GB cattle prices slip

Wednesday, 12 May 2021

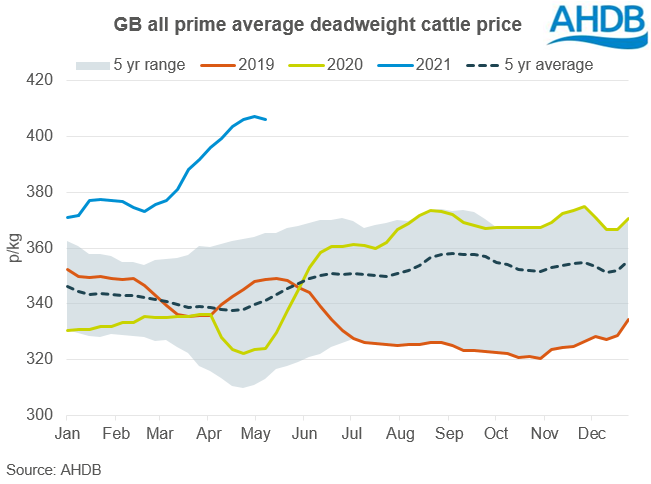

In the week ending 8 May, the GB all-prime average deadweight cattle price stood at 406.0p/kg, down 1.3p from the week before. This marks the first week-on-week decline in 10 weeks, with the measure having risen by 29p since the first week of February.

Reports suggest that the wetter weather has put a dampener on demand for eating out(side), with some beef remaining in freezers. However, with indoor dining allowed from next week, this could perhaps offer some demand support, especially for more expensive cuts. Reports suggest that import demand is starting to pick up, potentially due to the upcoming easing in dining restrictions and current high domestic cattle prices. Trade data for this period won’t be available for several weeks yet.

Despite the slip, the price is 82p ahead of the same week a year ago. At this point last year, prime prices were around the lowest they would turn out to be during 2020, due largely to disruption caused by the first lockdown (carcases devalued from consumers panic-buying mince, and foodservice closures at short notice).

Weekly movements in average GB prime cattle prices, w/e 8 May:

- Steers (overall): 407.1p/kg, -1.1p

- Heifers (overall): 405.9p/kg, -1.4p

- Young bulls (overall): 399.8p/kg, +0.2p

Tightness in cattle supplies remains. Prime cattle kill at GB abattoirs was estimated at 30,500 head for the week, down 10% from the week before, and down 7% from the same week a year ago. The shorter kill week (due to the early May bank holiday) will explain some of the weekly fall in throughput.

Cow prices also eased in the latest week, with the GB average price at 279.4p/kg, down 0.9p on the week. The price is still 57.9p above where it was at the same point last year. Cows of –O4L spec lost the same ground, down 0.9p to 296.1p/kg.

Estimated GB cow kill for the week stood at 8,600 head, down 15% on the week and up 1% on the same week a year ago.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.