Is it time to lock in rapeseed support? Grain market daily

Tuesday, 17 August 2021

Market commentary

- UK feed wheat futures fell back yesterday, following strong gains last week. The Nov-21 contract closed yesterday at £193.00/t, a drop of £2.00/t on the day.

- The Nov-21 contract remained £7.00/t above the same point last week and £41.25/t ahead of the average of the last five November contracts (£151.75/t).

- Early anecdotal reports of French cereal quality suggest that while harvest has been delayed quality has generally been acceptable. One primary concern for quality, given the rain, is Hagberg Falling Number (HFN). FranceAgriMer however, report that HFN is “generally satisfactory”. Protein levels are reportedly high to very high. Specific weight is the main area of concern, described as “irregular”, but generally satisfactory. Soufflet group reported last week that just 35% of samples collected so far reached 76kg/hl.

Is it time to lock in rapeseed support?

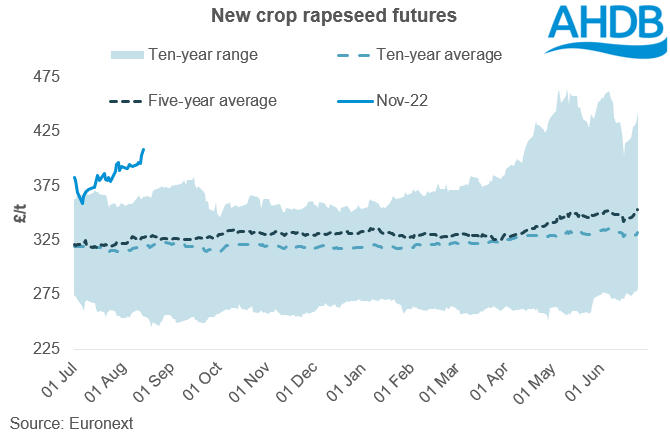

Across parts of the UK, new crop rapeseed planting is underway. Strong prices for new crop (Nov-22) rapeseed could well incentivise an increase in area, from the multiyear low seen for harvest 2021. Of course, much of the decision to plant rapeseed will be cost led, with the challenge of “managing” pests significant.

Prices for rapeseed are currently very strong for the time of year. At yesterday’s close, Paris rapeseed futures (Nov-22) hit £409.09/t, some £44.59/t ahead of the highest price for this point in the season over the last decade.

With prices so firm, the question of whether now is a good time to lock in the rapeseed price support will be key for many. The decision to sell is multi-faceted, and boils down to storage, budgeted yield, cash flow constraints and importantly the cost to produce the crop.

Some of these factors are arguably more challenging to determine for OSR. The significant crop losses experienced by many over the past few seasons are difficult to factor into a budget.

Where next for rapeseed prices?

This season (2021/22) looks set to be a tight one. EU rapeseed crops are challenged. Today Germany’s association of farm cooperatives trimmed its outlook for production by a further 170Kt, to 3.51Mt.

Furthermore, Canola is still suffering in the Canadian heat. Although the 14-day outlook does show some much-needed rain, this is potentially too late for some crops. These old crop drivers will likely continue to support rapeseed in the short to medium-term. Looking beyond that, we need to consider the Southern Hemisphere; how big will the Australian canola crop be?

We also need to consider the wider oilseed complex; sunflower production is expected to increase in 2021/22. Soyabean and vegetable oil prices also need watching closely. Keep an eye on our weekly market report for more information on oilseed market drivers.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.