European pig meat finding a market at home

Monday, 21 March 2022

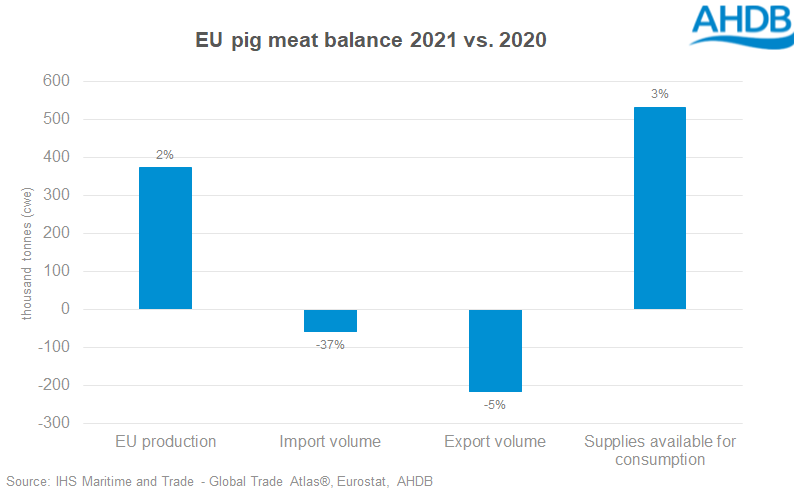

December production data from Eurostat now helps paint the picture of what happened in the EU pork sector in 2021. In summary, trade was lower, especially in the second half of the year as demand from China fell, and so the increase in production was consumed at home.

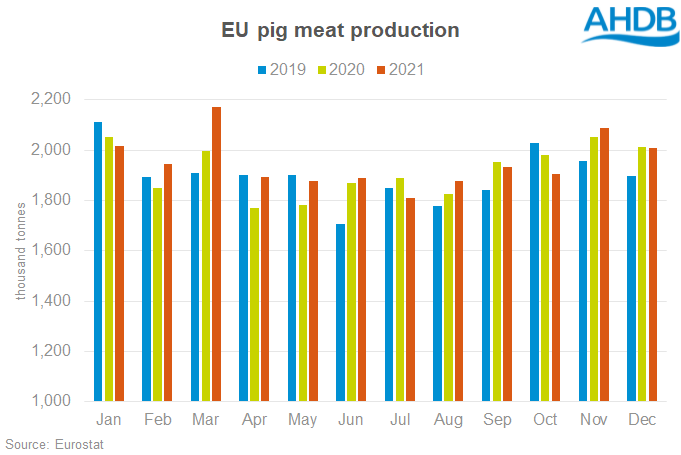

Pig meat production in the EU grew by nearly 2% in 2021, to 23.4 million tonnes, with 250 million pigs slaughtered.

Looking at some individual countries: production fell in Germany (-3%) year-on year, remained stable in Poland and France, but grew in the Netherlands (+3%), Denmark (+8%) and Spain (+4%). This secured Spain’s top spot of European pig meat production at 5.2 million tonnes, much of it underpinned by exports, with China as a very important market. Spanish exporters have apparently been more visible at trade shows, as they try to expand the number of markets they serve in the wake of a drop in Chinese import requirements.

We should be wary that the current rate of price rises for EU pigs may slow. While the EU pig population had declined year on year in December, the majority of the drop was in the heavier pigs, with a relatively smaller decline in the youngest piglets. It’s also thought that some pigs have been held back in anticipation of higher prices, further tightening current supplies by delaying slaughter. If it transpires that EU producers have held back only for a time, then the current shortage in slaughter pigs may ease soon. If reports of good pork supplies in the EU market are also true, together these factors might lessen the recent very strong support for EU pig prices.

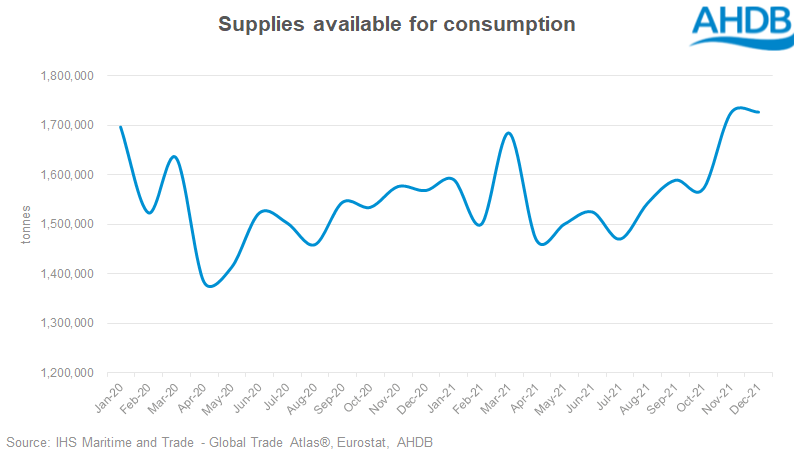

However, on the other side of the equation, the increase in demand* in 2021 overall is probably sustainable, and could go a long way to soaking up product that until recently had been destined for China. Demand in the EU would only need to return to levels seen in early 2019 to do this. The European market has consumed this product before and it can do so again, although we should be mindful of price inflation everywhere, and consumers’ willingness to pay. For now, reports suggest that the higher farmgate prices, and other higher costs in the supply chain that are being passed on too, are not yet deterring pig meat sales.

* demand here means “supplies available for consumption”, is calculated from production plus imports minus exports and includes stock changes.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.