- Home

- News

- GB Milk production: December production only slightly back on 2022 despite challenging market conditions for farmers

GB Milk production: December production only slightly back on 2022 despite challenging market conditions for farmers

Thursday, 11 January 2024

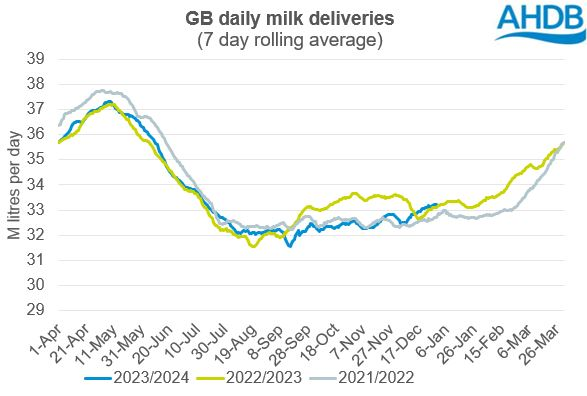

GB milk deliveries totalled 1,021 million litres in December, a slight decline of 0.4% (3.5 million litres) compared to last year. Daily deliveries averaged 32.9 million litres. This year’s milk season (April-Dec) production totals 9,272 million litres, slightly behind (-0.5%) the same point in 2022.

Up until December Q4 deliveries have been declining quite sharply with November back by 3% year on year. In our recent forecast update we estimated that December would continue in the same manner with a 3.4% decline. However, the latest figures indicate less of a slowdown than expected. What is driving that?

Source: AHDB

Whilst production levels appear similar to this point last year, particularly in the latter part of the month, weather conditions have been quite different. A prolonged and deep cold snap in December 2022 caused a relatively large dip in deliveries, as the presence of snow and ice impacted the ability of tankers to arrive on farm. In comparison, December of 2023 was much milder with temperatures above average for the whole of the UK except Northern Scotland. We are now annualising against what was a compromised production period which means that current production figures look less behind than if December 2022 had been a normal period.

Dairy farmers continued to feel the squeeze in December as input costs remained high, with big square baled straw up £20/tonne year on year, whilst farmgate milk prices dragged. As previously reported, 2023 has been a tough year for many farmers with some leaving the sector as a result. Margins have been increasingly tight, with some operating below the cost of production according to industry estimates. However, some farmers are looking towards maintaining cash flow via milk cheques, despite the margin situation, which may have moderated the decline. What factors sit behind this?

Following a period of very high milk prices in early 2023, many farmers are now preparing for high business expenses in the early part of 2024, be that in the form of a tax bill or repayments on farm improvement work, grants or loans. At this point where margins are smaller, pushing production may allow farmers to increase their cashflow in the short-term by pushing for greater production volumes, despite weaker prices, setting aside profit considerations.

Another contributor to supporting milk production in December could be the increase in autumn calving herds, which has been incentivised by many processors. Late autumn calvers would likely reach peak production in at the beginning of winter, boosting delivery volumes at this time.

Varying silage quality, depending on which year’s crop dairy producers are feeding, may also be affecting milk production levels. Reports suggested that the 2023 silage quality has been poor, however supplementation with the previous year’s crop may be contributing to boosted milk volumes in December.

A trend of increased production in December has been seen in Europe, with France and Germany recording similar trends, according to StoneX reports. StoneX reported that volumes in France for w/e 10th-24th December were up between 0.7% and 1.8% year-on-year, and in Germany up between 0.7% and 1.1% over the same period.

Market dynamics will remain a very important watchpoint over the coming months, as farmers make decisions about how they will manage their production against a backdrop of tight margins and potentially large expenses on the horizon. It is tempting to try to make up for lower milk prices by increasing volumes in order to bring in a stable milk cheque. However, the milk to feed price ratio is currently poor and chasing marginal litres will not be a profitable endeavour for most.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.