likely to close the season flat on last year’s volumes. Our baseline assumptions are of yields falling now that we are past the spring flush and that the GB milking herd is likely to remain relatively stable. Yield growth through the summer and winter months are likely to slow down to between -1.3% and 2% per annum compared to previous levels of 2-3% during the months of good rainfall. We are expecting production to be slightly above year ago levels until August (compared to last year’s drought period) and thereafter decline gradually for the remainder of the season.

Yield per cow (and whether it is growing or declining) is one of the primary drivers of production, which currently is below the average growth rate of 2-3% per annum. The high production levels enjoyed last autumn (September-November 2022) are now stalling, driven by lower milk prices. Dry weather during recent months has contributed to reduced grass growth and potentially a lack of good silage for some in the coming months. July is expected to see more unsettled weather, but time will tell if the rest of the summer can make up for such a dry start.

The size of the GB milking herd has been relatively stable with cow numbers only 0.5% lower in April 2023 than a year earlier. This is the smallest decline since 2018 according to latest BCMS data. The long-term trend of gradual decline is continuing. Considering the relatively stable size of the milking herd, we anticipate reduced yield growth will be mainly driven by availability of forage and lower milk prices compared to last year.

Price reductions announced by major processors are likely to continue at least for July on the back of weakening demand although we may see more stability in August. However, even with price changes slowing, the average UK farmgate milk price for May was 37.58ppl according to Defra. Input costs inflationhas eased in recent months, however costs remain at historically higher levels. Farm margins will be under increased pressure this season unless milk prices begin to rise again. This pressure could increase further if grass growth this autumn does not allow depleted silage clamps to be replenished. In addition, cull cow prices remain very high which may encourage farmers to rationalise their herds, particularly with more replacement heifers coming through due to increases in sexed semen use. All these factors of higher production costs, lower milk prices and strong cull cow prices might encourage farmers in reducing cow numbers and thereby lower production in the winter months.

Our next update to the forecast will be in September when there will be more clarity on the demand side, price levels and silage availability going into the winter months. The return of Chinese demand and renewed demand from South East Asia and the Middle East could be interesting factors to look into in the second half of 2023 coupled with any developments in weather.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.