Demand destruction for rapeseed? Grain Market Daily

Wednesday, 4 August 2021

Market Commentary

- UK wheat futures (Nov-21) closed yesterday at £185.60/t, down £0.75/t on Monday’s close. The May-22 contact closed down £1.05/t at £191.15/t.

- Forecasts rains in the U.S. Midwest contributed to this slight drop and the concerns over the amount of Delta variant coronavirus cases reported in places like China and the US.

- However, the global wheat market has recently experienced a bullish spur from production concerns especially for Northern Hemisphere crops.

Demand destruction for rapeseed?

Canadian canola prices have felt on-going support since the start of 2021. Initial soil moisture deficits before planting commenced in May and the on-going hot, dry weather in the Canadian prairies have continued to tighten supply prospects throughout the season.

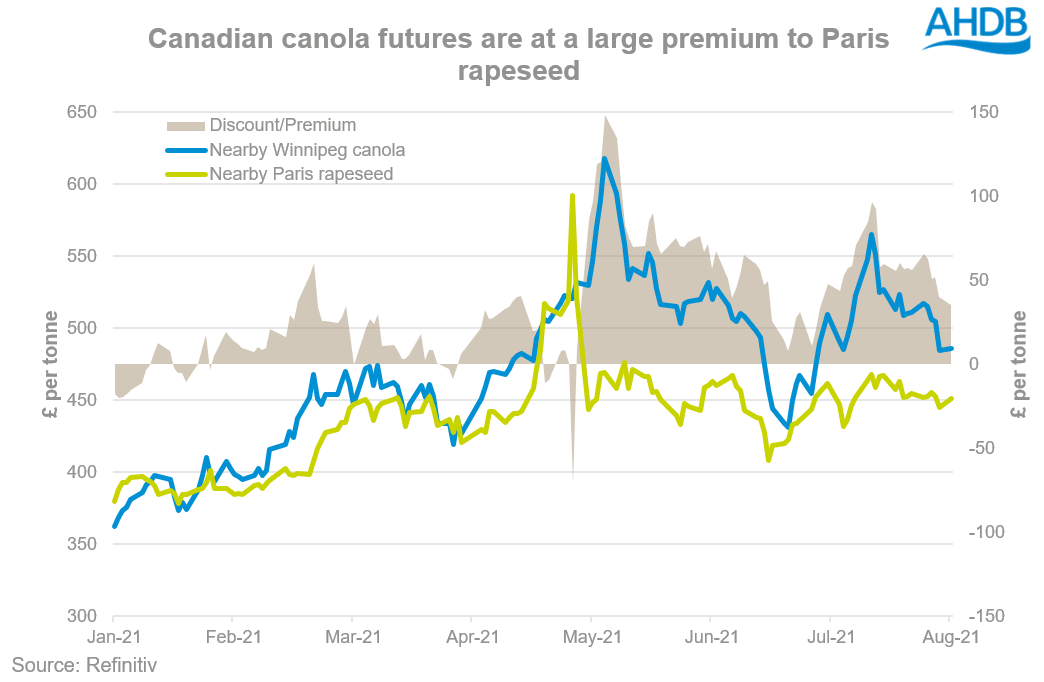

This has supported nearby Winnipeg canola prices, creating a sizable premium (notably from May) to Paris rapeseed.

Unknown impacts of the Canadian crop

The full effect of these drought conditions have yet to be quantified by StatCanada. Therefore, we can only go off the information that we currently have, namely previous average canola yields and the 2021 seeded area, as at 29 June.

Applying a 5-year-average yield would put the Canadian crop at just under 21Mt. However, conditions to date may result in below average yields. Using the 5-year-low yield (2020 yields) would peg the crop at 20.4Mt. This is nearer to the USDA’s projection of 20.2Mt, which was revised down 300Kt in July’s WASDE report.

This downward revision in July saw reductions in both production and Canadian exports, now estimated at 10.1Mt for 2021/22 (USDA).

Demand destruction for the EU?

The latest Stratégie Grains oilseed report, released last Friday, revised down domestic EU use for 2021/22 by 400kt, and imports by 900Kt, tightening carry out stocks, which are estimated at 1.4Mt.

The report cited crushing margins not being profitable from countries such as Canada and Australia as the driver for the import reductions. The premium in the Canadian market will be driving this lessened profitability to a degree, highlighting a classic example of a price lever coming into play to attempt to balance supply and demand.

Throughout July, nearby Canadian futures premiums were as high as £96.78/t to Paris rapeseed. These have since come down, but remain high to close yesterday at £40.18/t premium.

Conclusion

Any updates to the Canadian canola production estimate could strengthen or soften the premium, depending on which way they fall. Given the squeeze on EU crushing margins, there remains the potential for the EU to further reduce their demand if Canadian production tightens and potentially strengthens the Canadian premium, further reducing its competitiveness in the European market.

Despite all of this, what is critical to note is the global situation continues to remain tight for rapeseed as global ending stocks for 2021/22 are forecast at 5.6Mt (USDA), meaning that drastic prices reductions are not anticipated for the moment.

Domestically for 2021/22 prices will be driven by the continental deficit. Currently prices are supported as delivered prices (into Erith, Nov-21) were quoted at £460.00/t last Thursday.

What’s critical to note is Paris rapeseed futures for 2022/23 are at a c.£60.00/t discount to the nearby market, therefore considerations should be taken when planting after this harvest.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.