Delivered rapeseed prices reach historic highs this season: Grain market daily

Wednesday, 11 August 2021

Market commentary

- UK feed wheat futures (Nov-21) closed yesterday at £189.75/t, up £3.75/t from the previous close. Values traded in a £4.50 range throughout the day.

- UK futures followed the lead of both Paris milling wheat futures (Dec-21) and Chicago wheat futures (Dec-21), which gained €5.25/t and $5.24/t, respectively. Chicago wheat futures have since eased back down again this morning.

- Rain and cool temperatures in France have caused slow harvest progress and quality issues, supporting wheat prices.

- Strong Russian cash prices have also moved the market higher.

Delivered rapeseed prices reach historic highs this season

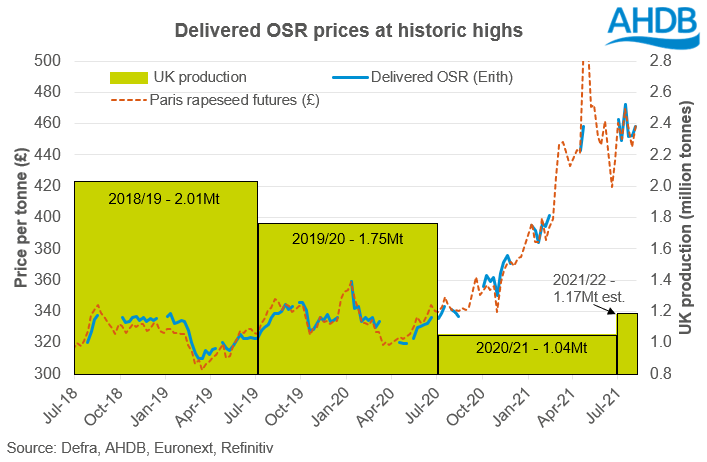

UK delivered oilseed rape (OSR) prices have reached historic highs in recent weeks. Delivered OSR, into Erith, was quoted at £458.50/t last Friday (06 August). This is the highest price in August since the survey began in 2005 (AHDB, delivered oilseeds survey). This is £119.00/t higher than the same point last year and £130.90/t higher than the 5-year average.

Why is the price so high and will it continue?

In recent years, small domestic crops have offered support to physical OSR prices. Despite a slight rise in current UK production estimates year-on-year, physical prices have started the 2021/22 marketing year strong. In recent history, the UK have been net importers of OSR. As such, our domestic crop size is only a small part in the puzzle. Our domestic prices generally track the Paris rapeseed futures, which are often influenced by the EU and global supply picture at this time of year.

This season has started with a relatively tight supply situation. European and Black Sea harvests have experienced delays. There is also no hiding from the situation in Canada, which has played a key role in rapeseed pricing throughout 2021.

EU imports of rapeseed have increased this season (from 01 July), to 414Kt (up 104Kt on the year), to help ease some of the harvest pressure. Usually, July imports would be dominated by Ukrainian supply. This year, supply has mostly come from Australia.

Canola imports from Australia are at a multi-year high. According to Oilworld.biz, Australian canola exports are due to decline through to September. Therefore, the EU will be looking to switch to Ukrainian supply in earnest. In July, rapeseed imports from the Ukraine were under half that of the previous year. Further, total Ukrainian rapeseed exports in July were the lowest since 2012 (Oilword.biz).

It is still unclear how big the losses have been to the Canadian crop, and this will remain a key watch point for UK prices.

Short-term, until Ukraine’s exports return to normal levels and Canadian crop losses are quantified, prices will likely remain supported. But the supply pressure could ease as harvest pace picks up in the Ukraine. After that, attention will turn to the Australian new crop picture.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.