First insight into Canadian canola crop damage: Grain market daily

Wednesday, 18 August 2021

Market commentary

- UK wheat futures (Nov-21) closed yesterday at £188.75/t, down £4.25/t on Monday’s close. The May-22 contract closed at £194.00/t, down £4.75/t on Monday’s close.

- This fall in the domestic market is due to pressure on Chicago (Dec-21) and Paris (Dec-21) wheat markets. Although there are still supply concerns for wheat, investors have been booking profits after wheat markets rallied last week.

- Paris rapeseed futures (Nov-21) closed yesterday at €574.75/t, gaining €0.75/t on Monday’s close. While the November 22 contract was down €7.00/t closing at €475.00/t.

First insight into Canadian canola crop damage

Following on from James's article yesterday, we now look in more detail at the state of the Canadian crop.

The reduction in wheat in last week’s bullish USDA World Agricultural Supply and Demand Estimates (WASDE) report took the spotlight. However, this August update gave insight into the tightening rapeseed (OSR) stocks and a first estimate into the cuts to the Canadian canola crop.

This North American drought has supported global rapeseed values and therefore our domestic values.

Last week delivered rapeseed (into Erith, Nov-21) at £485.00/t, the highest quoted this marketing year so far.

Global tightness

Despite recent high prices contributing to demand destruction. In the latest USDA report global production cuts (-4.2Mt) largely outweighed global consumption cuts on the month (-2.9Mt).

Global stock-to-use ratios (ending stocks/domestic consumption) of OSR now stand at 6.4%, down from 7.6% on the previous month. This is the tightest stock-to-use since 2016/17, when the stocks-to-use was at 7.3%.

Canadian tightness

With Statistics Canada production data not expected until 30 August this meant that this WASDE was the first insight into the drought damage.

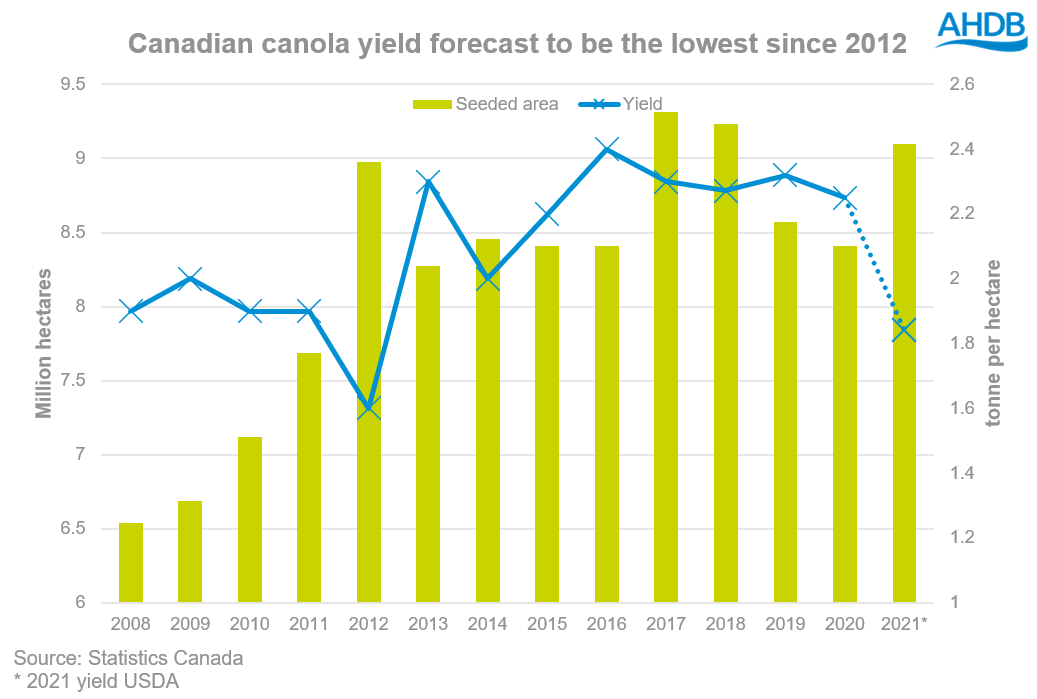

The Canadian crop was revised down 4.2Mt on the month with production now estimated at 16Mt. This figure was based on a lower (-300Kha, on the month) harvest area and the reduction in yields which now were revised from 2.24t/ha in July to 1.84t/ha in August.

With drought affecting much of Canada canola crop, it does not come as a surprise that when comparing this USDA yields to Statistics Canada this is potentially the lowest yield since 2012.

Exports forecasts are reduced significantly, to 6.9Mt for the 2021/22 marketing year, the lowest since 2007/08.

Interestingly Canada’s exports will account for c.49% of global OSR exports when on 5-year-averages they have averaged near 65% of global exports.

Growing OSR for 2022 harvest?

With prices currently elevated and Paris rapeseed futures (Nov-21) closing yesterday at £490.39/t, growers may be tempted to grow OSR for 2022 harvest.

However, it is critical to look at the forward market as Nov-22 closed yesterday at £405.28/t significantly lower. Although the Canadian crop is short for 2021/22, there is nothing to stop a large rebound for 2022/23 which would pressure futures values.

If prices seem economically viable for OSR in 2022, it would be wise to take advantage of them now, as outlined in yesterday's Grain Market Daily.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.