FAO Food Outlook 2021- what does it say about meat?

Wednesday, 23 June 2021

By Bethan Wilkins

The FAO has published its 2021 Food Outlook report this month. Here, we review some of the highlights for the meat industry.

Following two years of African Swine Fever-driven decline, global meat production is anticipated to expand in 2021, rising by 2.2% to 346 million tonnes. This is driven primarily by China, although production in Brazil, Vietnam, the US and the EU is also expected to increase. In contrast, declining production is foreseen for Australia, the Philippines and Argentina.

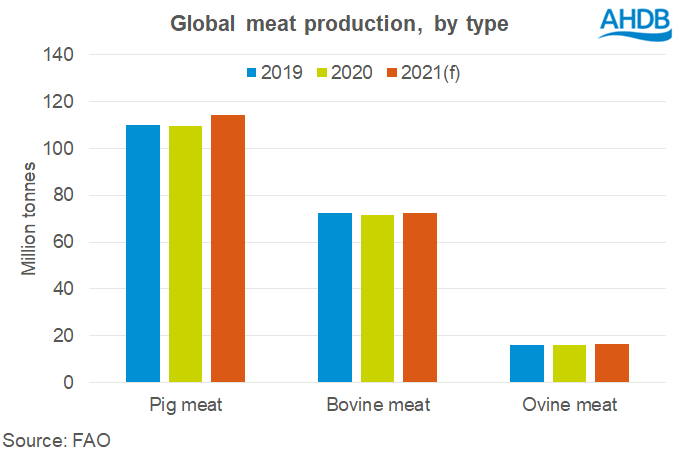

Within this, pig meat output is forecast to expand by 4.2% to 114 million tonnes. However, this is still 5% below the level before ASF began affecting Chinese production. Most of the anticipated increase stems from a recovery in Chinese production, expected to reach 46 million tonnes, a 10% increase on 2020 and 85% of the pre-ASF level. Global production of bovine meat is also forecast to recover slightly, up by 1.2% to 72 million tonnes. Growth is expected in particular from the US, Brazil and China. Global ovine meat output is forecast to expand by about 1% to 16 million tonnes. Again, China is expected to be the source of much of this growth.

Global meat trade is forecast to stagnate in 2021, totalling 42 million tonnes (carcase weight equivalent). Recovering meat production in China means the main driver of trade growth in recent years has waned.

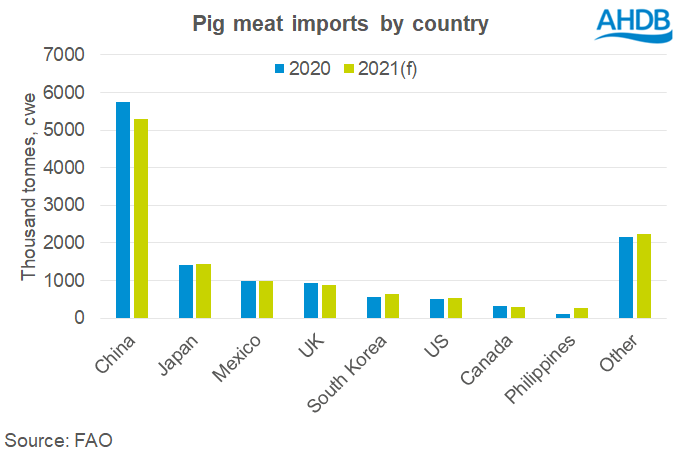

Pig meat trade could falter this year, falling by 0.6% to 12.8 million tonnes. An 8% decline in purchases is expected from China, and moderate import drops are also expected from Vietnam, Canada, and here in the UK. In response to the falling demand, exports are expected to fall from the EU, Chile and Canada, as well as the UK.

Global ovine meat trade is also forecast to contract this year, declining by 0.8% to just over 1 million tonnes. Supply constraints in New Zealand and here in the UK will lead to falling imports by the Middle East, as well as the US and EU. Chinese imports are still expected to rise.

In contrast, world bovine meat trade is expected to recover a little this year, rising by 1.1% to 12 million tonnes. This is mainly due to robust import demand from China. Brazil, the US, Uruguay and Canada are projected to meet much of the additional demand.

To read the full report, click here.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.