Market Report - 16 August 2021

Monday, 16 August 2021

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Maize

Barley

Last week’s USDA report saw big cuts to global wheat production (-15.5Mt) boosting the market short-term. Major exporters’ stocks-to-use ratio drops to 12.7%, which will likely keep support longer-term.

10.5Mt production cut to US maize crop in last week’s USDA report pushed prices higher. A tighter supply picture will likely offer continued support.

Strength comes from rises in the wheat market and a tighter supply picture. Barley will likely remain supported by wheat, although the discount has widened. This will keep barley competitive into feed markets.

Global grain markets

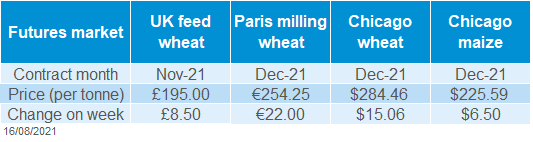

Global grain futures

Strong gains were made across the futures contracts last week. The gains followed the bullish USDA world supply and demand estimates (WASDE) report, released on Thursday.

The Dec-21 Chicago wheat and maize contracts closed Friday at $284.46/t and $225.59/t, up $15.06/t and $6.50/t respectively. Gains in Paris milling wheat futures (Dec-21) were even greater at +€22.00/t (9.5%) from Friday-to-Friday, closing at €254.25/t, a new contract high.

The USDA WASDE reported a 15.5Mt cut to global wheat production owing to large cuts to some major players; Russia (-12.5Mt), Canada (-7.5Mt) and the US (-1.3Mt). With cuts in production for major exporters, and a slight uplift in demand anticipated this year, the stocks-to-use (STU) ratio has fallen to 12.7%, lower than that in 2007/08 (13.1%).

There are also concerns over quality, particularly in Europe. Although the WASDE has suggested a rise in EU wheat production, wet weather, especially in France, poses a question of quality not quantity. Soufflet (French grain group) reported that only 35% of crop collected have reached the milling wheat test weight standard of 76kg/hl. According to Stratégie Grains, German test weights are also an issue, along with variable Hagberg Falling Numbers, but to a lesser extent than France.

Thursday’s WASDE also cut the US maize crop by 10.5Mt from the July report to 374.7Mt. Yet, production for major exporters was reported at 241.5Mt, up 2.6Mt from the previous report.

UK focus

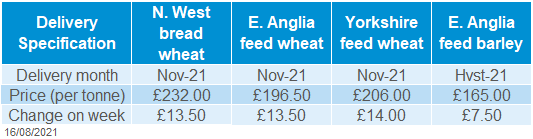

Delivered cereals

UK feed wheat futures (Nov-21) closed Friday at £195.00/t, a new contract high. This is following global trends as concerns about global supply tightness strengthen.

The Thursday-Thursday gain of £11.20/t on the Nov-21 futures contract was exaggerated further in physical prices. Delivered feed wheat (November delivery), saw an uplift of £12.50-£14.00/t from the previous week depending on location.

Delivered feed barley, for harvest delivery, also saw a week-on-week uplift; £7.50-£8.50/t depending on location. November delivery was quoted last week at £175.50/t in Avonrange, the highest price reported for November delivery since October 2018.

UK bread wheat premium to futures (Nov-21) also extended last week to £37.00/t for November delivery in the North West. This is up from £35.00/t as at 5 August.

Last week also saw the release of the second AHDB harvest progress report. It showed, by 12 August, the GB winter barley harvest was 88% complete and winter OSR harvest was 61% complete. Only an estimated 2.5% of the GB winter wheat area had been cut, the slowest start since 2017.

Oilseeds

Rapeseed

Soyabeans

Tight vegetable oil and global rapeseed supplies are supporting rapeseed prices.

Despite a smaller US crop, global production is expected to exceed demand by a bigger margin in 2021/22. However, this depends on record South American crops, for which planting will start next month.

Global oilseed markets

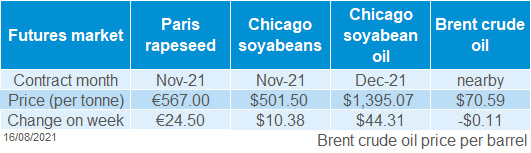

Global oilseed futures

Oilseed prices jumped higher last week due to stronger US soyabean export sales and rising veg oil prices. Last week (9-13 Aug) the USDA reported new export sales of 828Kt of soyabeans to China or unknown destinations in 2021/22.

Vegetable oil prices rose last week due to worries about Malaysian palm oil supplies. Dry weather and labour shortages due to COVID-19 measures are hampering production. In official data on Tuesday, production and stocks fell more than the market expected. The benchmark price on Malaysian palm oil futures (for delivery in three months) reached its highest ever level on Friday.

The USDA cut the 2021 US soyabean crop by more than the market expected in Thursday’s report. Chicago soyabean futures initially traded higher in response but ended the day virtually unchanged. US crush demand and exports were trimmed. The USDA also cut 1.0Mt from its forecasts of Chinese imports of soyabeans both this (2020/21) and next season (2021/22).

As a result, global stocks for the end of 2021/22 were unexpectedly increased by 1.7Mt to 96.2Mt. The USDA now expects global soyabean production to exceed demand in 2021/22 by 5.0Mt, compared to the 4.1Mt expected last month. The surplus still depends on the forecast record South American crops. Planting typically begins in Brazil in September and rain is needed to replenish soil moisture levels.

Rapeseed focus

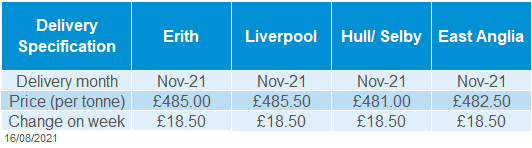

UK delivered oilseed prices

Rapeseed prices again rose sharply last week. On Friday, domestic rapeseed delivered to Erith in Nov-21 was £485.00/t in AHDB’s weekly survey. This was £18.50/t higher than 6 August and £25.00/t above the price on 30 July.

The USDA cut 4.2Mt from its estimate of the Canadian rapeseed crop to 16.0Mt, 21% smaller than last month. Despite a reduction to global rapeseed demand (-2.9Mt), global stocks at the end of 2021/22 are now forecast to be just 4.6Mt, the lowest since 2007/08.

In the Canadian province of Alberta, the local government estimates the canola (rapeseed) yield at just 1.38t/ha this year. This would be 40% below the five-year average. Alberta typically produces 29% of the Canadian crop but has been badly affected by the hot, dry weather this season.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.